Speedcast International Limited (ASX: SDA) is a telecommunications company. The stock of the company is classified under Communication Services within Telecommunication Services industry group. Besides, it is constituent of S&P/ASX 200, S&P/ASX 300 and a few more indices.

Speedcast International Limited was trading at A$1.915, up by 6.389%, (at 3:50 PM AEST, as on 22 July 2019). Besides, it has crashed down by generating a negative return of 45% this month (as of 19 July 2019), however, it is making a recovery against the losses suffered.

New Substantial Holder of SDA: On 22 July 2019, the company notified the market, that Norges Bank has become a substantial holder of the company, effective 18 July 2019. Norges Bank holds 13,247,515 ordinary shares with 13,247,515 votes and voting power of 5.53 percent.

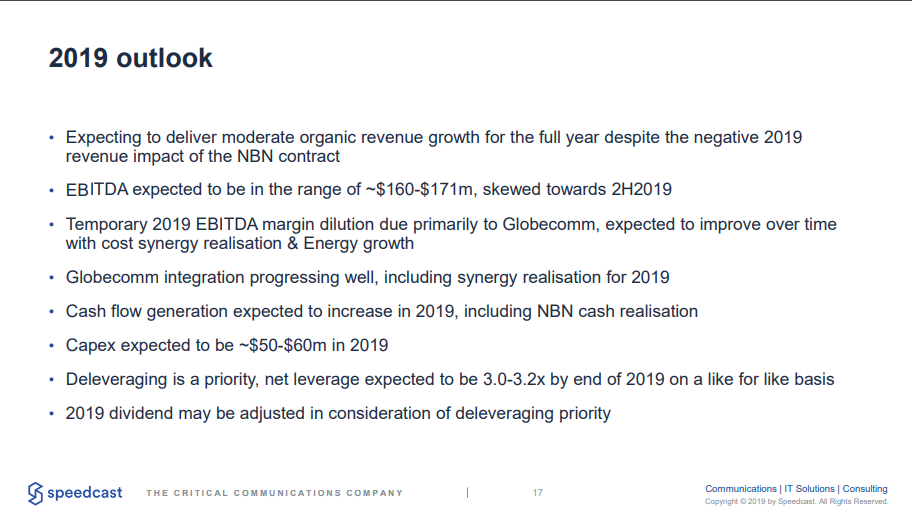

Revised Underlying EBITDA: Earlier this month, on 2 July, Speedcast International Limited reported an update on the expected Underlying EBITDA for 1H 2019 to be approximately US$60 to US$64 million and revised the Underlying EBITDA anticipation for the full year 2019 to approximately US$140 to US$150 million. Previously, on 20 May 2019, the company had updated the market with an EBITDA expectation of approximately US$160 to US$171 million; please refer to the figure given below:

2019 Outlook (Source: 2019 Speedcast AGM, May 2019)

2019 Outlook (Source: 2019 Speedcast AGM, May 2019)

Subsequently, the revised update considers the recent developments that might restrict the company to achieve the expected target declared in May 2019. Therefore, Speedcast has updated the expectation for Underlying EBITDA.

First-Half 2019: Reportedly, the market conditions in EEM have been weak along with the slower implementation of existing work, and the delays extend to revenue from the NBN project. Also, the implementations in VSAT vessels from a major Commercial Maritime contract have been below than expected. Besides, the anticipated contribution to EBITDA from Globecommâs is lower than the previous expectation, and the company also expects lower revenue from Energy against the previous assumptions.

Full-Year 2019: Admittedly, the Underlying EBITDA expectation for Globecomm for the full year is approximately US$21 million, down by US$5 million from the previous assumption. Also, the company expects modest growth in Maritime, and growth within Energy would be consistent with previous guidance. Besides, SDA has initiated re-organisation, and it is expected to deliver US$5 million to US$10 million benefits in 2H 2019 along with anticipated US$20 million in the full year 2020.

As per the release, the company remains confident of meeting the full year guidance for 2019, and it would be driven by anticipated cost-synergies from the acquisition of Globecomm and re-organisation benefits, combined with usual seasonality. Also, the proforma net leverage would be higher than the expected range of 3x to 3.2x due to the change in full-year expectations; however, it remains under the covenant level of Senior Secured Facility.

US Government Contract : On 5 July 2019, the company responded to a media release regarding the US Government Contract, which implied that the company had been awarded a US Department of Homeland Security (DHS) contract. Accordingly, the company asserted that it was one of the awardees of the contract. Nevertheless, SDA was not exclusively awarded the contract, and a particular level of revenue could not be guaranteed to SDA.

Chairmanâs Letter: On 17 July 2019, the company released Chairmanâs Letter to Shareholders, which acknowledged the difficult weeks for it. Accordingly, the Board of the company has been disappointed by the first-half performance, and the acquisition of Globecomm has proved to be challenging. Meanwhile, the company is dedicated to integrating the acquisition and expects the results by 2020.

Reportedly, the company has been implementing the organisational changes which would deliver the results in coming six to twelve months. Also, the company has a significant share of larger contracts, which could be complex for execution resulting in short-term negative influence on revenue predictions.

As per the release, the growth in Government and Maritime would be backed by solid fundamentals, and Energy business would deliver modest growth. Also, SDA believes that the scale of business would enable the company to win market share in the Enterprise & Emerging Markets business. Besides, SDA has considered opportunities to reduce the cost structure, and this would be discussed briefly during the SDAâs half-year financial results scheduled for Tuesday, 27 August 2019.

Moreover, Speedcast has an objective to achieve ~USD twenty million in annual savings from sales costs and operating costs. The company anticipates that these strategies would deliver a positive impact on the financial performance of the current year and 2020 as well.

Reportedly, the companyâs debt facilities are required to maintain Net Debt to EBITDA (Leverage Ratio) less than 4:1 under the covenants and SDA had of late indicated to be in the range of 3.5:1 to 3.6:1 as on 30 June 2019. Also, the Board remains confident in maintaining the covenant below the 4:1 limit at the end of this year. Besides, the leverage expectation has included benefits from its re-organisation activities, and it was prepared on a pro forma basis. The board of the company does not intend to raise any further equity, based on its current business outlook.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.