Highlights

- King River’s (ASX:KRR) September quarter saw continued exploration of its gold-copper projects with high-grade results

- The company has drafted a conceptual development plan for its Speewah vanadium-titanium-iron deposit

- The quarter saw laboratory process development testwork to identify and refine new process improvements to the ARC HPA process

King River Resources Limited (ASX:KRR), an ASX-listed exploration mining firm, has reported an action-packed September 2022 quarter. The reported period saw the company usher in a wave of developments at its robust project portfolio, including continued exploration across the Tennant Creek project, the drafting of a development plan for Speewah, and further testwork focused on the HPA project.

At the end of the quarter, the company held cash of AU$1,757,090.

Gold and copper exploration success at Tennant Creek

In its quarterly update, KRR highlighted that the Tennant Creek region had become very competitive for exploration in recent months.

Source: KRR update

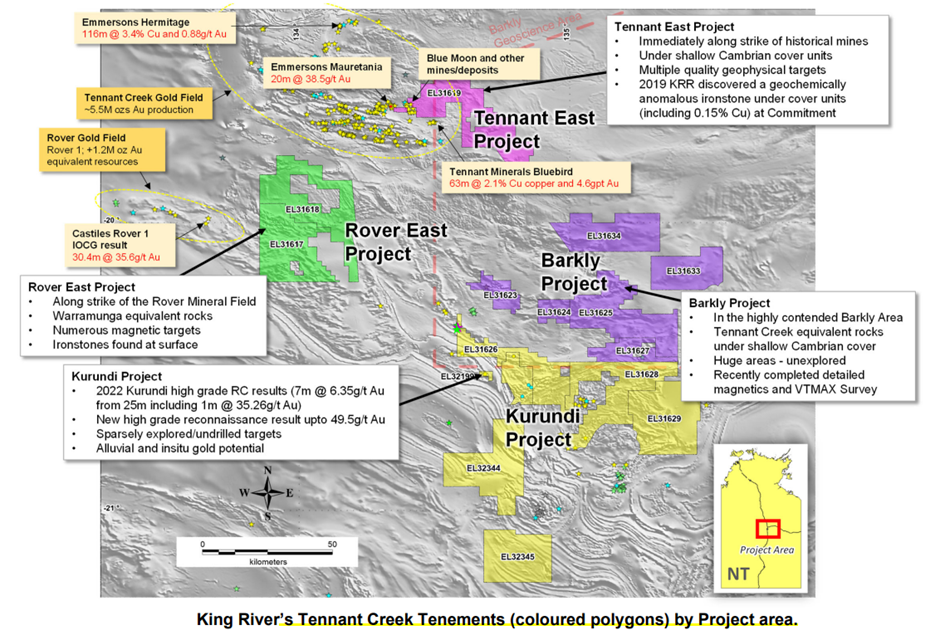

The quarter witnessed continued gold and copper exploration success at the company’s Tennant Creek project, covering 7,200km2 in 16 granted exploration licences.

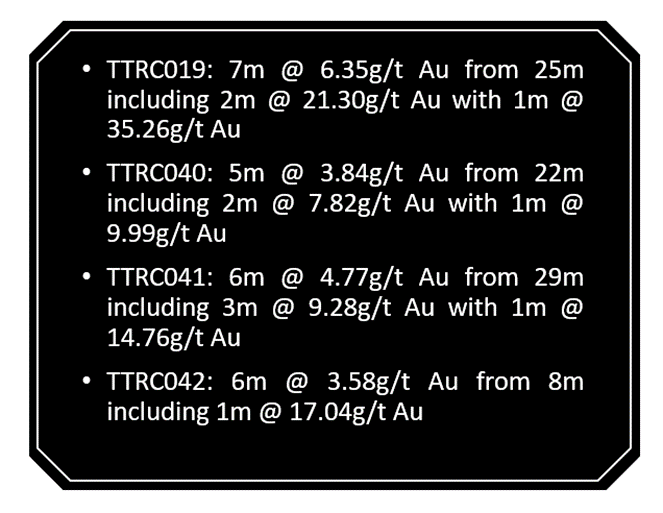

Kurundi tenement (EL32200): The drilling at Kurundi intersected a 1-5m quartz vein within a broader shear structure. The company obtained high-grade gold assay results from priority samples selected from visually mineralised intervals present in 14 holes.

Best results (Source: KRR update, 1 September 2022)

Also, the multi-element analysis of Kurundi RC drilling returned high-grade copper and silver values, as shown below:

- Highest copper result: 2m @ 8.4% copper including 1m @ 21.8% copper

- Highest silver result: 4m @ 59ppm silver including 1m @ 176g/t silver

High-grade surface gold results from reconnaissance exploration in the Kurundi region have led to additional drill targets for the company.

Tennant East Project: The project (EL31619) saw encouraging results from the nearby Tennant Minerals Bluebird discovery, where diamond drilling has delivered spectacular results.

King River has planned further drilling to locate the Mauretania/Hopeful Star corridor and test ironstone zones within the corridor.

KRR drafts conceptual development plan for Speewah

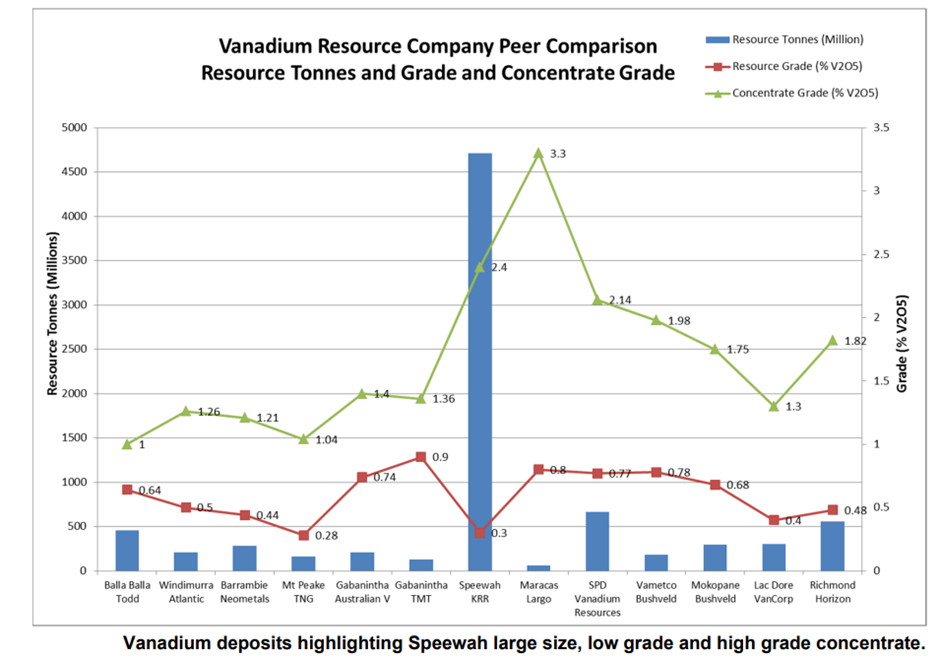

King River states that its fully owned Speewah Vanadium-Titanium-Iron deposit is Australia’s largest vanadium-in-magnetite deposit based on tonnes and V2O5 content. Its conceptual development plan opts for an open-cut mining operation, targeting the production of a magnetite-ilmenite concentrate for export.

Being a deposit with a large size, it supports a conceptual development plan for a potentially long mine life. The mining operation is scaled at 5Mtpa of feed to an on-site processing plant for production.

Murdoch University Hydrometallurgy Research Group is involved in metallurgical investigations to develop an optimised process flow sheet to produce high-purity vanadium pentoxide (V2O5), pigment-grade titanium dioxide (TiO2), and iron metal.

Source: KRR update

Testwork underway for HPA project

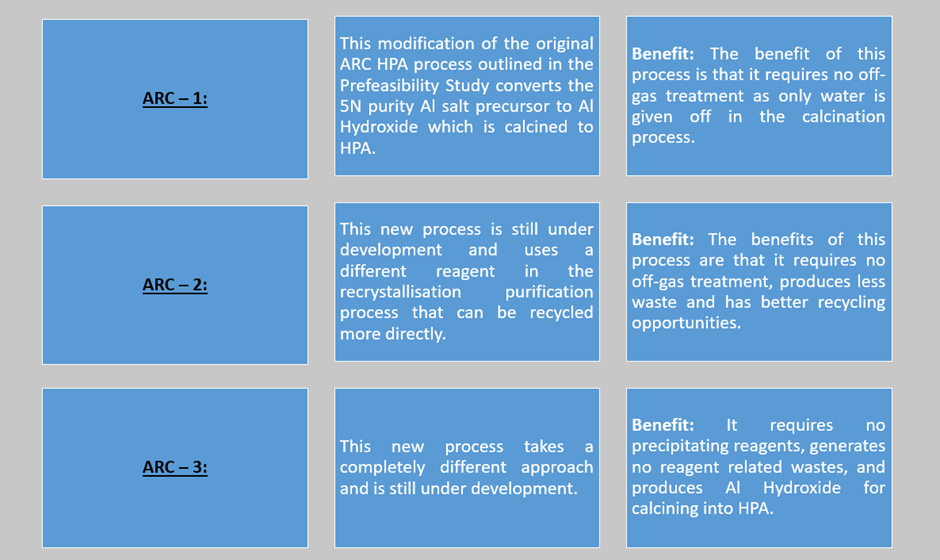

Source Certain International (SCI) is engaged in laboratory process development testworks for identifying and refining new process improvements to the ARC HPA process. It is targeted to make HPA production more economically and environmentally friendly.

The process modifications that are under investigation are:

Source: KRR update

The latest advances across projects

King River is in discussions with several potential buyers and/or partners for its Speewah Vanadium-Titanium-Iron deposit. The company recently completed a comprehensive technical background report of the project to assist the process.

The company has also released drill core and concentrate samples for firms interested in further assessment with their own studies.

For its gold projects, the company plans to approach several Australian and international groups for potential partnering in the projects’ exploration and development phases.

KRR shares were trading at AU$0.013 in the early hours of 27 October 2022.