Highlights

- Invictus Energy (ASX:IVZ) has initiated Mukuyu appraisal program with Mukuyu-2 spud targeted for early Q3 2023.

- The company has started the well services as well as long lead process tendering.

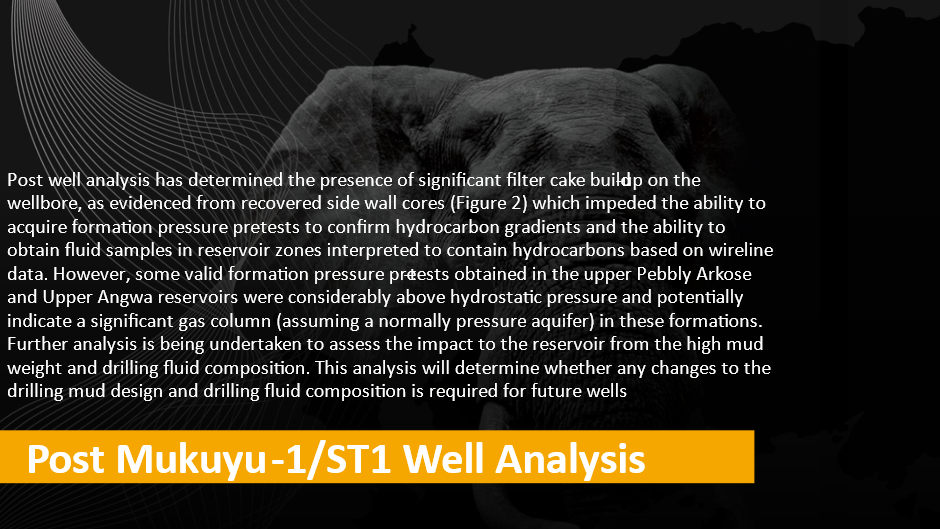

- The post well analysis of Mukuyu-1 indicates potential for substantial gas columns in Pebbly Arkose and Upper Angwa.

- Exalo Rig 202 has been warm stacked at the Mukuyu-1 wellsite. The upgrades and maintenance plans to be executed in April.

- The process of analysis of the Mukuyu-1 sidewall cores is underway, with both reservoir and source rock samples at different levels of evaluation.

Shares of Invictus Energy Limited (ASX:IVZ) appreciated more than 11% and were spotted trading at AU$0.145 midday on 24 February 2023 after the company released a market update relating its 80%-owned SG 4571 licence in Zimbabwe’s Cabora Bassa Basin.

In the latest announcement, ASX-listed oil and gas company announced that it has commenced the Mukuyu appraisal program. The company has targeted to spud the first well, Mukuyu-2, in the third quarter of the ongoing year 2023.

Numerous hydrocarbon (gas-condensate and potentially light oil) bearing intervals encountered in the Mukuyu-1/ST1 well in the Upper Angwa and Pebbly Arkose formations will be targeted at Mukuyu-2 to confirm a gascondensate discovery.

Shares of Invictus Energy Limited (ASX:IVZ) appreciated more than 11% and were spotted trading at AU$0.145 midday on 24 February 2023 after the company released a market update relating its 80%-owned SG 4571 licence in Zimbabwe’s Cabora Bassa Basin.

In the latest announcement, ASX-listed oil and gas company announced that it has commenced the Mukuyu appraisal program. The company has targeted to spud the first well, Mukuyu-2, in the third quarter of the ongoing year 2023.

Numerous hydrocarbon (gas-condensate and potentially light oil) bearing intervals encountered in the Mukuyu-1/ST1 well in the Upper Angwa and Pebbly Arkose formations will be targeted at Mukuyu-2 to confirm a gascondensate discovery.

Details of Mukuyu-2 appraisal well program

The appraisal well Mukuyu-2 will be designed in a way that ensures higher drilling efficiency and lower operational risks. The well will be testing the deeper potential in the Upper Angwa formation, which is thicker than pre-drill estimates.

The Mukuyu-1/ST1 well encountered gas pay to total depth, interpreted from wireline logs and fluorescence in numerous reservoirs across the 900-metre interval penetrated. This added prospectivity in the Upper Angwa and the undrilled Lower Angwa target offers additional up-side potential at Mukuyu-2, as per the company.

The Mukuyu-2 well design will allow Invictus undertake flow testing for confirming reservoir deliverability and connectivity. Presently, the tendering process for minor additional long leads and well services is underway. The timing of the spud date for Mukuyu-2 will be better defined upon completion of the process.

At the Mukuyu-1 wellsite, Exalo Rig 202 has been warm stacked as its upgrades and maintenance is planned for the month of April.

Post finalisation of well location and construction design, the construction work for wellpad will begin as all required permits and approvals have been received for the drilling campaign at Mukuyu-2.

Ongoing Mukuyu-1 sidewall core analysis

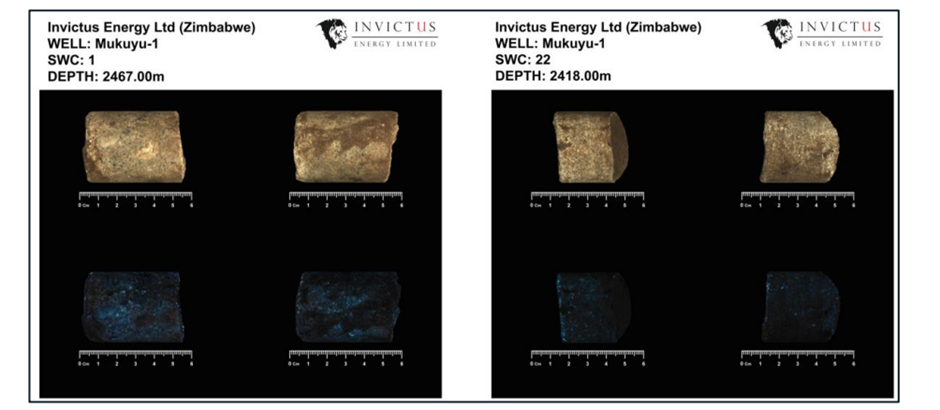

Mukuyu-1 Side Wall Cores from upper Pebbly Arkose showing strong fluorescence under ultraviolet light

The analysis of the sidewall cores from Mukuyu-1 is underway, with both reservoir and source rock samples at different stages of evaluation.

As per the initial processing at the lab, there is strong fluorescence in side wall cores obtained from ~2,407m Measured Depth in the upper Pebbly Arkose reservoir sections. Consequently, this has raised the gross interval of observed fluorescence and hydrocarbon charge in the Pebbly Arkose and Upper Angwa to 1,500m and substantially expands the play interval in the Cabora Bassa Basin.

Previously, fluorescence has not been detected in the drill cuttings across the upper Pebbly Arkose interval. According to the company release, this is probably because of the drilling fluid losses across this zone and remedial action essential for stabilising the fluid loss.

With sidewall core results, the company can aim for better calibration of the wireline log data for refining the log interpretation as well as net pay zones.

Further special core analysis (SCAL) will be undertaken on select plugs to determine saturation data and electrical rock properties upon finalisation of routine core analysis (RCA).

Also, there can be further calibration of the basin model and hydrocarbon generation and migration history because of results from geochemical analysis of the source rock side wall cores and cuttings. It will allow Invictus to better identify the possible liquid hydrocarbon migration and entrapment sites throughout its wider exploration acreage.

Data source: IVZ update, Image source: © 2023 Krish Capital Pty. Ltd.

2D seismic acquisition

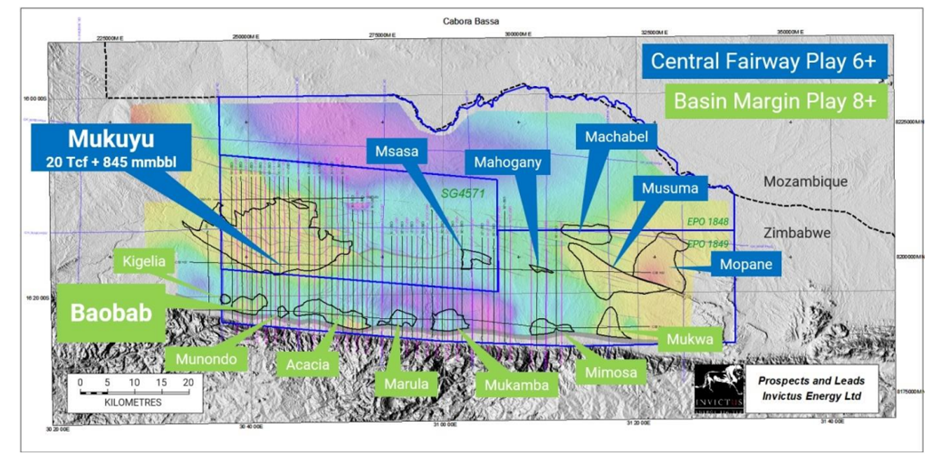

Invictus Energy is looking forward to acquire additional seismic in the eastern portion of EPO 1848 & 1849 with the purpose of maturing several leads (Mopane, Musuma, Machabel and Mahogany) in line with the proven play on trend to the east of Mukuyu and additional leads along the Basin Margin play (Mimosa and Mukwa).

Cabora Bassa Basin Prospect & Lead Map

The leads all display seismic amplitude anomalies like “flat spots” and velocity interval slowdowns, that correlate with the hydrocarbon bearing intervals intersected in the Mukuyu-1/ST1 well.

With acquisition of modern 2D seismic, Invictus Energy might be able to mature some of these leads, that have been previously identified on reprocessed vintage seismic data, to drillable prospects.

The company has been able to take forward the Seismic survey design. It is also anticipating to begin acquisition in the second quarter of the year (Q2 2023).

Management commentary

Data source: IVZ update, Image source: © 2023 Krish Capital Pty. Ltd.

Mr. Scott also highlighted that ‘additional fluorescence observed in the upper Pebbly Arkose reservoir sections has increased the gross interval with hydrocarbon charge throughout the Pebbly Arkose and Upper Angwa to 1,500 metres and substantially expands the play interval in the Cabora Bassa Basin’.

Keeping up the momentum

Invictus Energy has received industry interest for engagement in the Cabora Bassa Project, post confirmation of a working hydrocarbon system in the basin at Mukuyu-1/ST1.

Going forward, the company plans to hold an infill 2D seismic survey in EPO 1848/49 to mature several leads into drillable prospects along trend from Mukuyu, and the Basin Margin play.

The Board of the company, including Non-Executive Director Robin Sutherland and Non-Executive Chairman John Bentley, will be visiting Zimbabwe next month to meet Zimbabwe Government officials as well as local stakeholders for the Cabora Bassa Project. This meeting aims to boost the progression of some significant items, such as the Production Sharing Agreement.

The country tour will include a visit at the Ngamo-Gwayi-Sikumi (NGS) REDD+ project in conjunction with the Forestry Commission to interact with local stakeholders and have an official launch of the project.