Highlights

- IOUpay saw continued growth in consumer and merchant base for its BNPL service in September quarter.

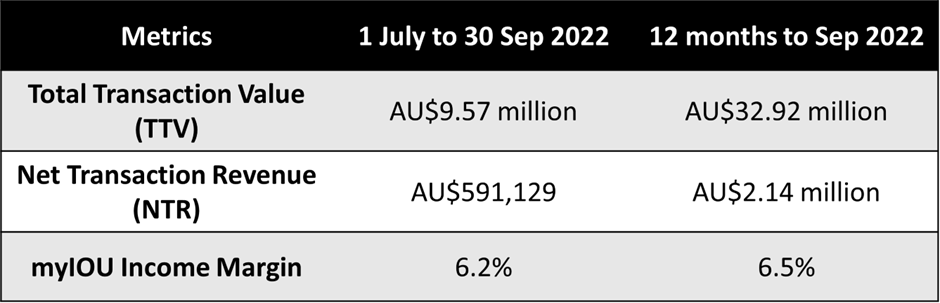

- Total transaction value stood at AU$9.57 million delivering net transaction revenues of AU$591,129 for the period.

- The company advanced on multiple strategic partnerships, including the first collaboration with a major retail bank.

- The period saw the roll out of myIOU 2.0 phase 2 and phase 3 under development, security enhancements and additional credit decisioning tools.

- IOUpay announced the development of a Shariah-compliant BNPL service under brand name 'myIOU Islamic'.

IOUpay Limited (ASX:IOU) has reported another quarter of impressive performance. The fintech and digital commerce company registered continued growth in the number of customer and merchant signups, approvals and onboarding for its primary BNPL service myIOU during the September 2022 quarter.

The quarterly report covers progress of IOUpay’s multiple strategic partnerships with Pine Labs, PayHalal, and other prominent names, along with technology updates and new product initiatives.

The quarter saw over AU$10.86 million in receipts from customers. By the end of the quarter, IOUpay reported over AU$4.14 million in cash and call deposits.

myIOU BNPL - Transactions, customer and merchant base

The Total Transaction Value (TTV) denotes the aggregate value of purchases made by customers using myIOU BNPL. The Net Transaction Revenue (NTR) denotes the balance left after payments are made out of TTV to merchants, effectively the gross margin.

Image source: IOU update

The non-performing loan (NPL) ratio of 0.68% at September end signifies the robustness in the company’s customer acquisition process and use of technology and due diligence in authenticating customers.

The company reported positive adjusted net operating cashflow for the fourth consecutive quarter. The value stood at AU$7.16 million after adding back AU$8.87 million payments to BNPL merchants that form part of BNPL receivables.

myIOU is well positioned in Malaysia, with 2,700 merchant outlets across 13 industry verticals active on the platform. Over 2,000 signed merchants at the quarter end are yet to be assessed for activation.

The period saw addition of 185 new merchants (total 428 outlets operated) to the list. Customer downloads of myIOU showed growth of 39% as compared to the previous quarter. Onboarding and account activation also showed strong quarter-on-quarter growth of 39% and 34%, respectively.

IOU progresses on multiple strategic partnerships

Pine Labs - IOUpay Asia, IOUpay’s subsidiary, has completed systems integration work as part of its master services partner agreement with Pine Payment Solutions. It is expected that the myIOU service would go live on Pine Labs’ merchant platform in November. This would enable mutual merchant clients to offer myIOU BNPL services to consumers via the Pine Labs merchant platform.

SOGO Department Stores - The September quarter marked the second phase of systems integration work under the company’s merchant agreement with SOGO. The agreement originally signed in the March quarter aims to enable integration of myIOU with SOGO departmental stores’ point of sale (POS) and e-commerce platforms. The POS integration went live in June, and the progress during the September quarter led to e-commerce integration in mid-October.

PayHalal - A merchant acquiring services agreement with Souqa Fintech was announced by IOUpay Asia in mid-July 2022. Souqa Fintech operates in Malaysia under the PayHalal brand name and provides Islamic fintech services to over 7,000 Shariah-compliant merchant partners. So far, 53 merchants referred by PayHalal have been approved by myIOU and the process of onboarding has begun.

Razer Merchant Services (RMS) - In July, RMS decided to expand myIOU BNPL offering by providing the two, three and six-month payment plans to customers. The next phase of integration is ongoing and would witness inclusion of additional plans made available by early next year (Q3 FY2023). At the time of the release of the September quarter report, myIOU was available as a payment option on 292 merchants onboarded by RMS.

IDSB - IOUpay is working with I.Destinasi Sdn Bhd (IDSB) to promote myIOU BNPL services to IDSB’s high-credit quality customer base comprising government civil servants. The plan is to enable the customers of IDSB to use KA$Hplus Visa prepaid cards to purchase goods and services and then convert those purchases into myIOU payment plans. The integration of the KA$Hplus cards to the myIOU BNPL platform is awaiting approval from Malaysia’s central bank.

A five-year strategic partnership agreement (SPA) was entered into by IOUpay Asia with IDSB in September for collaboration on strategic initiatives. The initial focus of this SPA is on providing Shariah-compliant personal financing services to over 1.7 million high-credit quality government servants in the country.

A local market-first Bridging Loan product to target the employees of the Ministry of Education has been launched as the first project under the SPA. IOUpay Asia would take the short-term credit risk of up to four months in individual loans of RM10,000 that would be offered to new government employees. The full repayment in this case would be via a pre-approved 10-year term loan by IDSB, with average loan of RM100,000 (funded by banking partners of IDSB).

Bank Simpanan Nasional - A marketing collaboration agreement between IOUpay Asia and Bank Simpanan Nasional (BSN) was announced in September. BSN is a state-owned entity, which employs over 7,000 people. BSN’s 390 branches offer retail banking services across Malaysia.

Under the agreement, myIOU BNPL is being promoted to over 6.5 million card members of BSN. The collaboration is in place for six months until March 2023, and is providing access to a new high-credit quality customer community.

Virtualflex - IOUpay had announced in June 2022 its collaboration with Virtualflex Sdn Bhd for the launch of co-branded myIOU KA$Hplus prepaid Visa card. In mid-July, the first phase of this partnership began and a press conference announcing the same was conducted in Kuala Lumpur, which was attended by the executives of the two companies, alongside officials from the Malaysia Digital Chamber of Commerce and similar other groups. The second phase is awaiting approval from Malaysia’s central bank.

myIOU Islamic & Shariah Compliance Certification

In its product development update, IOUpay announced the development of a Shariah-compliant BNPL service under the brand myIOU Islamic. This is set to expand IOUpay’s coverage of the Malaysian market where over 60% of the population are followers of the Muslim faith.

The Shariah Compliance Certification was received in July, which was followed by extensive preparations for providing both conventional and Islamic financing across the country. The partnership with PayHalal during the September quarter was a step in the same direction. The first Shariah-compliant BNPL transactions were processed by PayHalal and myIOU ahead of schedule in early September.

Technology upgrades and myIOU 2.0

IOUpay has over two decades of experience in the financial technology sector of Southeast Asia. During the September quarter, new technological advancements were attained, which reinforce IOUpay’s brand leadership position.

The quarter saw the completion of the second phase of myIOU 2.0 and its roll out. In August, the updated app was made available for download to customers using iOS and Android services.

The ongoing third phase, which is presently in development, would see inclusion of new elements like ‘mini shopping cart’, ‘Merchant scan 3DS’, and ‘Merchant App UI/UX’. These elements would add to the customer experience besides allowing merchants to offer selected goods to customers directly through the app.

On the technology front, IOUpay is also working to integrate Experian (credit analysis tools) with the myIOU platform to enhance the customer credit limit application process and provide a backup for the existing credit reference service. This would enhance IOUpay’s automated consumer financial background analysis.

In September, a digital footprint service was also deployed, which adds more security to the myIOU platform by helping to prevent users from creating multiple accounts.

IOUpay is also working with PayHalal for tokenisation integration, which would make it possible to send any Shariah transaction made using myIOU to PayHalal via digital token.

What is in store?

IOUpay expects further expansion of merchant coverage and introduction of myIOU to new customer communities. The company plans to widen its merchant and consumer base by tapping new collaborations with financial institutions, payment gateways, digital payment processors and other reputable partners.

In the future, IOU remains committed to securing central bank approvals for integration of the co-brand myIOU KA$Hplus Visa prepaid card to the myIOU platform.

Moreover, IOU eyes strengthening its brand leadership position, pursuing new markets and diversified growth through innovative product development and ongoing technology platform enhancement.

IOU shares were trading at AU$ 0.055 midday on 1 November 2022, up nearly 4% from the last close.