Highlights

- Lithium Australia raised AU$12.1 million through a placement of shares @ AU$0.065.

- The placement saw participation from existing and new shareholders, as well as a company director.

- The ASX-listed company plans to use the funds raised to support the operations of its subsidiaries, Envirostream and VSPC.

- LIT is tapping opportunities in battery recycling and advanced cathode materials space.

Lithium Australia Limited (ASX:LIT) has strengthened its financial footing with the successful completion of a placement offer raising AU$12.1 million (before costs).

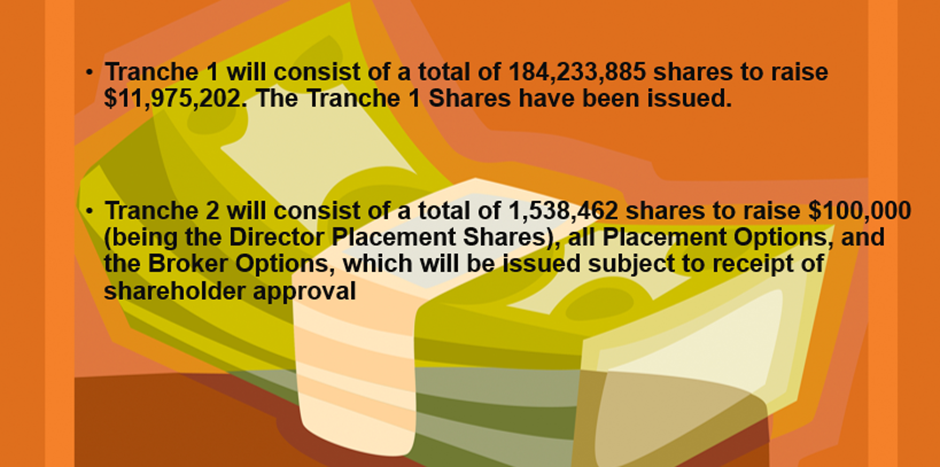

As part of the placement, the company will issue 185,772,347 ordinary shares at a price of AU$0.065 per share under two tranches. The company has issued over 184.23 million ordinary shares under the Tranche 1.

The placement witnessed active participation from existing shareholders, institutional investors, and new high-net-worth sophisticated investors. LIT also highlighted that a director of the company subscribed for 1,538,462 shares valued at AU$0.1 million.

In addition to the shares, subscribers will also receive an attaching one for two options. These options could be exercised at a price of AU$0.10 and will have an expiry of three years from the date of issue.

Opportunities in battery recycling and advanced cathode materials

The funds raised will be used to support the operations of the company’s 100%-owned subsidiaries, Envirostream Australia Pty Ltd and VSPC Pty Ltd, as well as general working capital. The two subsidiaries are working to promote a circular battery economy.

Envirostream, a major player in the Australian battery recycling industry, collects batteries from outlets operated by the company. It plans to expand operations nationwide by FY23.

Recycling is expected to provide meaningful disposal of lithium batteries, which could cause pollution if disposed of in landfills. It is also expected that the metals extracted from recycling could help in bridging the gap between the demand and supply of battery metals.

VSPC, on the other hand, is working to develop advanced powders, primarily lithium ferro phosphate (LFP) for next-generation lithium-ion batteries. China is the market leader in this segment and has a monopoly.

VSPC is working to provide an alternative source of LFP batteries. The funds raised through the placement will be utilised to complete engineering studies for the possible expansion of VSPC’s current facilities and establishing relationships with stakeholders in the LFP supply chain.

Data source: LIT update, 31 August 2022

Overview of the placement offer

Perth-based CPS Capital Group Pty Ltd managed the placement offer. CPS Global will receive 6% of the total amount raised as a fee for its services. In addition to the fee, it is also entitled to receive 1 for four options, subject to shareholders’ approval.

LIT has also appointed CPS Global as its corporate advisor for a tenure of 12 months in view of advisory services the company would require in the near future. CPS will receive a monthly fee of AU$6,000 for its services as a corporate advisor.

The record date for the placement offer is 26 August 2022, when LIT shares traded at AU$0.083 apiece on ASX. The company will issue new ordinary shares @AU$0.065, representing a discount of 22% to the last closing share price on 26 Aug and 21% to the 5-day and 10-day VWAP of AU$0.082.

The placement to be completed under two tranches.

Image source: © Imagesparkstudio|Megapixl.com; Data source: LIT update, 31 August 2022

After the successful completion of the placement offer, LIT believes that the company is in a strong financial position and does not see any reason to go for the At-the-Market Subscription Agreement or ATM with Acuity Capital in the near future.

LIT shares were trading at AU$0.060 midday on 8 September 2022.