Highlights

- Bounty Oil & Gas holds a significant interest in 19 producing fields within the Naccowlah Block, located in southwest Queensland.

- The company holds 100,000bbl of oil behind perforations in the suspended Alton and Fairymount oilfields.

- Bounty is also advancing the Eluanbrook 2 development well, which holds 90,000 barrels of P50 recoverable oil.

- Bounty aims to raise production to a P50 target of 280-355 barrels per day, potentially generating around AU$16 million annually.

Bounty Oil & Gas NL (ASX:BUY) is a well-established player in the Australian oil & gas industry with a clear focus on steady production and development. The company operates in key oilfields across the country, including its interest in 19 producing fields in the Naccowlah Block, located in southwest Queensland. These fields continue to provide a stable and consistent production base.

Steady Oil Production and Development Potential in Naccowlah Block

The company holds a significant stake in the Naccowlah Block, which is home to 19 producing oilfields. One of the key areas of focus is the Jackson oilfield, the largest onshore field in Australia, where Bounty has identified 50,000 barrels (net to BUY) of development and appraisal targets as part of a re-evaluation process.

Potential Upside in Suspended Wells and Future Appraisal Targets

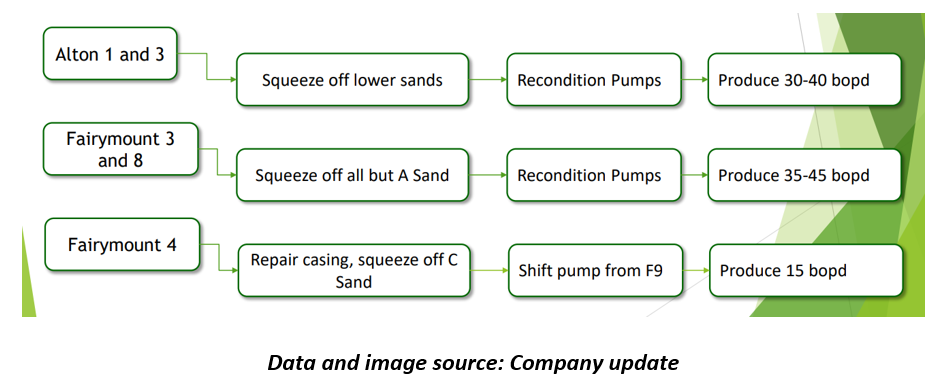

Its existing assets are supplemented by substantial upside potential in fields such as Alton and Fairymount. The company holds 100,000 barrels of oil behind perforations in these suspended oilfields, along with an additional 280,000 barrels of P50 recoverable oil in development and appraisal drilling targets in Alton 11, 12, and Fairymount 10 wells.

Further, Bounty is advancing the Eluanbrook 2 development well, which holds 90,000 barrels of P50 recoverable oil.

These efforts are part of a comprehensive work program aimed at raising production to a P50 target of 280-355 barrels per day, expected to generate around AU$16 million annually.

Expanding Oil & Gas Interests

In addition to its onshore ventures, Bounty holds a 15% interest in PEP 11 in the offshore Sydney Basin, with a 500 PJ gas drilling target located adjacent to Australia's largest gas market.

The company is also in negotiations to earn a 25-50% interest in the Jacobson (formerly Cerberus) project in the Carnarvon Basin, positioning Bounty in a target-rich oil & gas environment.

Bounty’s stage 1 strategy for increasing income involves realising cash flow from low-risk reserves, driving steady financial growth.

Similarly, stage 2 involves the following:

- Realising cash flow from low-risk development opportunities in the Alton Field, with plans to drill Alton 11 Eastern Attic, develop 130,000 barrels of P50, and produce a Qi of 100 bopd.

- Realising cash flow from low-risk development opportunities in the Fairymount Field, with plans to drill Fairymount 10 Southern Lobe Attic, develop 80,000 barrels of P50, and produce a Qi of 50 bopd.

Stage 3 involves realising cash flow from appraisal opportunities in the Alton Field, with plans to drill Alton 12 Western Attic to appraise reservoir development. If successful, it plans to develop 70,000 barrels of P50, producing a Qi of 60 bopd.

BUY shares last traded at AU$0.004 a piece on 25 November 2024.