Penny stocks are those type of stocks that trade at a very low price, and the market capitalisation of these stocks is very low as well. These types of stocks have upper circuit and lower circuit. The upper circuit represents the price of a stock that cannot increase beyond a pre-determined percentage and lower circuit on the other hand, represents the price of a stock that cannot be reduced by a particular percentage. The positive news about a company always have a positive impact on its stock prices, and can be a good sign for the investors, irrespective of whether it is hitting the upper circuit or not.

Let us look at the three ASX listed penny stocks from different sectors.

Splitit Payments Limited (ASX : SPT)

Headquartered in New York, Splitit Payments Limited (ASX : SPT) is involved in payment solution business, is the only global cross-border payment solution provider. The company focusses on debit solutions, card payments, money transfer and other related activities.

Recently, SPT declared a date for AGM to be held on 30 October this year.

SPT inked deals with Shopify and Divido

On 14 October 2019, the company announced on inking of agreements with both Shopify and Divido. The new agreement will provide a solution to more than 800,000 merchants across 20 countries for Shopify and payment solution to 1,000 merchants of Divido, banks and so forth. SPTâs technology-based solution has been incorporated with the platform of Shopify. As a result, Shopifyâs merchants can make an addition of SPTâs BNPL solution to their websites to provide their consumers with a choice of BNPL payment.

SPT striking a deal with Divido is anticipated with the companyâs BNPL solution to join Dividoâs multinational platform for lending money, where lenders and retailers are connected.

The solutions would be launched in the United States post its initial launch in the United Kingdom region. The company also signed several agreements with several known US brands such as Eight Sleep, Chill Technology, BlueFly, Ace Marks, Nili Lotan, Ashford, and 1800-Accountant.

Management Changes

SPT on 19 September 2019, stated that Gil Don, the companyâs co-founder had decided to quit from his position as SPTâs CEO and take responsibility as General Manager of EMEA. The company would have a new Chief Executive Officer Mr Brad Paterson with effect from 1 October 2019.

Revenue boosted by 293 per cent for the half-year period

On 30 August 2019, SPT reported the half-year report of the period ending 30 June this year. The highlights are as follows:

- The revenue of the company was boosted by 293 per cent to $1.14 million compared to the previous year same period.

- US$3.8 million of net loss reported by the company compared to US$1.2 million in H1 FY18.

- Gross profit of the company rose by 550% to stand at $1.03 million versus its pcp.

- Active merchants of the company increased by 121 per cent to 509.

- On the balance sheet front, SPTâs cash in bank stood at $33.9 million.

Stock Performance

The stock of SPT last traded at $0.895, up by 4.07 percent relative to its last close (as on 22 October 2019). The company has $264.48 million market cap with around 307.53 million shares outstanding. The 52-week low and high of the SPTâs stock is noted at $0.305 and $2.000, respectively. The SPT stock has given a negative return of 13.13 per cent in the last six months timeframe.

Marley Spoon AG (ASX:MMM)

Founded in 2014, Marley Spoon AG (ASX:MMM) is a global subscription-based meal kit service, that brings fresh easy cooking to the people. The company currently operates into three primary regions, i.e. United States, Australia and Europe.

MMM recently on 16 October released a copy of its new Constitution as approved and adopted at the General Meeting of the shareholders conducted on 29 August 2019.

Marley secured $8 million Funding Deal

On 26 September 2019, the company announced that it has given a nod to structured debt transactions with two existing investors, coming to $8 million in total.

Each of the United Statesâ centered venture capital entity Union Square Ventures (USV) via 2 affiliated funds and a subsidiary company of Woolworths Group Limited (ASX: WOW), made an investment of a further $4 million.

Key Terms under USV Convertible Bonds are anticipated to be as follows;

- The bond has a Maturity Date of 3 years from the date of issue.

- Interest of US$ Libor + 5 per cent per annum, payable at maturity.

- Conversion price of AUD 0.50/CDI.

- Fully Issued US Convertible bonds to be converted by USV into an aggregate amount of around 8,170 shares / 8,170,000 CDIâs at any time during the conversion period.

- Additional prepayment fees of US$2,776,487.50 to be paid by the company, if prior to conversion, MMM elects to end and redeem the USV Convertible bonds if a shift of control takes place.

Key Terms under Woolworths Group

- MMM and WOW have given a nod to a senior secured commercial loan agreement for the amount $4,047k with a term of six months period.

- The interest on notes is at a fixed rate of 7 per cent per annum.

- MMM may elect to substitute WOWâs loan amount for one non-pro rata, senior secured convertible note instrument under German law, subject to a shareholder approval.

- MMM proposes to seek stakeholder approval to issue WOWâs Convertible Bond along with creating corresponding conditional /authorised capital to allow MMM to issue CDIs on conversion of WOWâs Convertible Bond at a general meeting to be conducted in later part of this year.

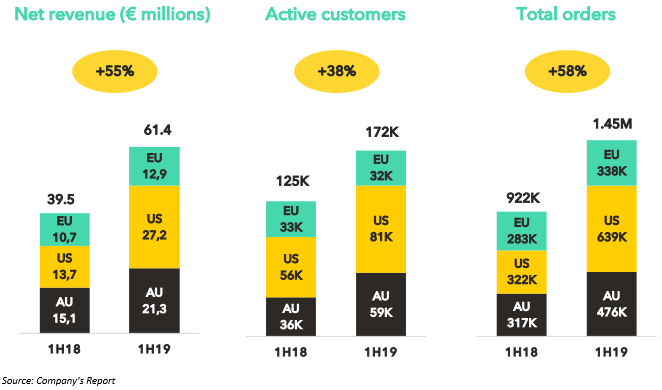

Net Revenue increased by 55 per cent in the half-year of 2019

On 30 August 2019, MMM released its 1H 2019 results; below are the highlights of the same:

- The revenue of MMM rose by 55 per cent to â¬61.4 million compared to the previous year same period.

- Operating EBITDA margin of the company grew to 28 per cent during the period, up from 36 per cent in 1H 2018.

- MMMâs new manufacturing technology was rolled out in Europe and Australia and anticipates achieving international contribution margin in the middle to high 20s for CY 2019 period.

Stock Performance

The stock of MMM last traded at $0.450 on ASX, on 22 October 2019, zooming up by 12.5 percent relative to its last closing price. The company has 148.67 million outstanding shares and a market cap of $59.47 million. The 52-week low and high value of the companyâs stock is at $0.340 and $1.045, respectively. The stock has generated a negative return of 3.90 per cent in the last six months.

Roots Sustainable Agricultural Technologies Ltd (ASX:ROO)

Established in 2012, Roots Sustainable Agricultural Technologies Ltd (ASX:ROO) is an agricultural technology company. ROO is focused on developing and commercialising disruptive, cutting edge technologies to address critical problems faced by agriculture in the contemporary era.

ROOâs shares placed in trading halt

On 21 October 2019, ROO notified the market that its shares were placed in trading halt on its request, pending a release of an announcement related to capital raising. Roots Sustainable anticipates the trading halt would be until the release of an announcement by it, no later than market pre-opening on 23 October 2019.

Roots RZTO technology increases cannabis yield up to 118 per cent

On 16 October 2019, the company provided an update wherein it mentioned that it had increased the dry cannabis flowers yield by 118 per cent relative to uncooled crops from various strains under a climate-controlled greenhouse at Canndescentâs facilities in Southern California. The outcomes were attained at the US growing facilities of cannabis producer and pursue a commercial sale and installation in May this year.

The information on RZTO Israeli Contract With New Patent-Protected Heat Exchange Stub Technology can be read HERE.

ClearVue and Roots to work together on greenhouse opportunities

On 14 October 2019, the ClearVue Technologies Limited (ASX: CPV) and Roots sustainable and agricultural technologies updated the market on inking a collaboration agreement to delve into complementary sales prospective under the growing greenhouse space including the construction of a world-first demonstration greenhouse in Israel.

Stock Performance

The stock of ROO last traded at $0.055 on ASX, on 16 October 2019. The company has 93.39 million outstanding shares and a market cap of $5.14 million. The 52-week high value of the companyâs stock is at $0.280. The stock has generated a negative return of 27.63 per cent in the last six months and a negative return of 45.00 per cent in Year to Date period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.