Highlights

- During FY22, Lithium Australia saw developments at its wholly owned subsidiaries committed to circular battery economy.

- Envirostream Australia witnessed a sharp increase in spent battery volume for recycling at its processing facilities.

- Envirostream’s sustainable standards also enabled partnerships with household brands.

- LIT’s subsidiary VSPC roped in Lycopodium for a pre-qualification facility and a definitive feasibility study for a 10,000tpa LFP manufacturing facility.

The growing popularity of EVs has led to significant shifts in the global battery industry. With this change, the price of one of the most sought-after mineral commodities of today’s time, lithium has been skyrocketing. Lithium carbonate cost saw a nearly 450% jump over the 12 months to June 2022.

Having said that, Australia-based company Lithium Australia Limited (ASX:LIT) is leaving no stone unturned to meet its objective of delivering sustainability to the battery industry.

The company is implementing its goal via

- Envirostream Australia Pty Ltd – battery recycling unit

- VSPC Pty Ltd – committed to developing leading-edge cathode active materials like lithium ferro phosphate for e-mobility and energy storage

LIT is also engaged in the development of lithium chemicals extraction and refining technologies like LieNA® and SiLeach®.

The company has recently released its annual report, highlighting the course of action taken to meet its set objectives during FY22 ended 30 June 2022.

Envirostream making strides in li-ion battery recycling

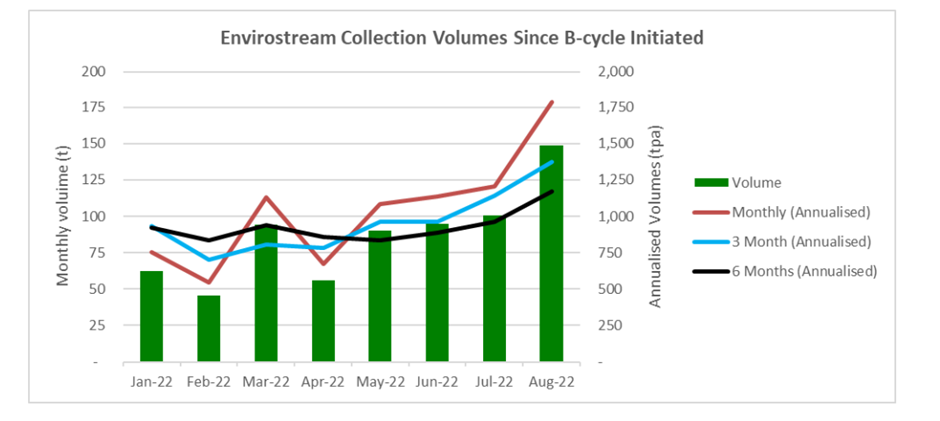

On the recycling business front, the company’s wholly owned subsidiary Envirostream saw a significant volume increase after the launch of the battery recycling scheme (‘B-cycle’) in January this year. It has inculcated a safety culture in its operation, facilitating a 99-year EPA licence for the Berwick Road facility, the first in the industry.

Source: Company’s update

Moreover, partnership with some of the leading household brands existing in Australia highlighted Envirostream’s high sustainable standards. Some of these associations are Bunnings Warehouse, Officeworks, and Battery World.

Envirostream expects steep growth in the number of lithium-ion batteries available for recycling in the coming years, based on commitments made by larger energy storage manufacturers like LG Energy Solution.

The company is also expecting a profound impact from the change or shift in state/federal policy regarding the sustainable disposal of spent batteries. The policy change is likely to aid Envirostream in addressing its main competition, landfill, as more than 90% of end-of-life (EOL) li-ion batteries are consigned to landfills.

VSPC advancing well to develop cathode powders

VSPC, a 100%-owned subsidiary of LIT, is developing the next generation of cathode powders including lithium ferro phosphate (LFP). The company has collaborated with Lycopodium for a pre-qualification facility and a definitive feasibility study (‘DFS’) for an initial 10,000tpa LFP manufacturing facility.

As per reports, the demand for LFP is expected to increase by seven times by 2030. Currently, China dominates the global production of LFP.

VSPC is positioning for its first commercial footprint, with R&D facility (pilot plant) located in Queensland and customer offtake discussions advancing in parallel.

Significant exploration upside exposure

LIT has a 30% free-carried interest over the Wundowie, Lake Johnson and Bynoe projects of Charger Metals NL (ASX:CHR). Moreover, the company has a 20% free-carried interest over the Greenbushes South project of Galan Lithium Limited (ASX:GLN).

Strong financial footing

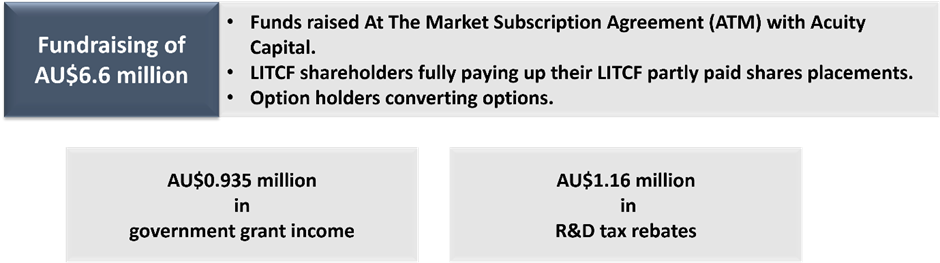

During the reported period, the company boosted its financial stance.

Data source: company update

Also read: Sneak peek into Lithium Australia’s (ASX:LIT) $12.1M capital raising to support battery tech