Highlights

- Definitive feasibility study (DFS) confirmed the potential of the Swanson Li-Ta project as significant cashflow generator.

- Mineral resources at the Bitterwasser lithium clay project pans grew from 286,909 LCE tons to 327,284 LCE tons.

- Significant lithium brine anomaly of 42 km x 9 km defined by geophysics over the Bitterwasser lithium brine project, expected to be drilled in the next quarter.

- At Karibib’s Gamikaub prospect, drill assay results confirmed high grade mineralisation up to 1.98% Cu and 0.92 g/t Au.

Diversified exploration company Arcadia Minerals Limited (ASX: AM7, FRA: 8OH) reported significant progress across its projects in Namibia during the latest quarter ended 30 June 2023.

Some of AM7’s projects are located near established mining operations and significant discoveries. The company highlights that all its projects hold substantial potential to host economic quantities of minerals that can be further developed and explored.

Let us skim through major developments undertaken by the company during June quarter.

Stellar DFS numbers for Swanson mining project and fully funded development financing package inked

Orange River Pegmatite (Pty) Ltd (ORP) inked a funding-through-subscription transaction with HeBei Xinjian Construction CC. With this transaction, plant and infrastructure development is expected to start with the intent to execute mine development and the deployment of a multi-gravity separation plant at the Swanson tantalum-lithium project.

Arcadia has an 80% interest in ORP, and after the execution of the transaction, 38% interest in ORP would be acquired by HeBei for the consideration of a minimum US$7 million mine development funding package. Aside from the funding package to construct the mine, HeBei would also be required to put the mining operation into a 3-month steady state of production to earn its interest in the project.

During the quarter, the company announced definitive feasibility study (DFS) results, confirming the project’s potential as a substantial cash flow generator. The study indicated AU$6.4 million in free cash flow per annum.

The project is forecast to be in production by the first quarter of 2025.

For detailed discussion on DFS, read here.

Mineral resources upgrade at lithium in clays project

During the quarter ended 30 June 2023, mineral resources at the Bitterwasser lithium clay project increased to 327,284 LCE tons from 286,909 LCE tons. The overall mineral resources cover only two out of fourteen known pans. Exploring additional pans is anticipated to increase mineral resources to 500,000 tons LCE, suggests the company.

The company intends to conduct a preliminary economic assessment to ascertain high level project economics in the new quarter.

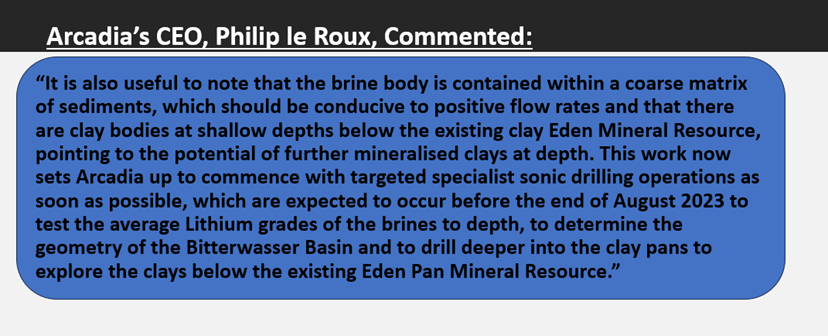

Sonic drilling to commence at lithium in brines project

Stratigraphic drilling across the Bitterwasser basin led to the identification of brines mineralised with lithium intersected at 28m below the surface over a 42km x 9km geophysical anomaly. The company plans to undertake a sonic drilling program in the coming quarter across the anomaly.

Data source: Company update

Karibib project to be explored further

Assay results from phase one drilling at Karibib project confirmed mineralisation at the Gamikaub prospect. Significant mineralisation in sulphides zones was reported in two of the drillholes:–

- KRC03 from 24m to 28m, width of 4m @ 1.35% Cu & 0.68 g/t Au, including 2m from 26 to 28m @ 1.73%Cu & 1.2 g/t Au

- KRC08 from 9 to 13 m, width of 4m @ 1.98%Cu & 0.92g/t Au & 0.72% W

The company plans to conduct follow-up drilling at the area where mineralisation was reported. Also, the larger 20km target zone is expected to be further explored through geophysical methods with the intent to locate more drill targets for the second phase of drilling program.

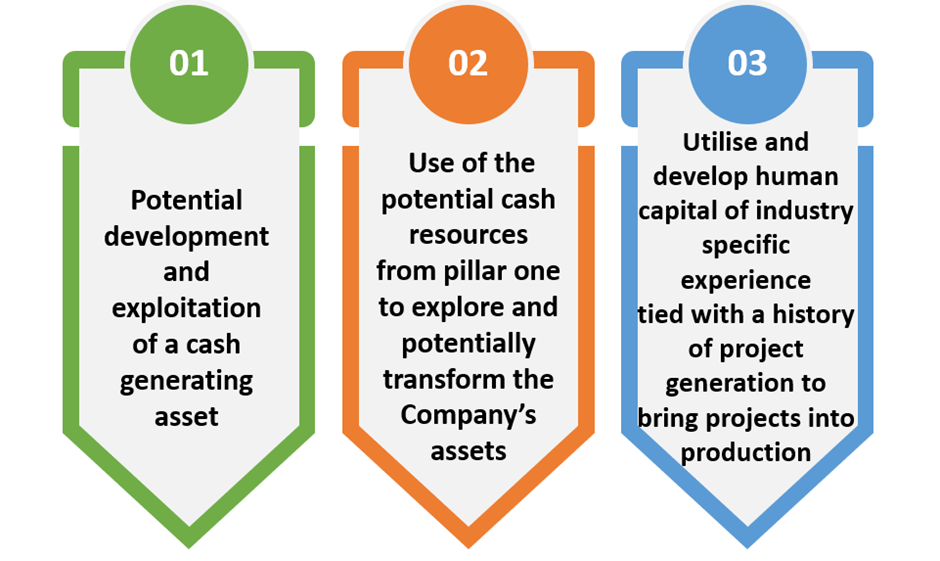

All in all, the company made significant progress across its projects as part of its three-pillar strategy.

Data source: Company update