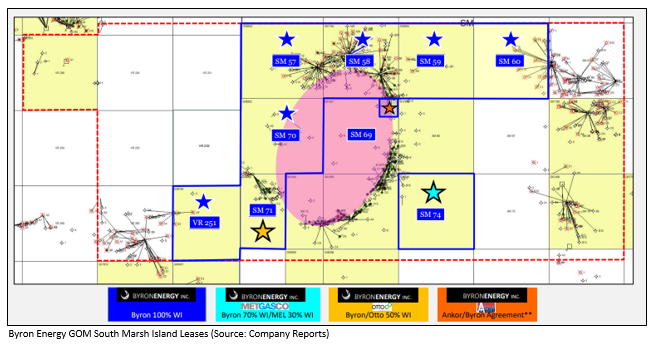

Byron Energy Limited (ASX: BYE) is an Australia registered company involved in the development and exploration of oil and gas in shallow waters of the Gulf of Mexico and the USA. Today, on 5th June 2019, the company announced via a release that a wholly-owned subsidiary of Byron Energy Limited, Byron Energy Incâs bid for South Marsh Island 60 lease, which is located in the Gulf of Mexico OCS Lease Sale 252 has been deemed acceptable by the Bureau of Ocean Energy Management and additionally, the leases have been awarded to Byron Energy Limited. The South Marsh Island 60 lies immediately east of the companyâs existing South Marsh Island 59 lease. Moreover, the lease enhances the companyâs lease position around SM 73 salt dome, where it has 23 blocks of recently reprocessed RTM 3D seismic data.

According to the companyâs previous announcement dated 21st March 2019, the company made a bid of around US$188,000 as a bonus bid, wherein the company has 100% working interest along with 87.50% net revenue interest in the South Marsh Island Block 60.

In the period of 1976 to 2006, the company concluded nine wells for the production on South Marsh Island 60, which produced 385 billion cubic feet of gas with 787,000 barrels of oil. South Marsh Island 60 (or SM60) lies within the area of lately announced RTM reprocessing project, which was used to evaluate the prospect potential on the block.

In terms of the companyâs previous announcement dated 27th May 2019, BYE operated SM74 D-14 well, which is the first test well on the South Marsh Island 74 block, was drilled to a depth of 3,510 ft Measured Depth with a true vertical depth of 3,464 ft, and the surface casing was set and cemented in place. The company further pointed out that SM74 D-14 exploration well is currently drilling ahead with 4,490 ft Measured Depth. In addition, the well is being drilled from Ankorâs SM73 D platform utilising the White Fleet Drilling 350 jack-up rig.

The company earlier provided more details on the Raptor prospect, which is being drilled by SM74 D-14. The Raptor prospect will be drilled to a depth of 16,464 ft Measured Depth and South Marsh Island 74 D-14 well will test three multiple seismic amplitude supported target sands. The SM74 D-14 well is anticipated to be drilled to a depth of 16,747 ft along Measured Depth with the total vertical depth of 14,726 feet and will take around 50 days to drill from spud.

Additionally, the company farmed-out a 30% working interest of SM74 to Metgasco prospect on standard terms of the industry, as per which, BYE will be paying 60% and Metgasco will earn its interest by paying 40% of the $11.4 million initial well dry hole costs. After the initial well is drilled to the total depth, the company and Metgasco will also be bearing their respective costs of 70% and 30%, respectively. BYE is the operator of well via its wholly-owned US subsidiary Byron Energy Inc.

Turning to the Quarterly Report of the company. BYE presented its rectified quarterly report on 30th April 2019. The company has highlighted that its share of oil and gas production from SM71 and SM58 E1 well stood at 107,995 barrels of oil and 274,511 mmbtu of gas for the March 2019 quarter and the net revenues from SM71 and SM58 was around US$6.7 million. In the March 2019, BYE inked a Letter of Intent with SM69 leaseholders to drill an SM69 E2 development well off the recently acquired E Platform to earn an interest in the north-east portion of the SM69 lease block.

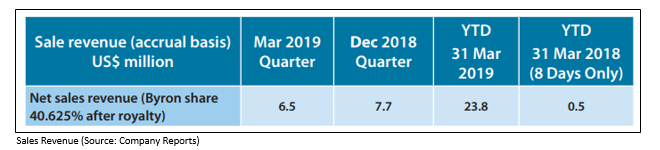

In terms of net sales revenue, the companyâs share of net revenue stood at approximately US$6.5 million in March 2019 quarter when compared to US$7.7 million in December 2018 quarter. The share of net revenues was impacted by slightly lower oil production and lower average realised oil and gas prices.

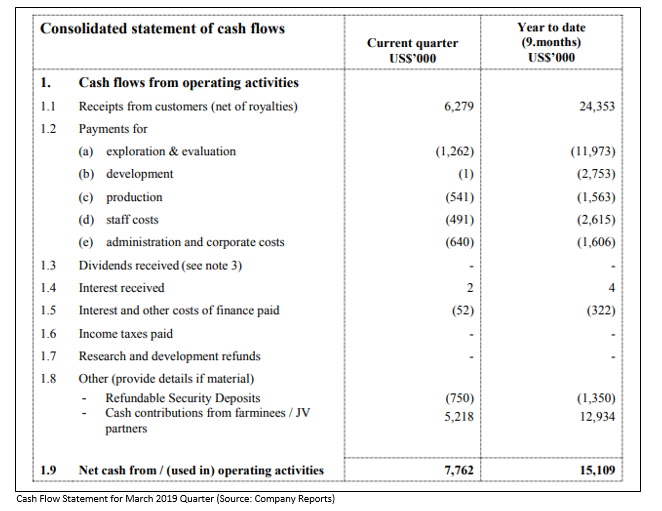

The net cash from operating activities stood at $7.762 million, including $1.262 million of exploration and evaluation expenses and $0.640 million of administrative and corporate costs.

During the March 2019 quarter, the company realised an average oil price of US$54.69 per bbl subsequent to the uplift for LLS (Louisiana Light Sweet crude) price differentials and deductions for transportation, oil shrinkage and other applicable adjustments as compared to US$60.89 per bbl and US$67.72 per bbl, respectively for the December quarter.

At the time of writing, i.e. on 5 June 2019, AEST 03:30 PM, the stock BYE is trading at $0.280 per share, down 1.754% during the dayâs trade with a market capitalisation of $695.37 million. The stock has generated YTD return of 35.71% and provided returns of -3.39%, -14.93% and 23.91% for one month, three months and six month period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.