Highlights

- In FY22, the company marked its listing on ASX and started trading on FSE.

- The company renewed the portion of the Saraya permit prospective for uranium for another three years.

- The company purchased a 40 man camp and acquired the historical data for the Saraya uranium project containing ~60,000m of historical drilling.

- Haranga developed an exploration target of 5 to 20 MT at a grade range of 350 to 750 ppm eU3O8 (4-35 Mlb contained eU3O8) at the Saraya prospect as per the guidelines of the JORC Code (2012).

- The company commenced a permit wide termite mound soil sampling program across the 1,650km2 permit and completed its maiden drill program at the Saraya uranium prospect.

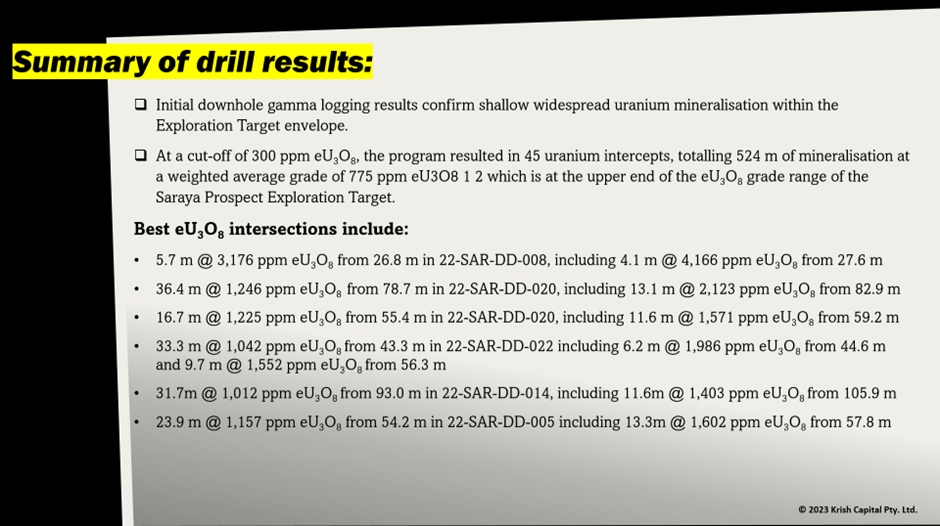

- Drill results received following 3,021m validation drill program with uranium mineralisation intersected in all holes drilled, with average weighted grade of 775 ppm U3O8.

- The company’s next target is the exploration target conversion to initial MRE.

Multi-commodity focused company Haranga Resources Limited (ASX:HAR; FRA:65E0) recently released its annual report for the 12-month period ended 31 December 2022 (FY22).

In January last year, the company got officially admitted to the Australian Securities Exchange (ASX) as well as started trading on the Frankfurt Stock Exchange (FSE) during the year.

Haranga majorly focused on its Saraya uranium project in Senegal with major developments including establishment of a significant exploration target and drilling programs during FY22.

For the Saraya uranium permit, the company received a notification relating renewal of the permit for another three years.

The company conducted a regional termite mould sampling program to identify bedrock derived uranium anomalies.

- Under the orientation survey at the Saraya prospect, the company collated over 1300 samples with the known mineralisation for uranium. Anomalous uranium concentrations between 2.5ppm and 41ppm were yielded from the survey over the known Saraya occurrence. Using cost-effective surface sampling of the termite mounds, uranium mineralisation can be identified in the bedrock below the thick saprolite cover, suggested the outcomes.

- Through the permit-wide survey, the company defined anomalies spread over several kilometres, with anomalous concentrations (7-17 ppm). Also, the company defined numerous prospects infill sampling in the future. Some of the pending results are expected to be received in Q1 2023.

The company involved RSC Global Pty Ltd to assess the historical data secured for the project. This set of data includes details for ~61,437m of drilling, exploration results, prospects as well as resource estimations.

Haranga developed an exploration target of 5 to 20 MT at a grade range of 350 to 750 ppm eU3O8 (4-35 Mlb contained eU3O8) at the Saraya Prospect as per the guidelines of the JORC Code (2012) after RSC reviewed the historical uranium exploration results.

It is to be noted that this target is contained in an area of only 0.2 km2 of the 1,650 km2 Saraya permit.

Haranga wrapped up a 3,021-metre maiden drill program at the Saraya prospect in December 2022. According to the drill core logging, there exists broad zones of episyenitic and deuteric alteration in the exploration target envelop, suggesting that zones of potential uranium mineralisation were intersected in all drill holes.

Also, the company carried out downhole geophysical surveys for all drill holes during the reported period. In the last quarter of 2022, the team of HAR consultants began interpretation of the results of the downhole surveys to find out the corresponding equivalent uranium concentrations.

Post the reported period, the technical team started the preparation of half-core drill samples for laboratory uranium analyses by ICP-MS.

Data source: Company update

Upon receipt of ICP-MS results expected in the second quarter of 2023 and validation of the historical results, the company aims to convert the exploration target to an initial Mineral Resource estimate (MRE) classified in accordance with the JORC Code (2012).

Stock price performance

The stock was last spotted trading at AU$0.140, with market capitalisation of AU$8.41 million, on 21 March 2023.