Highlights

- Arcadia Minerals has received assay results for the lithium infill drill programme conducted at the Bitterwasser Lithium Clays Project over the Eden Pan.

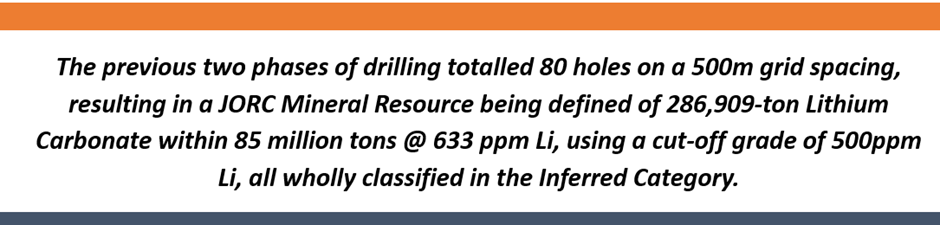

- The third phase of drilling was completed over the pan in December 2023, with 26 infill holes over 213,2m on a 250m drill spacing.

- Total 155 clays samples and 13 QC samples were tested for lithium, of which 101 samples reflected values of >500 ppm Li.

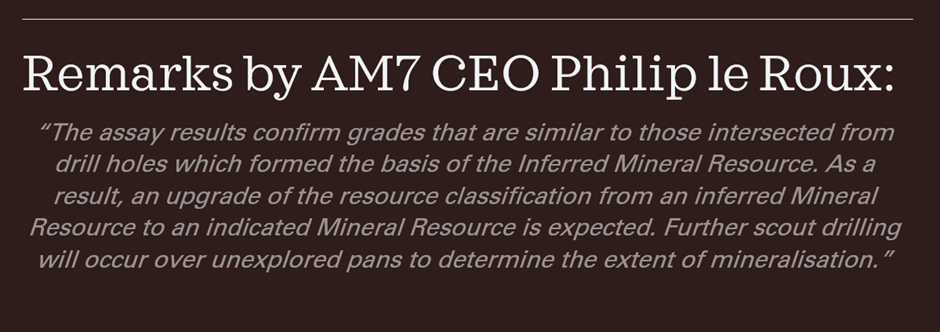

- With the latest results, the company is expecting an upgrade to the mineral resources for Eden Pan–existing inferred JORC mineral resource of 286,909-ton LCE

- Updated Mineral Resource is expected by the second quarter in 2024.

- If an upgrade of the Mineral Resource is achieved, a Pre-Economic Assessment will commence over the Lithium in Clays of the Eden Pan

- Supplementary heap leach test work over Eden Pan clay ore by MetalTek expected by March 2024

Diversified exploration company Arcadia Minerals Limited (ASX: AM7, FRA: 80H) has received assay results for the lithium infill drill programme conducted at the Bitterwasser Lithium Clays Project over the Eden Pan. AM7 had completed the third phase of drilling over the pan in December 2023, with 26 infill holes over 213,2m on a 250m drill spacing.

The three highest individual samples from the 155 samples collected during the drilling campaign included EDD13 from 10 to 11.4 m @ 1 138 ppm lithium, EDD10 from 9 to 10 m @ 1 003 ppm lithium and EDD15 from 10 to 12 m @ 935 ppm lithium.

The three drillholes with the highest weighted average grades included EDD10 from 0 to 10 m @ 751 ppm lithium, EDD15 from 0 to 12 m @ 748 ppm lithium and EDD13 from 0 to 11.4 m @ 730 ppm lithium.

Data source: company update

Data source: company update

Overview of drill program

The latest drill campaign aimed at potentially increasing the mineral resource classification of the Eden Pan.

Data source: company update

In this third phase, the highest individual values are:

- EDD13 from 10 to 11.4 m @ 1 138 ppm Li

- EDD10 from 9 to 10 m @ 1 003 ppm Li

- EDD15 from 10 to 12 m @ 935 ppm Li

The drillholes in the centre of the pan had the highest weighted average grades:

- EDD10 from 0 to 10 m @ 751 ppm Li

- EDD15 from 0 to 12 m @ 748 ppm Li

- EDD13 from 0 to 11.4 m @ 730 ppm Li

As per the assay results, only three drillholes - EED12, EDD26 & EDD27 – delivered a weighted average grade <500 ppm Li. The three holes located on the edge of the pan were drilled considering stratigraphic modelling factors and fall outside of the current JORC complaint resource using a 500ppm lithium cut-off.

The company is expecting reclassification of the existing inferred resource into the indicated Mineral Resource category.

Further, a pre-economic assessment will be done for the Eden pan, after the Mineral Resource is converted into an indicated Mineral Resource.

Notably, Arcadia Minerals is expects to announce the updated Mineral Resource by the second quarter in 2024. The current JORC Mineral Resource at Eden Pan stands at 286,909-ton LCE.

Also, MetalTek has initiated bulk heap leach test work on a 600kg sample that was collected from drill core over the resource area. AM7 is expecting its results to be out by March 2024.

AM7 shares traded at AU$0.067 on 05 February 2024, with a market cap of over AU$5.99 million.