Highlights

- Lithium Australia (ASX:LIT) has entered into a binding agreement with Charger Metals for the sale of its remaining 30% interest in the Lake Johnston Lithium Project.

- As consideration for the transaction, Charger Metals will issue 7 million fully paid ordinary shares in its capital to LIT, representing a value of AU$2.9 million.

- Charger Metals has approved a first right of refusal for offtake of up to 30% of lithium produced by the project to LIT for future commercial production of lithium ferro phosphate.

Lithium Australia Limited (ASX:LIT) has executed a binding agreement with Charger Metals NL (ASX:CHR) for the sale of its remaining 30% interest in the Lake Johnston Lithium Project.

As per the agreement, Charger will be acquiring the remaining 30% interest owned by Lithium Australia in the Lake Johnston Lithium Project tenements. Also, Charger will acquire LIT’s remaining 30% interest in the contractual rights to lithium in the tenements of the Lake Johnston Lithium Project.

In return, Charger has agreed to issue 7,000,000 fully paid ordinary shares to LIT in its capital. These consideration shares represent a value of AU$2.9 million as per the closing price of Charger Metals on the previous closing price.

Data source: Company update; Image source: © 2023 Krish Capital Pty. Ltd.

Major highlights of the agreement

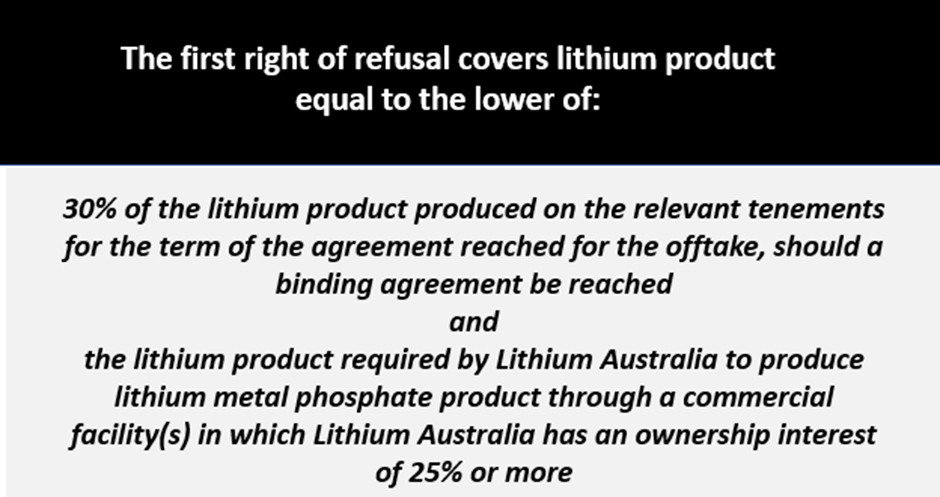

As part of the agreement terms, Lithium Australia has also secured a conditional first right of refusal over the lithium product produced from the tenements.

The company needs to make a financial investment decision (FID) announcement prior to 31 December 2029 to avail this option. The FID will be designed towards the development of a commercial facility to produce lithium metal phosphate cathode powders.

Data source: LIT update

Lithium Australia to hold 24% interest in Charger Metals

Lithium Australia holds a relevant interest of 15.5% in Charger Metals, as of 7 February 2023. The company suggests that the latest development would increase its stake in the ASX-listed lithium and battery metals exploration firm to 24%.

It is to be noted that the issue of the consideration shares to Lithium Australia is subject to approval by Charger’s shareholders with a decision expected during an upcoming meeting.

Lithium Australia considers the latest development in line with its continued transition to lithium processing and recycling from exploration since 2014.

LIT shares were trading at AU$0.047 in the early hours of 8 February 2023, up more than 2% from the previous close.