Diversified player, BPH Energy Limited is listed on the Australian Stock Exchange with code âBPHâ. Headquartered in Australia, BPH holds investments in multiple sectors including oil and gas, biotechnology and medical cannabis sectors. The company owns significant interests in Advent Energy Ltd, Cortical Dynamics Ltd, Patagonia Genetics Pty Ltd and Molecular Discovery Systems.

Overview of BPHâs Investments

BPH is progressing rapidly with its growth-driven strategy in resources, biotech and medical cannabis space. Let us take a quick look at each of its investments in these sectors below:

Biotechnology Sector

In the biotech sector, the company owns 4.43 per cent stake in Cortical Dynamics Ltd and 20 per cent interest in Molecular Discovery Systems.

Cortical Dynamics Limited is a medical device technology firm that has developed Brain Anaesthesia Response Monitor (BARM), an industry disruptive brain function monitor, with an objective to better detect the effect of anaesthetic agents on brain activity, thereby supporting anaesthetists in keeping the patients optimally anaesthetised.

In a major milestone, Cortical has already received the CE mark, Korean KGMP Certification and the Therapeutic Goods Administration (TGA) approval for BARM.

Molecular Discovery Systems has been engaged in the validation of biomarkers and drug discovery for disease, therapy and diagnostics. The company intends to validate tumour suppressor gene HLS5 as a novel gene, particularly for liver cancer.

Oil and Gas Sector

BPH Energy holds 22.6 per cent stake in an oil and gas exploration entity, Advent Energy Limited. Advent has compiled numerous hydrocarbon permits, including PEP 11 in the offshore Sydney Basin and EP386 and RL1 in the onshore Bonaparte Basin of Western Australia. Adventâs permits hold near term production prospects with developed infrastructure and exploration upside.

Medical Cannabis Sector

BPH has recently flourished into the medical cannabis space via investment in Patagonia Genetics Pty Ltd (PG Aust). The company has secured 10 per cent interest in PG Aust, along with an option to secure 49 per cent total shareholding in PG Aust via a terms sheet.

Financial Performance of BPH Energy

BPH has made tremendous progress so far on the operational front, backed by its significant investments. In addition, the company has delivered strong performance during the year ended 30th June 2019.

In its recently released Annual Financial Report 2019, the company notified about a massive increase of 17.8 per cent in its revenue during the period from $235,824 in FY18 to $278,227 in FY19.

The increase in revenue was driven by the interest accrued by BPH on its secured loans to its investee companies. Net cash outflow from operating activities stood at $487,427, against prior corresponding periodâs outflow of $466,968.

BPHâs debt to equity ratio for FY19 was reported at 0.13x, representing an improvement on prior corresponding yearâs ratio of 0.16x. The above reduction implies a financially stable business with a lesser risk for the companyâs creditors and investors in comparison to the previous year.

As per the Annual Report, the debt reduction was undertaken through the issue of 282,000,000 fully paid ordinary shares for cash. Proceeds from the issue were also utilised for other purposes such as making investments in oil and gas, medical devices and biotechnology.

The company recorded a cash balance of $437,316 at the end of the financial year 2019.

BPHâs Performance (FY15-FY19)

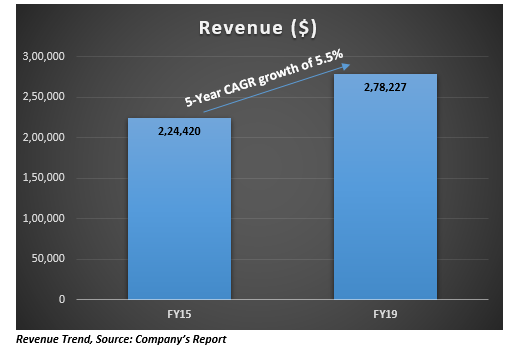

Over a period of 5 years covering FY15 to FY19, the company reported top-line CAGR growth of 5.5 per cent, with FY15 and FY19 revenue amounting to $224,420 and $278,227, respectively. Although revenue in FY16 declined at a rate of around 19 per cent, it started gaining momentum in the subsequent years. The highest increase during the five-year period was reported in FY17, representing an increase of 19.3 per cent on the previous year.

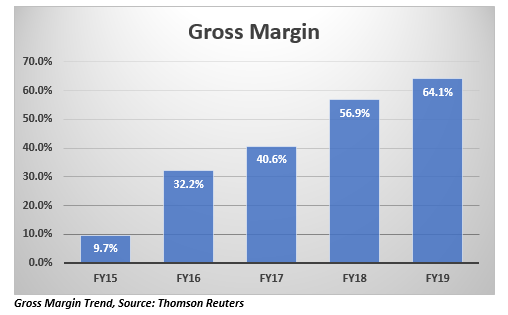

Gross margin over the five-year period also witnessed a continuous upward movement. In FY19, the company has a gross margin of 64.1 per cent as compared to prior corresponding yearâs margin of 56.9 per cent. Considering the gross margin of 9.7 per cent in FY15, the margin has improved significantly over the above stated period, demonstrating sound financial health of the company.

It can be seen that BPH has delivered robust financial performance in the last five years, driven by significant improvement in its revenue and gross margin. The companyâs performance indicates that it is well positioned to progress further with its diversification strategy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.