Highlights:

- Jindalee Resources is all set to spin out its wholly owned Australian lithium, nickel, and gold assets into a new proposed ASX-listed vehicle, Dynamic Metals Limited.

- JRL is committed to repositioning itself as a pure-play US lithium developer. Thus, post completion of the spin-out, the company will be focusing on its flagship, US-based McDermitt Lithium Project.

- Dynamic Metals plans to undertake an IPO to raise at least AU$5 million and at most AU$7 million at an issue price of AU$0.20.

- Shareholder approval will be sought by Jindalee at its forthcoming Annual General Meeting.

As previously announced, Jindalee Resources Limited (ASX:JRL) is proceeding with the spin-out of its Australian lithium, nickel and gold assets into a new vehicle, Dynamic Metals Limited.

An Initial Public Offering (IPO) is proposed to be undertaken by Dynamic. Per the update released 09 November 2022, Dynamic is expected to be a dedicated, ASX-listed, critical mineral-focused exploration company, with the proposed ASX ticker of ‘DYM’.

Handing over its Australian portfolio to the spin-out company, i.e., Dynamic, the following two purposes will be served at once:

- Jindalee will now be able to focus on the development of its advanced McDermitt Lithium Project, Oregon, USA, and

- It could provide investors with increased exposure to its earlier-stage exploration projects in Western Australia, says Jindalee.

The Company intends to be a pure-play US lithium developer with McDermitt considered as one of the largest lithium deposits in the US.

What will the minerals portfolio of Dynamic look like?

The portfolio of Dynamic will have Jindalee’s extensive landholding in the Widgiemooltha district and the Lake Percy Project, both of these being highly prospective for lithium, nickel, and gold.

In addition, it will include the recently acquired Deep Well Ni-Cu-PGE Project, where Dynamic will be owning an interest of 80% post listing.

IPO details: priority offer for existing JRL shareholders

Dynamic Metals proposes to launch an Initial Public Offer (IPO) to raise at least AU$5 million and at most AU$7 million at an issue price of AU$0.20 apiece. The proposed IPO will include the following:

- a priority offer of up to AU$2.5 million of IPO shares to eligible Jindalee shareholders, and

- a public offer to new investors.

Canaccord Genuity Australia Pty Ltd and Discovery Capital Partners Pty Ltd will act as Joint Lead Managers to the IPO.

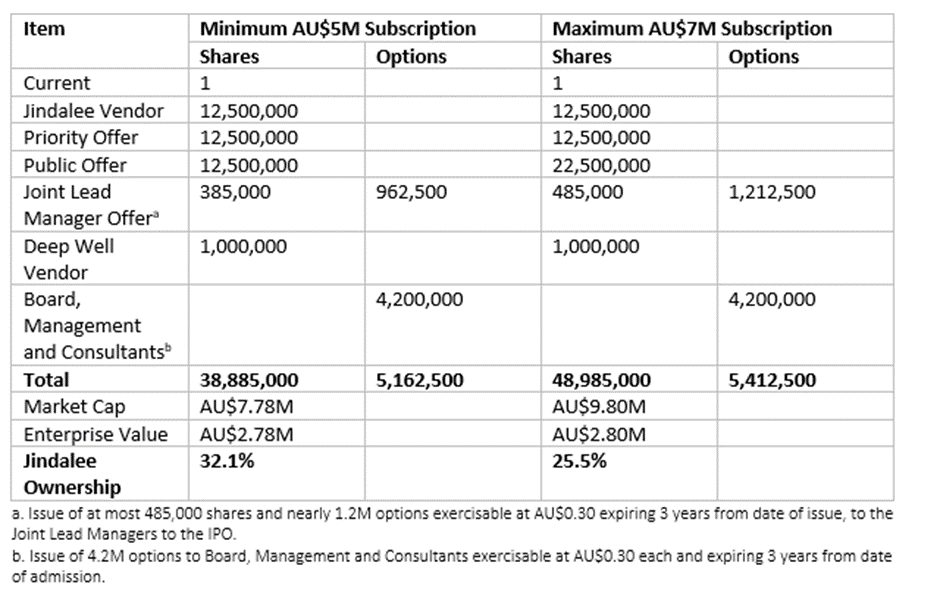

The following is the Indicative capital structure of Dynamic following the IPO completion:

Source: Company update dated 09 November 2022.

The way ahead

To spin-out its Australian assets to form Dynamic Metals, Jindalee will ask for shareholder approval at its forthcoming Annual General Meeting.

More IPO details will roll out in the coming weeks in the prospectus that Dynamic will lodge for the IPO.

JRL shares traded at AU$2.380 midday on 11 November 2022.