Highlights

- IOUpay, a fintech player operating in the South East Asian region, has shared numbers for the first half of this quarter

- myIOU BNPL offering has grown during the 1.5-month period, and cost reduction measures have been implemented

- Total consumer activated accounts until 15 February 2023 exceeded 64,000, while active merchant outlets figure was over 3,000

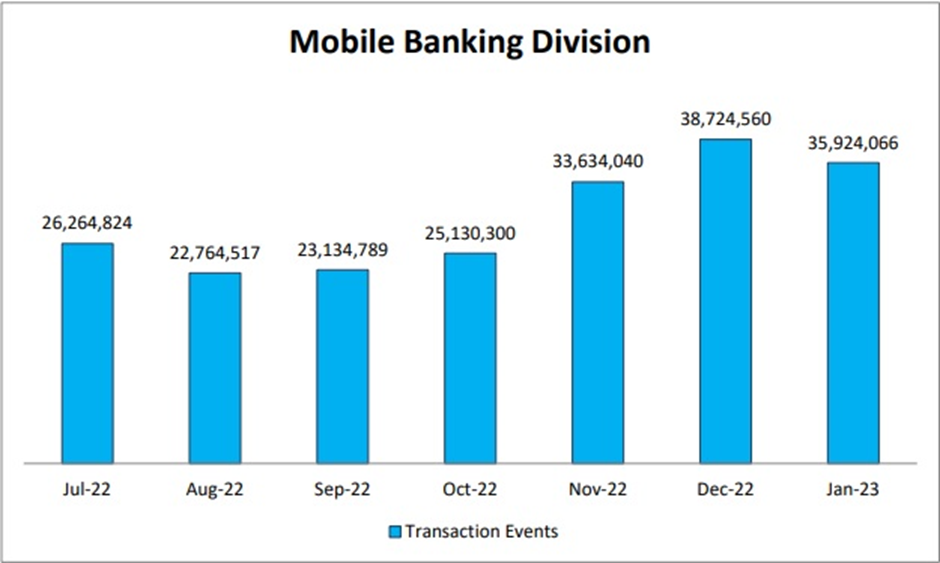

- Mobile Banking Division registered more than 30 million transaction events in January, the third consecutive month of strong performance

ASX-listed provider of financial technology (fintech) and digital software services, IOUpay Limited (ASX: IOU) has released a mid-quarter business and operational update. During the first half of the ongoing quarter (1 January 2023 to 15 February 2023), the company’s Total Transaction Value (TTV) was over AU$7.22 million, with Net Transaction Revenue (NTR) of AU$420,333.

Another major highlight shared by the company that operates Mobile Banking and Digital Payments divisions in the South East Asia (SEA) region was continued growth in customer and merchant sign ups between 31 December 2022 and 15 February 2023.

Also, the Mobile Banking Division continued to deliver strong performance with over 30 million transaction events for third consecutive month in January.

Instalment Credit Business Update

Besides the above-mentioned figures for TTV and NTR, the income margin of myIOU stood at 5.8% for the mid-quarter ended 15 February 2023. Separately, TTV and NTR for the past 12 months (as at 15 February 2023) stood at over AU$28.9 million and AU$1.8 million, respectively. IOUpay mentions that effective annualised returns for individual transaction profiles meet its internal target range.

The company continues to sign up new merchants wishing to offer the myIOU BNPL service and, during the period, reached over 3,000 merchant outlets activated on the myIOU platform. Consumer downloads broke through 200,000 during the period with 76% of those having been onboarded (cumulative totals as at 15 February 2023) to the myIOU app.

The company is focusing on setting up a community of quality merchants and consumers, for what IOUpay calls ‘best-in-class’ brand positioning in the SEA region.

Merchant & Consumer Activation

During the period to which the latest report pertains, 56 new merchants were added. IOUpay mentions that these merchants operate 127 outlets across Malaysia and represent eight industry verticals including beauty & wellness, and electronics & gadgets.

In comparison to results as at 31 December 2022, myIOU’s consumer downloads have jumped 12% and account activation is up by 10%.

Mobile Banking Division

Transaction events for this division were recorded above 30 million in January 2023, which marks a third successive month of this feat. Further, Malay New Year events are expected to boost sales during the month of March 2023, IOUpay has said.

Source: IOUpay ASX release 6 March 2023

Cost Reduction and Efficiency

IOUpay states that the Board has initiated the process of assessing staffing levels and other costs to maximise efficiencies. Improvement was noticed during the December 2022 quarter when the net cash used for operating activities was recorded as AU$0.832 million (as against over AU$1.7 million during the preceding quarter).

IOU shares were trading at AU$0.041 midday on 9 March 2023, up over 5% from the last close.