Highlights

- EcoGraf has completed an Independent Engineering Study for the TanzGraphite Mechanical Shaping Facility in Ifakara, Tanzania.

- The facility will process 20,000 tonnes of flake graphite per year, delivering a spherical graphite (SpG) yield of over 60%.

- Stage 1 construction cost is projected at US$58.6 million, with an operating cost of US$419 per tonne.

- A potential Export Processing Zone (EPZ) designation could provide additional incentives, including a 10-year corporate tax exemption.

EcoGraf Limited (ASX:EGR; FSE:FMK) has completed an Independent Engineering Study for the development of the TanzGraphite Mechanical Shaping Facility in Ifakara, Tanzania. This study represents the outcome of more than ten years of extensive technical research and is based on the preferred site near Ifakara, which offers significant advantages in terms of clean power and transportation.

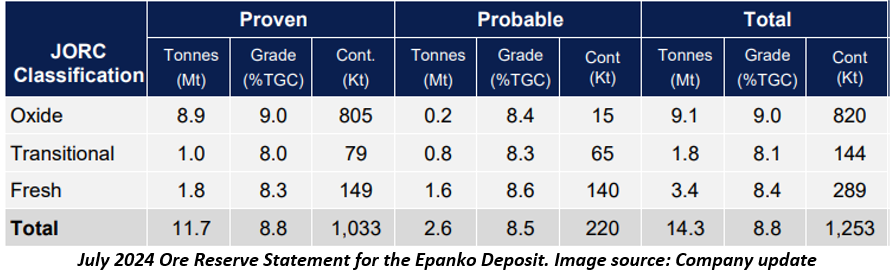

The Ifakara location supports the company’s planned expansion of its Epanko operation, aimed at producing approximately 300,000 tonnes per annum of flake graphite products.

The facility will add value by processing 20,000 tonnes per annum of natural flake graphite from Epanko into spherical graphite. This conversion is expected to achieve a yield of over 60%, supported by extensive pilot and commercial-scale mill testing. The mechanical micronizing and shaping process will serve as the initial stage in transforming flake graphite into battery-grade anode material, which is essential for lithium-ion battery production.

The estimated cost for Stage 1 construction is US$58.6 million, with a forecasted operating cost of US$419 per tonne. The Tanzanian location provides notable cost advantages in terms of power and transportation.

Furthermore, the potential designation of an Export Processing Zone (EPZ) could offer additional benefits, including a corporate tax exemption for the first 10 years.

Proven Testing and Efficient Design

The facility’s design is based on comprehensive pilot and commercial-scale tests, confirming an Epanko yield of over 60%.

Milling and shaping programs have produced qualification samples that meet industry specifications.

Cost Estimates and Sustainability Benefits

The study deployed an engineering, procurement, construction and management (EPCM) approach to estimate capital costs, covering plant infrastructure, roads, power, and water storage. Additional costs, including spares and waste treatment, will be assessed once the site layout design is finalised.

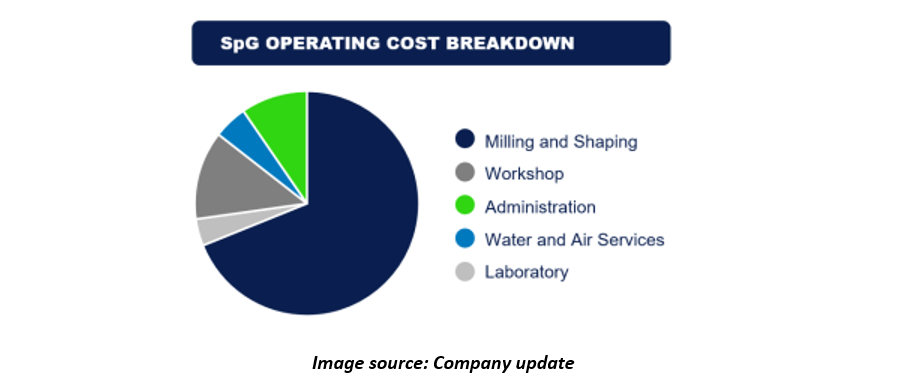

Operating costs breakdown for spherical graphite (SpG) production –

Notably, 40% by-product fines have been allocated to EcoGraf GreenRECARB for the global steel sector.

An Independent Life Cycle Assessment confirmed a ~20% reduction in CO2 emissions due to Tanzania’s hydro-energy. The company is also working with the EU Commission in Tanzania to further support the facility’s development, including studies on the value-addition uses of graphite fines, including EcoGraf’s GreenRECARB.

Strategic Infrastructure Advantages

Ifakara is well-connected via roads and rail, with plans for a dedicated rail-siding. The EU-funded Ifakara sub-station, operational since June 2024, provides clean power from the Julius Nyerere Hydropower Project. A sealed highway links Ifakara to Dar es Salaam, and Ifakara is approximately 75km from Epanko by road.

Ongoing engineering campaigns at the Ifakara site are optimising logistics for transporting Epanko graphite products to the export port of Dar es Salaam.

The completion of this study follows the company’s recent announcement regarding its HFfree® purification technology, which has been operating continuously with reliable performance in both materials of construction and key equipment during production programs.

EGR shares traded at AU$0.29 per share at the time of writing on 24 March 2025.