Highlights

- Jindalee has completed 21 holes at McDermitt with four holes confirming broad lithium intercepts from shallow depths.

- Initial alkali salt roast testwork of McDermitt ore delivered lithium phosphate assaying 5.89% Li before purification from ore grading ~0.15% Li.

- JRL seeks to demerge its Australian assets via its subsidiary Dynamic Metals, which recently inked a deal to acquire a project.

- The company remains well-funded to advance its projects and tap new opportunities.

Jindalee Resources Limited (ASX:JRL) has witnessed a quarter full of developments across its flagship McDermitt lithium project in the United States.

The period saw the release of an updated mineral resource estimate and high-grade assays from drilling focused on McDermitt. During the period, the company announced plans to separate its Australian assets to form a new entity. Moreover, subsequent to the period, the company updated on encouraging results from initial alkali salt roasting testwork using McDermitt ore.

What’s more, Jindalee closed the quarter with AU$7.7 million in cash and securities. The company believes that its financial stance provides a strong base for advancing projects currently held and tapping new opportunities.

Updated MRE at McDermitt project

During the quarter, JRL declared an updated Mineral Resource Estimate (MRE) at its fully owned McDermitt Project. This key development came after incorporating results from 12 holes drilled in December 2021. The combined Indicated and Inferred MRE at the project stood at 1.82 billion tonnes at 1,370 ppm Li for a total of 13.3 million tonnes of lithium carbonate equivalent (LCE).

In late July, JRL initiated further drilling aimed at infilling and upgrading the resource and defining the complete extent of lithium mineralisation at the project. So far, 21 holes, including 10 diamond and 11 reverse circulation holes, have been completed.

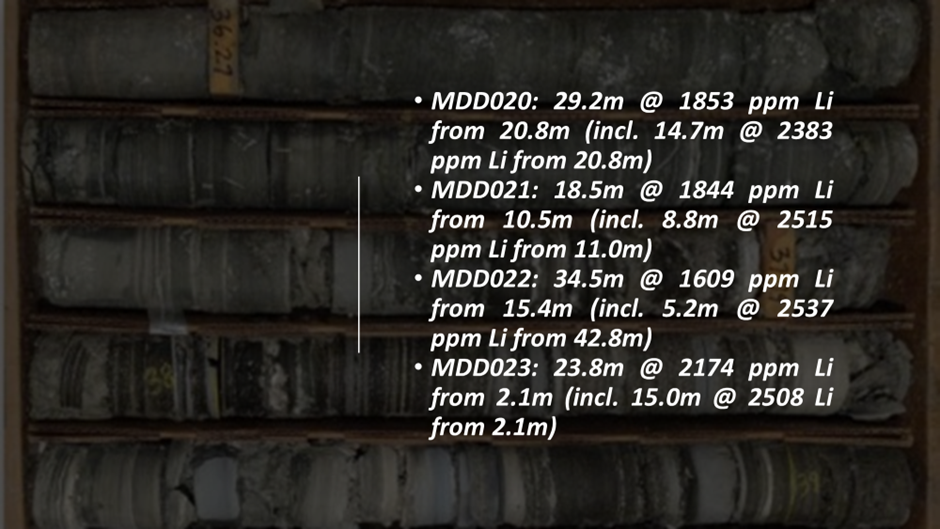

The first four holes have delivered the following assays, confirming substantial shallow intercepts:

© 2022 Kalkine Media® | Data Source: JRL | Image Source: JRL

JRL expects results from the remaining 17 completed holes through to December 2022.

Positive testwork with McDermitt ore and strong tailwinds

Lithium phosphate (Li3PO4) was also produced during mid-October from initial alkali salt roast testwork of McDermitt ore. Presently, LFP batteries account for 25% of the Li-ion battery market and this figure is anticipated to increase to 40% by 2030 because of improved battery configurations enhancing range performance.

The results from the initial alkali salt roasting testwork are encouraging for JRL, indicating a viable alternative processing route to sulphuric acid leaching. JRL has planned additional testwork.

JRL believes that the following recent developments are encouraging as they have favourable implications for the potential development of its McDermitt Project.

© 2022 Kalkine Media® | Data Source: JRL | Image Source: © Antonella865 | Megapixl.com

Along with the 2022 drilling program and metallurgical studies, environmental baseline studies are also progressing ahead of the submission of application for an Exploration Plan of Operation (EPO) in the March 2023 quarter.

Demerger of Australian assets

Another key development during the quarter was the announcement of the demerger of JRL’s Australian assets. The separation of JRL’s Australian assets is proposed via a new listed vehicle, Dynamic Metals Limited.

The separation is proposed to be implemented by way of an initial public offering (IPO) of securities in Dynamic to raise AU$5 million to AU$7 million. This currently remains subject to shareholder and regulatory approvals.

JRL looks to get approval from shareholders at the AGM scheduled to be held on 30 November 2022.

Focus on mapping of lithium pegmatites at Widgiemooltha

The Widgiemooltha Project, which sits within the Western Australian goldfields south of Kalgoorlie, is prospective for nickel, gold and lithium. The recent exploration success in the district offers significant encouragement to the company while work across the project continues to be mostly non-ground disturbing.

Moreover, key tenements are pushed forward for the grant, with a continuing focus on the mapping of lithium pegmatites. A four-day heritage survey was completed across 7 priority targets in early September 2022.

Work at Lake Percy project and acquisition of Deep Well project

JRL’s 100%-owned Lake Percy project indicates potential for nickel and lithium, along with several pegmatite intrusions identified in historic workings and drilling.

During the quarter, the project witnessed progress in terms of permitting initiatives for planned nickel exploration. The final preparations helped in successfully completing the heritage survey in the first week of October. Besides this, the field part of the flora survey was finalised in late September, and the company now expects to conclude the remaining targeted environmental survey work by the end of CY22.

Subsequent to the September quarter, JRL shared that its subsidiary Dynamic Metals is acquiring the Deep Well Nickel-Copper-PGE Project. Read more here

JRL shares traded at AU$2.4 on 02 November 2022.