Automotive Industry Scenario

Global auto industry is entering a phase of restructuring with major focus on connectivity and digitisation. Executives in the industry believe that a shift is imminent, and the players operating are required to focus on their core competencies. Over the coming years, the automotive industry is anticipated to be largely driven by policies and regulations. As the retail landscape is undergoing a dramatic transformation, it is assumed that the count of retail outlets would be reduced by 30-50 per cent by the year 2025. The automotive industry in Australia is leaning into headwinds of their own, coupled with the shifting trends on the global level. Moreover, factors such as changes in the lending capacity by financiers and decline in housing prices have already impacted the performance of the industry in the Australian market. In the first six months of the year 2019, the industry registered lower car sales, owing to factors including decreasing vehicle affordability and continuous pressure on OEMs for bringing radical changes in their business models as well as product offerings. Retailers and dealers are also getting impacted by all the trends. Some of them are focusing on reducing their expenses and inventories, while some are even considering selling their businesses. The main factor that could be attributed for the decline in the automotive sector is car-sharing concept, which is becoming more popular nowadays in Australia. However, itâs not just the Australian market that is hitting the brakes; global sales are also expected to experience a significant dip this year. Irrespective of the downward shift in the industry, there are few players that are showing the upward trend in their share price. Let us discuss one such stock, i.e. AP Eagers Limited, which has delivered excellent returns to its investors.AP Eagers Limited

AP Eagers Limited (ASX: APE) is an Australia based automotive retail group, engaged in the sale of new and used cars, in addition to automobile accessories. The company, representing a diversified portfolio of automotive brands, also finances and extends warranties of motor vehicles. It was officially listed on the Australian Stock Exchange under the ticker âAPEâ in the year 1957. The company has shown a drastic growth from $500 million to over $4 billion in revenue since 2000 with the number of employees growing from 600 to 4,342.Recent Updates

- On 24 September 2019, the company announced that Patterson Chency Investments Pty Limited ceased to be a substantial holder of APE.

- On 23 September 2019, the company released a notice related to the change in the interest of a substantial holder. After the change, the holder (W F M Motors Pty Ltd, NGP Investments (No 2) Pty Ltd, NGP Investments (No 1) Pty Ltd, Sitil Management Pty Ltd and N G Politis) has a voting power of 27.7852 per cent against an earlier voting power of 29.3863 per cent.

- On 20 September 2019, APE unveiled that PERPETUAL LIMITED and its related bodies corporate ceased to be a substantial holder in the company.

AP Eagers to Acquire Remaining AHG Shares

In a market update on 17 September 2019, Automotive Holdings Group Limited (ASX:AHG) referred to the off-market takeover by APE to acquire all the ordinary shares in Automotive Holdings Group that APE does not currently own. AP Eagers unveiled that its relevant interest in AHG shares surpasses 90 per cent. In line with this, AP Eagers would proceed to compulsory acquisition. The acquisition would result in the suspension of the AHG shares from trading on the Australian Securities Exchange from the close of trading on 24 September 2019 and the AHG stock would be removed from ASX on 27 September 2019. More on the deal can be READ here. Few Takeaways- The company would boost its market position with increased national footprint

- Additionally, the deal would give small but strategic presence for APE in New Zealand

- $13.5 million in pre-tax synergies to be realised within the initial six months and an additional $16.5 million targeted within the next 12 months

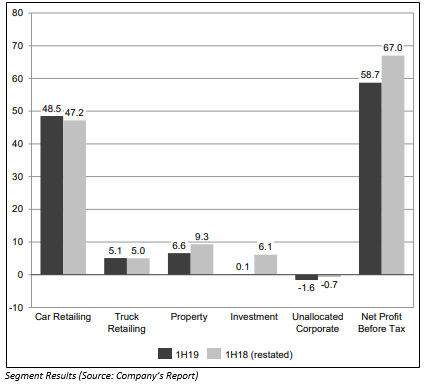

Consolidated Financial Highlight for half-year ended 30 June 2019

On 29 August 2019, AP Eagers Limited announced half-yearly results for FY2019 (ended 30 June 2019). Few highlights from the results are:- Total revenue of the company decreased by 1.8 per cent to $2,059 million compared to $2,097 million in the same period a year ago

- EBITDA of the company also went down by 5.4 per cent to $103.7 million

- Profit after tax reduced by 17.1 per cent year on year to $42.4 million

- The company announced an interim dividend of 14.0 cents per share, reflecting the confidence of the Board in the business strength and consistent strong operational performance

- Basic Earnings Per Share (basic) decreased by 17.0 per cent to 21.9 cents

- Cash and cash equivalents stood at $35.9 million

Outlook

AP Eagers Limited has a high-quality asset base, which demonstrates that the company is well-positioned to progress even in current trading conditions. Additionally, the company is focusing on driving value from the existing business through operational synergies, process improvement ad organic growth opportunities. The merger of AHG and AP Eagers would result in the formation of a leading automotive group in Australia, with the group holding greater diversification in terms of geographies and brand portfolio. The company would focus on the realisation of $30 million in synergies over the next twelve months, provided it manages too secure the 100 per cent ownership.Stock Performance

The stock of APE was trading at $14.255 on ASX on 30 September 2019 (AEST 03:15 PM), up by 2.26 per cent from its previous closing price. The company has a market cap of $3.49 billion and approx. 250.26 million outstanding shares. The 52-week high and low value of the stock is at $14.490 and $05.660, respectively. The stock has generated a positive return of 87.11 per cent in the last six months and a positive return of 131.95 per cent on a year-to-date basis.Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.