Highlights

- Arcadia Minerals has announced results from the Definitive Feasibility Study (DFS) conducted over the Swanson Project.

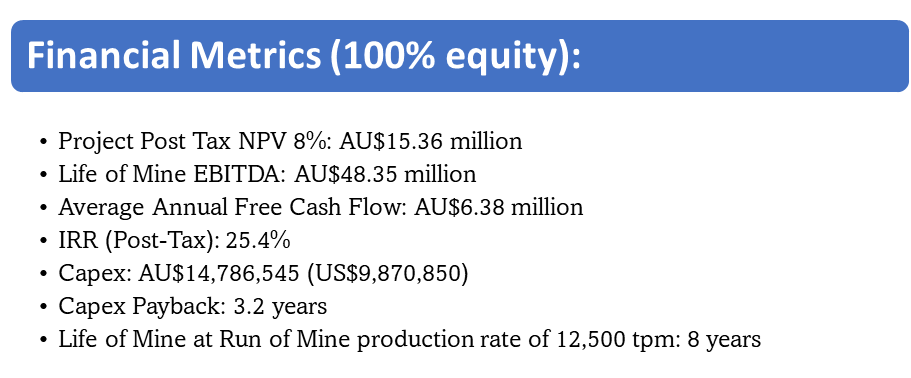

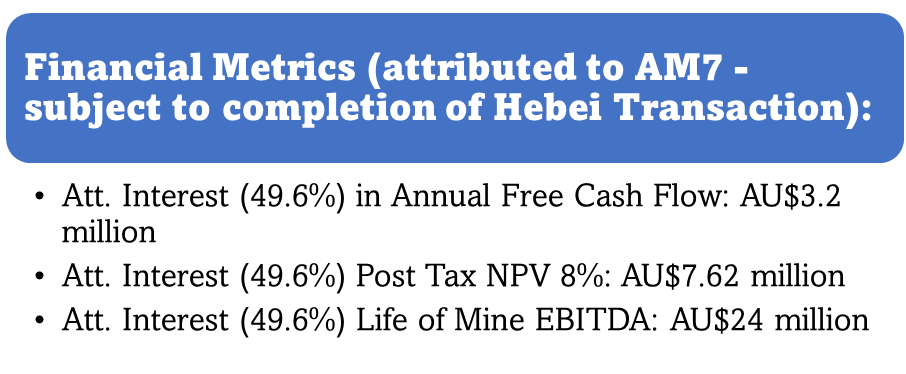

- The DFS has indicated an attributable (49.6%) NPV8% of AU$7.62 million, annual free cash flow to Arcadia (49.6%) of AU$3.2 million and an attributable (49.6%) life of mine EBITDA of AU$24 million, subject to the completion of transaction with Hebei.

- Under the deal with Hebei, Hebei will fund a minimum US$7m in construction funding and commission the plant to consistently produce a minimum 25% Ta2O5 concentrate from a minimum feed of 12,500mt per month, for an equity interest of 38% in Swanson.

- The life of mine may be extended through exploration over the mine and over nearby EPL 7295 and EPL 5047.

In the latest update, diversified exploration company Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) has shared results from the Definitive Feasibility Study (DFS) that was conducted over its Swanson Tantalum-Lithium Project.

According to the company, ‘the compelling financial metrics of the DFS tied with the comprehensive construction funding capacity gained from the recently announced transaction with Hebei Construction, underlines the significant value proposition of Arcadia and validates our ambitions of establishing a cash generative enterprise to fund exploration objectives at our potentially company transforming assets.’

Data source: AM7 update

DFS points to compelling financial metrics

Arcadia Minerals had engaged M.Plan International Ltd, a Canadian mining and minerals advisory firm, for compilation of the results of the DFS on the Swanson Tantalum and Lithium Project, into a Competent Person Report.

Data source: AM7 update

Arcadia holds interest in the Swanson Project via Orange River Pegmatite (Proprietary) Ltd (ORP), in which AM7 has an 80% interest. AM7’s interest will reduce to 49.6%, subject to construction funding of at least US$7 million by Hebei Construction CC in return for an equity interest of 38% in ORP. As per the terms, Hebei will build a plant, infrastructure, roads and do mine development and commissioning of a multi gravity separation (MGS) Plant to consistently produce a minimum 25% Ta2O5 concentrate from a minimum feed of 12,500mt per month.

To know more about this development, read here

Data source: AM7 update

As per the DFS report, the Swanson Project includes the open cast mining of the D-pegmatite and E F-pegmatite deposits, primary and secondary contractor crushing and screening, a spiral concentrator plant, dry stacking of the spiral tailings and mine waste and associated bulk infrastructure supply and other services related to open cast mining in Southern Africa.

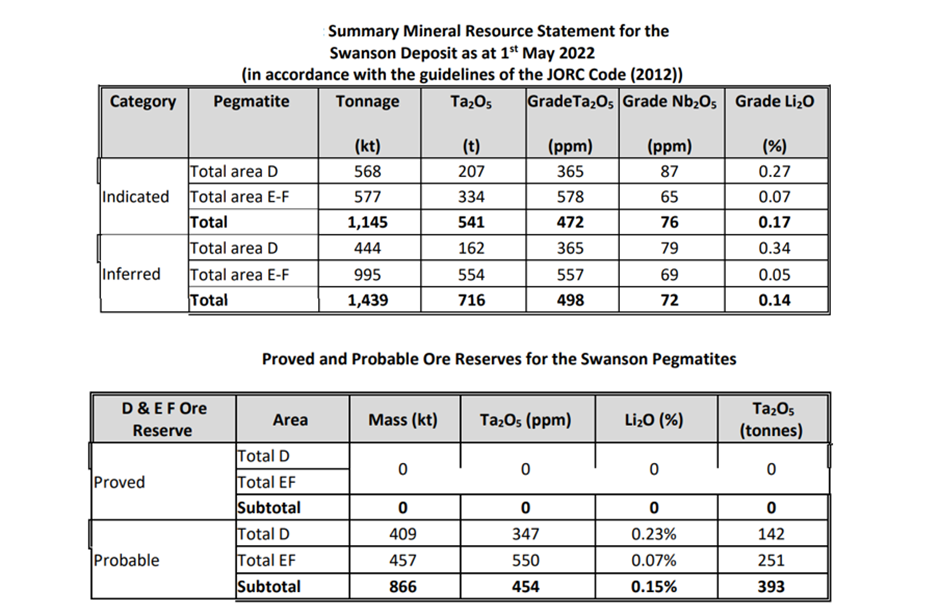

Mineral Resource & Ore Reserves Estimation

Image source: AM7 update

Arcadia’s plans for future exploration

For all the exploration operations being conducted at the Swanson Property, the Mine Geological Department (MGD) of ORP will be responsible. In total, three proposed drilling programmes will be implemented over the life of mine (LoM), to extend the 1 May 2022 Mineral Resource Estimate.

An overview of the Swanson Project

The Swanson Project neighbours the active Tantalite-Lithium mining license ML 77 operated by African Tantalum (Pty) Ltd, which is owned by Hebei Construction CC (Hebei) in terms of a transaction with London Stock Exchange (AIM) listed, Kazera Global Plc (AIM: KZG). ML 77 is located within the boundaries of EPL 5047.