Highlights

- The pandemic phase growth in cryptoassets seems to have become a thing of the past

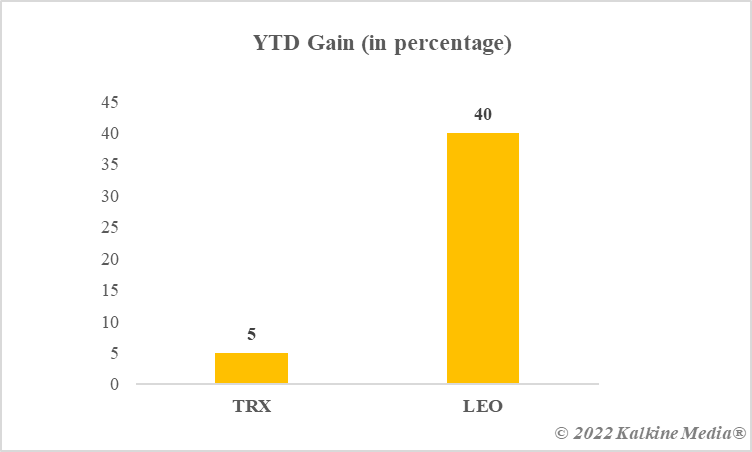

- Only two tokens among the top 100 are in the green in terms of price fluctuation this year

- The LEO token has had a sustainable ride, while the TRX token appreciated only after May

Cryptocurrencies enjoyed one of the best bullish phases after the world was struck by the pandemic in 2020. Though not all cryptoassets would have gained during this phase -- CoinMarketCap tracks nearly 20,000 -- the overall market cap skyrocketed, led by gains in BTC and other major tokens.

This year, virtually all variable-return assets, including stocks and cryptos, are reeling from volatility. A couple of cryptocurrencies, however, have defied all odds to register year-to-date (YTD) gains. All the assets, sans these two and some stablecoins that make the top 100 cryptos, either have no gains or a negative YTD.

The ones not in the top 100 have a comparatively very low market cap and they can be hyper-volatile. And hence their price movements may not make much sense when talking about YTD.

1. UNUS SED LEO (LEO)

BNB is a popular token, and so is CRO. Both these tokens represent crypto exchanges Binance and Crypto.com, respectively. The LEO token also represents the Bitfinex exchange. However, the asset is yet to break into the top 5 assets like BNB.

But even at position 17, with respect to market cap, as of writing, the LEO token is a big player. What’s most impressive is its resilience against the ongoing bearish phase in the cryptoverse. The LEO token, which started this year at a price of under US$3, is trading at nearly US$5.5 as of writing. By contrast, the BNB token has lost 45% on a YTD basis. BTC and ETH YTD loss is at 37% and 52%, respectively, as of writing.

The upward momentum in the LEO token began in February, and at one point, the price reached even US$7.5. The price momentum has largely stayed in the green throughout the year.

Also read: AS Roma Fan token volume balloons 400%; here are key features of ASR

2. TRON (TRX)

If near competitors of the LEO token are BNB and CRO, TRON crypto competes with blockchains like Ethereum and Solana. TRON is used by blockchain developers for smart contracts, decentralised apps, and other products.

TRON claims to have a better speed than Bitcoin and Ethereum. This is because of the “delegated proof-of-stake” method of transaction recording. The TRX token of TRON rose in May before which, it was largely in the red all through the year. TRX’s price on January 1 was nearly US$0.07. As of writing, the price is over US$0.08. TRX has not gained as sharply as LEO, but as of now, these two are the only cryptos in the green in YTD terms.

TRON is a top 15 cryptoasset, having a market cap of over US$7 billion.

Data provided by CoinMarketCap.com

Also read: What you should know about Josh Allen NFTs

Bottom line

In the top 100 crypto list, there are many stablecoins like BUSD and PAX Gold. Stablecoins’ value is usually dependent on the value of the asset they are pegged to. Therefore, their gains or losses do not compare with that of speculative assets like BTC, LEO and TRX. LEO and TRX have gained so far this year, but what happens in the latter half of 2022 is unpredictable.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.