In order to start a business, one needs financing which can be secured through various options such as traditional loans, micro loans, or borrowing funds from friends. When one seeks money from lenders, money needs to be repaid with the interest amount. However, when funding is secured from investors, they inject funds in exchange for ownership of part of the business. Investors can be a reliable source of funding for businesses as well as for sound business advice and strong business network.

With this backdrop, let us have a look at some factors that investors should consider before making investments.

Financial Roadmap

Before investing in any stock, investors should do a complete screening of their own financial situation. The primary step is to figure out the goals and levels of risk tolerance. There is no guarantee that one can make a profit out of their investments; however, it can be achieved only with an effective intelligent plan. Thus, before making an investment decision, have a clear and honest look at your personal financial roadmap.

Diversification Strategy

Through diversification, one can reduce their risk on investments. By investing in more than one asset, the risk of losing the money is minimised, and the chances of achieving better investment returns improve, as if one category of investment fails, the other category of investment may perform better.

Emergency Funds

Smart investors always put sufficient money to cover an emergency like unemployment crisis. Investors should always keep a part of their earnings as an emergency fund. These funds can be used to bear the effect of mis happening or uncertainty.

Expert Advice

Investors should talk to an expert before investing in securities. Stock market experts are those professionals who have deep learning into various sectors and securities. In case you are investing in a stock market for the first time, itâs always better to consult professionals before investing. They are the ones who can guide better and help to choose good stocks.

PE ratio, dividend yield and past returns are some of the factors that investors consider before injecting their funds in stocks.

Here in this article, we are discussing Regis Resources Limited, a metals & mining sector player, which has an annual dividend yield of 3.21% and PE ratio of 15.48x, while the other company Austal Limited is an industrials sector player, which has delivered outstanding returns of 115.71% on a year-to-date basis.

Let us have a look at their recent market updates.

Regis Resources Limited (ASX: RRL)

Perth-based gold production and exploration company, Regis Resources Limited has operations in Africa and Australia. The company is scheduled to hold its annual general meeting on 26 November 2019, discussing financial report of RRL for the 12-month period ended 30 June 2019 and considering following resolutions.

- Resolution 1 â Adoption of remuneration report

- Resolution 2 â Re-election of director â Steve Scudamore

- Resolution 3 â Re-election of director â Fiona Morgan

- Resolution 4 â Approval of grant of long-term incentive performance rights to Jim Beyer

- Resolution 6 â Approval of grant of short-term incentive performance rights to Jim Beyer

- Resolution 7 â Approval of increase in non-executive directorsâ fees

September Quarter Report

On 25 October 2019, the company released its September quarterly activities report. Few highlights from the report are as follow:

- Quarterly gold production stood at 87,633 ounces, compared with 90,966 ounces in the June quarter.

- Pre-royalty cash cost (CC) for the September quarter reached $914 per ounce and AISC stood at $1,234 per ounce.

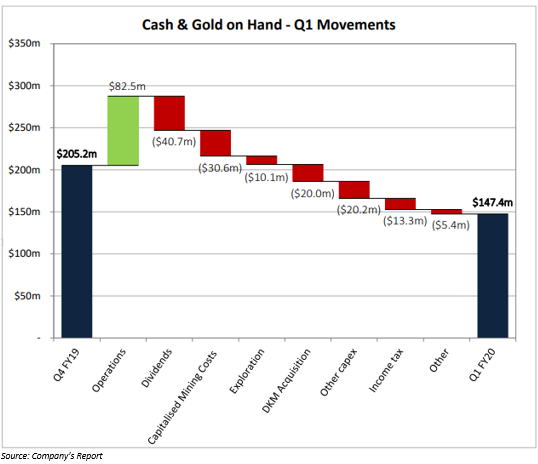

- Cash flow from operations stood at $82.5 million for the September 2019 quarter (June 2019 Quarter: $85.2 million).

- The company declared FY19 net profit after tax of $163.1 million in August 2019 and $40.7 million in fully franked dividends paid in September 2019.

- Cash and bullion reached $147.4 million at the end of the quarter (June 2019 Quarter: $205.3 million).

The company reported a significant lift in exploration during the September quarter, driven by the acquisition of a large strategic tenement holding in the Duketon Greenstone Belt. RRL also reported good progress of underground mine development at Rosemont decline and the first ore was achieved during the quarter. Additionally, the company lodged development application for McPhillamys along with the Environmental Impact Statement for appraisal and assessment by the Department of Planning, Industry and Environment in New South Wales.

Meanwhile, in the three months to September 2019, Garden Well underground target drilling continued to extend gold mineralisation at depth with exciting results including 11 metres @ 7.9 gram per tonne and 3 metres @ 6.9 gram per tonne gold. At the Baneygo underground target, significant drill intercepts aided the view of potential underground resources, while at Idaho, high grade drill intercepts in shallow oxide material unveiled potential for further extension to open pit resources.

Regis Resourcesâ full-year guidance remain unchanged including the production of 340,000-370,000 ounces at an AISC range of $1,125-$1,195 per ounce.

Stock Performance

The stock of RRL closed at $5.000 on ASX on 04 November 2019, up by 0.402% from its previous close. The company has ~508.18 million outstanding shares and a market capitalisation of $2.53 billion. The 52 weeks low and high value of RRL is at $4.030 and $6.720, respectively. The stock has generated a positive return of 5.06% in the last six months and a positive return of 4.84% on a year-to-date basis.

Austal Limited (ASX: ASB)

Austal Limited is into shipbuilding operations. The company is engaged in designing, manufacturing and supporting vessels. Austal Limited has operations in the United States of America, Philippines and Australia. The company caters to the commercial and defence customers across the globe.

Catamaran Contract

On 24 October 2019, the company announced to have secured a design and construction contract worth approx. $136 million for a new vessel. The new Auto Express 115 or 115-metre-high speed catamaran for Molslinjen of Denmark will be the largest ferry ever built by the company, in terms of volume. The company will start the construction work in 3Q20, while the vessel delivery is scheduled in 1Q22.

According to Chief Executive Officer, David Singleton, the new order from Molslinjen once again demonstrated the capability of the company to offer the best, advanced high-speed ferries with competitive cost and highest quality. In January 2019, the company had delivered the 109-metre-high-speed catamaran Express 4 to Molslinjen.

2019 Annual General Meeting

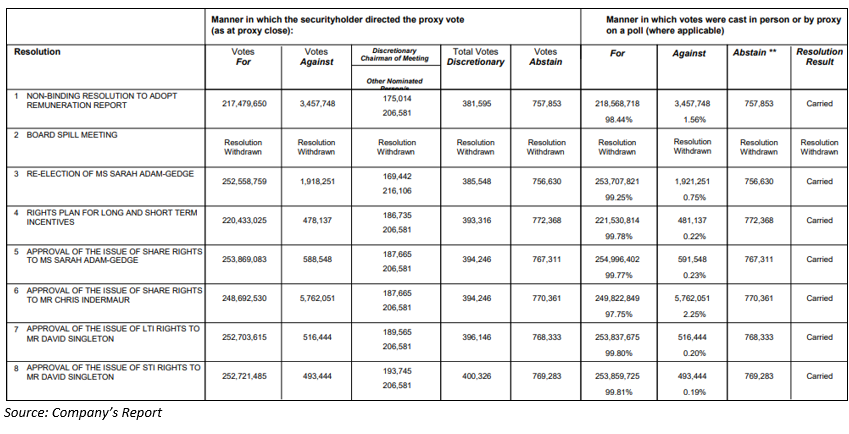

The company held its Annual General Meeting on 1 November 2019. Results of the meeting are as depicted in the figure below:

During the meeting, business priorities for 2020 were also unveiled including

- Boosting footprints in the United States through participation in new USN programs

- Driving investments in Asia to boost competitiveness

- Group wide cost efficiency

- Building the worldâs best ships through major expansion of research and development in investment

The companyâs performance during the financial year 2019 was also discussed. During the year ended 30 June 2019, the company reported

- EBIT of $92.8 million, up 46% year-on-year

- NPAT of $61.4 million, representing an increase of 64% from the same period a year ago

- Operating cash flow of $164 million, up $99 million year-on-ear

- Net cash at the end of the year stood at $151 million

Stock Performance

The stock of ASB settled at $4.370 on ASX on 4 November 2019, up by 6.068% from its previous close. The company has ~356.53 million outstanding shares and a market capitulation of $1.47 billion. The 52 weeks low and high value of ASB stands at $1.725 and $4.630, respectively. The stock has generated a return of +49.82% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.