Telecommunication services has changed the way Australians interact as demands for Mobile has increased over the fixed line services. There is a rise in revenue generation due to increase in consumption of mobile data.

As per the annual report (2017-18) filled by ACCC on competition and price changes in the Australian telecommunications sector, real prices of telecommunications services continued to decline across most categories with Data consumption continuing its inexorable rise, supported by increasing data allowances. The report also stressed on the continued investment in network capacity driven by competition, while NBN rollout continued towards completion as the focus shifts to the operational phase.

Superloop Limited

Superloop Limited (ASX: SLC) is the trusted enabler of connectivity and managed services in Asia Pacific with the principal activities including construction and operation of independent telecommunications, operation of wireless broadband network, provision of IT services, cyber safety and residential broadband services.

As per latest ASX update on 24 September, Superloop would undertake a fully underwritten $90 million equity raising, which includes a 1 for 6 pro rata entitlement offer of fully paid ordinary shares of approximately 42,216,840 to raise $35 million. The balance of $55 million would be raised via a fully underwritten two-tranche institutional placement representing approximately 18.7% of the ordinary shares. The offer price for the Entitlement Offer will be $0.82 per share.

The company further announced recapitalision of its existing senior debt, with the renegotiated covenants more appropriately aligned to Superloopâs business.

FY19 Operational performance (for the period ending 30th June 2019)

- Rise in on-net buildings by 26% YoY to 392, Traffic on network recorded a 1900% jump on FY16

- Award-winning network as best telco innovation, best Wireless Provider, best virtual network operator.

- The major growth drivers were insatiable demand for bandwidth coupled with live and operational infrastructure including optic fibre infrastructure, strategic sites and fixed cost leverage.

FY19 Financial Performance (for the period ending 30th June 2019)

- During the year, the company generated the total revenue of $119.8m where fibre networks connecting key hubs in Singapore, Australia & Hong Kong and INDIGO subsea cable contributed the highest YoY growth in revenue by 89%, followed by 11% YoY growth in Fixed Wireless, Guest WiFi, Home Broadband and CyberHound Security. Cloud Managed Services, providing hosted IT & equipment procurement to small businesses, resulted in negative revenue growth of 31%.

- Gross margin stood at $55 in FY19 as compared to $54 in FY18.

- The company generated the total EBITDA of $8.5m in FY19 which is significantly less than the previous year. This is because of lower subsea develop margin, fixed wireless margin, retirement of non-core CMS margin and high opex growth from prior year acquisitions.

- Net debt at 30 June 2019 was $70.3m and Senior bank debt facilities of $120m would mature in October 2021.

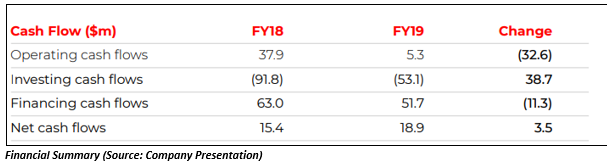

Cash Flow Generation

- FY19 Operating cash flows of $5.3m was lower than that of FY18 operating cash flows. This is because FY18 included a greater number of IRUs and one-off sales.

- Investing cash outflows lower in FY19 from lower investment in acquisitions.

- Financing cash flows from $31m equity and $26m debt versus $35m equity and $33m debt in prior year.

FY20 Guidance

- Operational EBITDA to approximately double year-on-year to $14m-$16m.

- Future capital requirements are expected to be predominantly customer-led, i.e. incurred on signing contracts with customers.

- Major focus areas in FY20 include further executing master service agreements, contracts and orders to provide connectivity to major bandwidth customers across on-net footprint, to exploit extension of NBN to Australian service providers and enterprises and to continue to drive operational efficiencies

Stock performance:

Currently, the stock is currently trading at A$1.010 (AEST- 3:45 PM) with a market cap of A$255.83m. Over the period of one month, the stock showed a positive performance of 9.78%

Speedcast International Limited

Speedcast International Limited (ASX: SDA) envisages to be a global leader in the provision of remote communications and IT services. It provides network services, value added services, professional services, equipment sales and system integration.

On September 5, 2019, S&P Global lowered its issuer credit rating to B from B+ and Moodyâs lowered its issuer credit rating to B2 from B1 while retaining its negative ratings outlook.

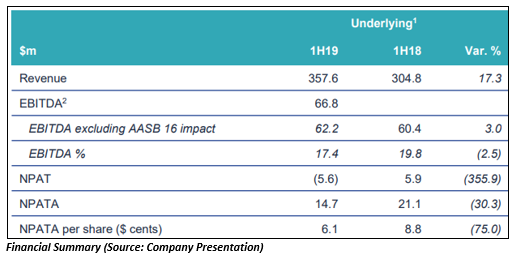

HY19 Financial performance (for the six months ended 30 June 2019)

- Revenue grew up to 17.3% to $357.6m in HY19 from $304.8 in HY18, with Globecomm contributing $70.3m revenue, splitting to Maritime $14.6m, EEM $21.0m, Government $32.8m, Energy $1.9m.

- Revenue (organic basis) for the period went down by 5.8% due to delay in implementation of new projects and transition from phase 1 to phase 2 of the nbn project coupled with slower than expected implementation of VSAT backlog and major expected churn event in Commercial Maritime.

- EBITDA for the period increased by 3% to $62.2m, with contribution from Globecomm coming in at $9.1m. Additional costs due to technical difficulties and organic revenue declines in EEM and Maritime led to decline in EBITDA by 12.1% (organic basis).

- Negative Working capital movement of $40.6m reflects increased inventory and receivables. The increase in inventory included an investment in Maritime inventory and the increase in receivables was due to specific situations in the Cruise segment and Increased DSO across rest of business due to change in IT systems and supporting processes.

- Net debt took a rise from $586m in December 2018 to $625m in June 2019.

Cash Flow Generation

- A cash outflow of $25.2m in 1H19 was generated from core cash activities of the business which included $20.7m that is not expected to continue in second half.

- Negative working capital movement of $40.6m and a negative impact of 2% leases resulted in cash conversion of 36%.

- Capex investment was at 8% of revenue, down from 10% in FY18.

Division wise performance:

- Maritime: The revenue of Maritime was up by 12% to $119.3m driven by Globecommâs $14.6m contribution.

- EEM: The revenue for EEM went up by 6.8% to $79.6m on the back of contribution of $21m from Globecomm.

- Government: The revenue for government went up 69.3% to $80.4 million on the back of contribution of $32.8m from Globecomm.

- Energy: The revenue for energy was up by 2.6% to $78.3m primarily by Globecommâs contribution of $1.8m and increase in growth of revenues.

Business Highlights

- ERP is now one system in terms of financial data and transactions, with Globecomm integration completed wherein there are 81 operating entities in total and Global Operations, Billing, Supply Chain and Accounting are all transacting in a single ERP system.

- Improved Security posture and strengthened business continuity plan and Service management system rolled out globally.

Outlook for FY19

- EBITDA is expected to be in the range of $150m - $160m and Globecomm underlying EBITDA is expected to be $21m including the cost synergies of $11m. The Globecomm cost synergies is expected to be $18-20m in 2020.

- The company is targeting $50m capex with no dividend to be declared for 2H19.

Stock performance:

The stock is currently trading at A$1.080 (AEST-3:45 pm) with a market cap of A$268.51m with an annual dividend yield of 6.43% (as per ASX).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.