Summary

- Commodity markets across the globe have put up a good show amidst COVID-19 outbreak with many rallying to record highs.

- The surge in the commodity space, especially in gold, silver, iron ore, and copper, has been a boon for ASX200 and other—listed mining stocks.

- Many mining stocks are now either trading around their record or multi-period highs, delivering price appreciation and significant returns to shareholders.

- A look at the shiners of the post-COVID outbreak period.

Commodity markets across the globe have put up a good show amidst COVID-19 outbreak with some such as gold & silver surging in the wake of market fear and growing need to hedge the equity portfolio against a sell-off instigated by the economic meltdown on a global scale while others such as iron ore, copper, nickel, surging due to supply disruptions.

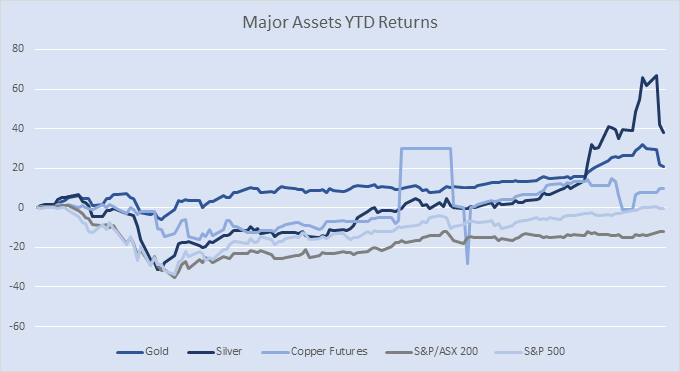

Data Source: Refinitiv Eikon Thomson Reuters

The Precious Metals Space

Gold and silver have been a stallion of the post-COVID-19 period with both surging to a record high in the recent past as the demand from global gold- and silver-backed ETFs soared, taking the total money flow in structured products to a record high, especially during the June 2020 quarter.

The silver spot inked a high of USD 29.863 per ounce (as on 7 August 2020) while the gold spot contoured a record of USD 2,079.65 (as on 6 August 2020), leading to a substantial price gain and strong YTD returns, which primarily surpassed the returns of other major equity indices such as S&P 500 and S&P/ASX 200.

To know More, Do Read: Australian Gold-Backed ETFs – Massive Capital Influx, Impeccable Performance, And Record Values

The surge in gold prices has prompted many listed stocks on the exchange to test new records or multi-period highs in the recent past, some of which, have even outperformed gold in the wake of a gradual recovery in the equity market during the June 2020 quarter.

To Know More, Do Read: Gold Stocks Attempting Volatility Breakout – NST, SAR, GOR, and RRL

The surge in gold is just not ignited by record demand from global gold-backed ETFs, like many other commodities, supply disruption has also played its part in the rally.

Due to several restrictions imposed by various governments on the international front, the workforce squeeze has disrupted many mining operations on the global scale, including gold mining, leading to a supply gap, which in the middle of strong demand, has fanned gold prices to record high.

To Know More, Do Read: Gold Supply Disruptions and Paradigm Shift in Gold Miners’ Business Strategy

On the other counter, the other precious metals member – silver has also led a strong charge on the global front with silver even outperforming gold on multiple stances.

A strong rally in gold saw a rub off effect on silver, leading to a FOMO buying in silver.

To Know More, Do Read: Silver Outperforms Gold with Over 30% Return; Money Managers Betting on Silver!!

Amidst an impeccable rally in silver, silver mining stocks have also performed well in the recent past with returns from many surpassing returns from gold, gold mining stocks, and silver itself.

To Know More, Do Read: Silver Mining Stocks Beating Gold Top Guns – Adriatic PLC, Aeon Metals, and Silver Mines Turn Multibaggers

Iron Ore And Base Metals

While the precious metals space has been the stallion of the year, iron ore and base metals have also been the talk of the town with returns from both the space standing tall, prompting many miners such as Fortescue Metals Group Limited (ASX:FMG) to reach record highs while aiding some stocks such as BHP Group Limited (ASX:BHP), Rio Tinto Limited (ASX:RIO) to deliver strong returns.

Robust demand from China and supply disruptions caused by bad weather across Brazil and Australia has supported iron ore prices on the international front with prices reaching a record high of RMB 915.00 per dry metric tonne (as on 6 August 2020).

The steel demand in China remains robust till date as the government pulls major strings to provide stimulus to the economy, leading to spiked construction activities and a large investment in fixed assets, which in turn, propelled the steel demand, leading to a supply surge, supporting iron ore demand and price.

To Know More, Do Read: Iron Ore Prices Poised to Weather The Supply Normalcy Storm?

On the base metals counter, copper has emerged as the poster boy with a supply gap leading to a rush in price amidst high demand from China.

Also Read: Commodity Supply Chain Disruption and Australia Export Position

The COVID-19 outbreak along with weather and mining challenges in Peru had impacted copper production across major mines, leading to a quarterly decline of 25 per cent in March 2020, with the first quarter production plunging by 12 per cent.

This decline across Peru had a considerable impact on the global mine production, which slipped by 2.5 per cent in March 2020.

To Know More, Do Read: Copper Rush Drawing Australian Titans; Australia To Climb the Supply Ladder?

In the wake of such a splash in prices across major commodities, many ASX-listed stocks have emerged as the star performer of the mining space, delivering considerable price appreciation to shareholders along with strong returns.

To Know More, Do Read: Commodity Stocks Making Their Way To The Top

To summarise, commodity segment has performed relatively well in the post-COVID time period with a strong performance from a multitude of commodities such as gold, silver, iron ore, and copper, prompting the mining space on the exchange to perform considerably well.

Many mining stocks are now either trading around their record or multi-period highs, delivering price appreciation and significant returns to shareholders.

Furthermore, the estimated global recovery over the coming years is now serving as tailwind with many mining companies relatively optimistic over their operations and performance ahead.

In the recent past, gold, silver, iron ore, and copper stocks have gained considerable momentum, and it would be worth studying how the market works out for other commodities such as lithium and oil, which have been in a hibernation mode after a brief fall so far.