Highlights

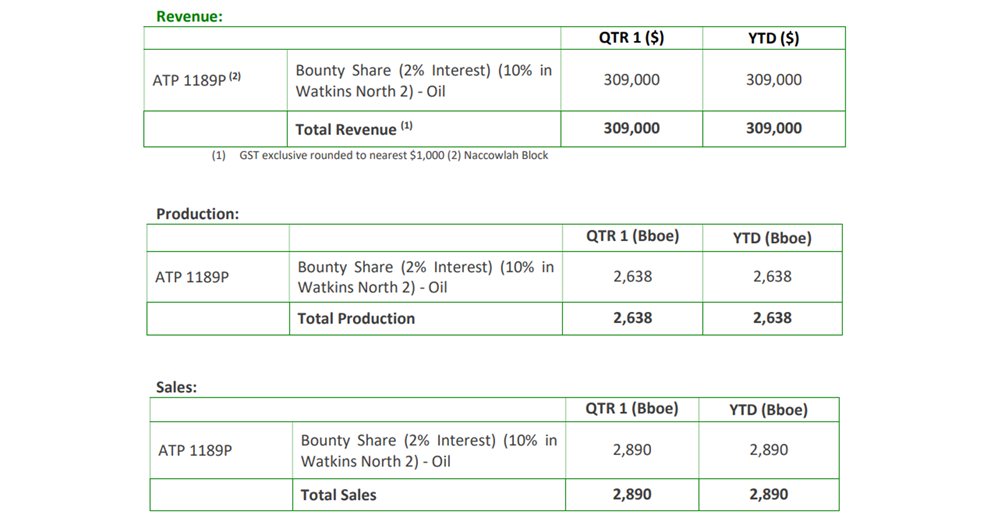

- Bounty Oil & Gas NL recorded oil revenue of AU$309,000 for the September quarter.

- Oil development at the Naccowlah Block is advancing, with drilling plans for the Watson/Watkins and Jackson Field reserves set for 2025.

- Bounty acquired 100% ownership of additional oil reserves near Alton and is working to restore Surat Basin fields for 2025 production.

Bounty Oil & Gas NL (ASX:BUY) concluded the latest quarter with significant progress in its oil production and development activities, recording oil revenue of AU$309,000 for the period.

The company plans to commence production from the Alton area in the Surat Basin, SE Queensland, between late 2024 and early 2025.

Unaudited petroleum revenue and sales for the quarter are summarised below.

Data source: Company update

ATP 1189P Naccowlah Block and Associated PLs in SW Queensland - Bounty 2%; Watkins North 10%

PL 2 Alton Oilfield and PL 46 Fairymount Oilfield - Southern Surat Basin Onshore Queensland, Bounty - 100%

During the period, Bounty acquired 100% ownership of additional proved oil reserves and facilities at PL46, adjacent to Alton. Field operations continued with the aim to bringing the Surat Basin fields back into production in 2025.

Detailed studies and seismic re-mapping were also carried out to explore proven oil in the Showgrounds Formation at PL46 Fairymount.

In 2024, Bounty plans to bring two wells at Alton back into production, starting with the Alton 3 well, which is expected to generate an initial production of 100 bopd, contributing approximately AU$2 million in gross revenue for 2025.

Jacobson (formerly Cerberus) Project

On the Jacobson (formerly Cerberus) Project in the Offshore Carnarvon Basin, Bounty has the right to earn 25%, with options to increase its stake to 50%.

In August 2024, Bounty announced the execution of a binding Heads of Agreement (HoA) with a rig contractor for a Carnarvon Basin drill program, securing key commercial terms. The timeline for next quarter’s drilling depends on Coastal’s progress in securing permit extensions, with further extensions contingent on securing drill funding. The remaining permits extend beyond 2025.

Bounty’s oil reserves and resources grew in 2024. By the end of the quarter, producing and contingent oil reserves in Queensland totaled 313,000 bbls. This growth was driven by the Watkins North NFE and new discoveries in the Cooper Basin, along with Surat Basin acquisitions. Bounty is also looking forward to participating in additional NFE and development drilling programs at the Naccowlah Block. Total production is expected to surpass AU$ 2.5 million per annum by late 2025.

The company’s cash and liquid investment assets stood at AU$1.06 million on 30 September 2024.

The stock price of BUY was AU$ 0.005 on 07 November 2024.