Highlights

- Chimeric substantially bolstered its portfolio and advanced clinical development during FY22.

- The period saw the licensing of a novel CAR T cell therapy from the University of Pennsylvania.

- The company continued to advance its first asset in a glioblastoma Phase 1 dose escalation study in the US.

- Chimeric exercised an option to licence a CORE‐NK platform.

- The company strengthened its balance sheet with an entitlement offer and shortfall placement coupled with an equity placement agreement with L1 Capital.

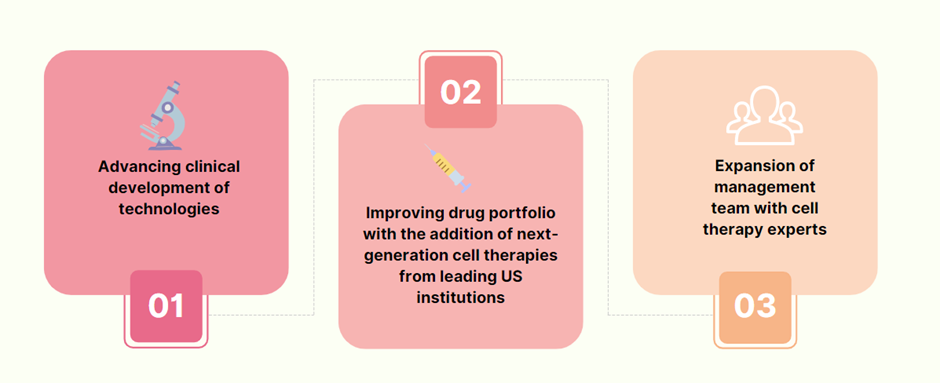

Chimeric Therapeutics (ASX:CHM) witnessed a year of great progress on many fronts during the 12-month period ended 30 June 2022. The primary focus during the reported period remained on bolstering the company’s product portfolio and advancing clinical development, as part of the journey to become a world leader in the cell therapy sector.

Primary focus areas (Data source: CHM update)

© 2022 Kalkine Media®

Strong financial footing

During the reported period, Chimeric boosted its financial position. The company established an equity funding agreement with L1 Capital Global Opportunities Master Fund for up to AU$30 million.

Moreover, the company conducted entitlement offer and shortfall placement, raising nearly AU$14.4 million.

Clinical progress during FY22

- CHM 1101 (CLTX CAR T) continues to advance in glioblastoma study

Chimeric secured IND clearance from the FDA for patients with recurrent/relapsed glioblastoma. The company intends to expand the clinical development program of CHM1101 to new Phase 1 sites.

In June, the company completed the production and quality release for the CHM1101 viral vector.

In March, the company entered a strategic relationship with a top US organisation, Be The Match Biotherapies, for supply chain solutions that will assist in expanding the clinical development of CHM1101. The company also joined hands with OncoBay Clinical to expand the clinical development program of CHM1101.

A patent entitled “Chimeric antigen receptors containing a chlorotoxin domain” has been granted by the United States Patent and Trademark Office to CHM1101 and pre-clinical stage CAR NK asset CHM 1301. CHM1101 also secured a European patent.

- Chimeric advancing CHM2101 - novel CAR T cell therapy

The period saw the licensing of the first-in-class CDH17 CAR T cell therapy, CHM 2101, from the University of Pennsylvania, the world-renowned Cell Therapy Centre.

Further, Chimeric expanded the licence to Viral Vector Technology from the university. It has also completed the production of CHM 2101 research-grade plasmids.

Moreover, pre-clinical data of CHM 2101 was published in the highly prestigious journal, Nature Cancer.

Since this asset acquisition, the company has been focusing on completing the necessary work required for US FDA IND submission to enable CHM 2101 to enter in the near future.

- CHM 0201 (Core NK Platform)

In December, Chimeric entered an exclusive option on CORE-NK technology from Case Western Reserve University (CWRU). It rapidly initiated the CORE-NK combination trial approved by the FDA.

In March this year, the company announced positive Phase 1 clinical trial results, boosting its confidence in the potential of this asset.

As a result, the company secured FDA approval for a new clinical trial to analyse CHM 0201 in combination with IL‐2 and Vactosertib.

Strengthened leadership team

During the last year and subsequent to the period, the company remained focused on boosting its leadership capabilities.

- Jennifer Chow accepted promotion to CEO and Managing Director

- Dr Eliot Bourk moved into the role of Chief Business Officer (CBO) and Head of External Innovation

- Celgene veteran Dr George Matcham joined the Board of Directors

- Dr Jason B. Litten appointed as Chief Medical Officer

- Kelly Thornburg joined as Vice President, Head of Quality

Moreover, Chimeric initiated a new Cellular Immunotherapy Scientific Advisory Board (CI-SAB) comprising world-class experts from the cellular immunotherapies space.

CHM shares closed the day’s trade at AU$0.096 on 6 October 2022.