The benchmark index S&P/ASX 200 settled at 6,440.1 on 26 August 2019, down 1.29%, while the S&P/ASX 200 Communication Services Sector closed trading at 1,295.2 on the same day, down 1.11%. Letâs have a look at recent updates from three stocks - oOh!media Limited, Hutchison Telecommunications (Australia) Limited and Southern Cross Media Group Limited, which are operating in the communication services sector.

oOh!media Limited

oOh!media Limited (ASX: OML) is an out of home advertising company, which was officially listed on the Australian Stock Exchange in 2014. Recently, the company published an investor presentation, under which it communicated about its operational and financial performance for 1H 2019. It was reported that despite tough external conditions, the company registered a solid performance in the first half., backed by the diversity and scale of its multi-platform portfolio.

1H19 Result Highlights:

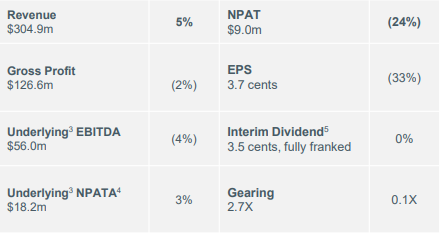

The key portfolio products of the company pushed revenue by 5% on a pro forma basis. The revenue of the company stood at $304.9 million in the first half of 2019, compared with $291.0 million in the same period a year ago. Net profit after tax of the company stood at $9.0 million in the first half of 2019, representing a decline of 24% from $12.0 million in the first half of 2018. Its gross profit declined by 2% to $126.6 million. When it comes to return to shareholders, the company declared an interim dividend of 3.5 cents per share, fully franked, which was steady on pcp. The record date and payment date for the fully franked interim dividend is 30 August 2019 and 30 September 2019.

1H19 Key Financials (Source: Companyâs Report)

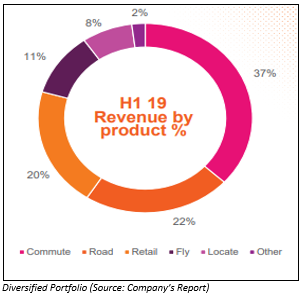

The company unveiled that all of its channels like Commute and Road would be booked via new technology platform by end 2019. The Commute platform of the company witnessed an increase of 13% on a pro-forma basis, on the back of the digitisation opportunity inherent with this format and improved positioning in the Melbourne market after the launch of Metro Trains Melbourne. However, the Road platform reported a decline due to reducing spending by major brands in Out of Home and media more broadly. The Fly segment of the company reported revenue amounting to $32.9 million in 1H 2019 as compared to $29.3 million in 1H 2018, reflecting a rise of 12%, on the back of management actions which were taken in the past two years and continued to deliver benefits in 1H 2019.

Outlook:

The company is expecting to register underlying EBITDA in the range of $125 million - $135 million for 2019, which excludes the integration costs as well as the impact of AASB16. The company had earlier provided the EBITDA guidance range of $152 million - $162 million.

Stock Performance:

The stock of oOh!media Limited closed trading at A$2.910 per share on 26 August 2019, depicting a fall of 4.59% from its previous closing price. OML has a market cap of A$729.93 million and approximately 239.32 million outstanding shares. In the last three months and six months, the stock has delivered negative returns of 25.68% and 18.23%, respectively, while in the last one month, OML provided a negative return of 29.40%.

Hutchison Telecommunications (Australia) Limited

Hutchison Telecommunications (Australia) Limited (ASX: HTA) in engaged into providing telecommunications services. Recently, the company via a release announced that Frank John Sixt has made a change to his holdings in the company by acquiring 30,000 ordinary shares of CK Hutchison Holdings Limited at a consideration of HK$72.4683 per share on 2nd August 2019. It added that Canning Fok Kin Ning also made a change to his holdings by acquiring 50,000 ordinary shares of CK Hutchison Holdings Limited at a consideration of HK$75.7613 per share on 6th June 2019.

Half Yearly Performance:

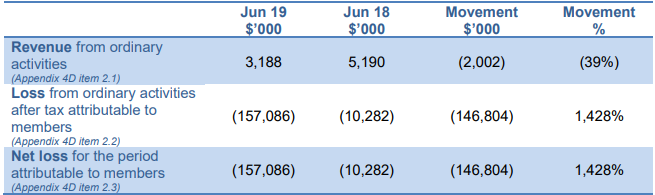

For the half year ended 30th June 2019, the company reported a net loss amounting to $157.1 million, reflecting an increase of $146.8 million from the $10.3 million net loss recorded in the same period a year ago. The net cash inflow from operating activities stood at $2.564 million for the half year ended 30th June 2019 after setting payments to suppliers and employees of $0.713 million. The cash and cash equivalents of the company stood at $21.162 million as at 30th June 2019.

HTA Financial Performance (Source: Companyâs Report)

Hutchison Telecommunications (Australia) Limitedâs revenue from ordinary activities reflects interest income received on loans to Vodafone Hutchison Australia Pty Limited (VHA). The companyâs revenue from ordinary activities witnessed a decline from $5.2 million to $3.2 million, primarily due to the reduction in shareholder loan balances provided to VHA. Hutchison Telecommunications (Australia) Limited remains committed to make investments in VHA and it would continue to support VHA in the future.

Stock Performance:

The stock of Hutchison Telecommunications (Australia) Limited closed trading at A$0.115per share on 26 August 2019, with a market cap of A$1.56 billion and approximately 13.57 billion outstanding shares. In the last three months and six months, the stock has given negative returns of 4.17% and 14.81%, respectively, while HTA provided a positive return of 4.55% in the last one month.

Southern Cross Media Group Limited

Southern Cross Media Group Limited (ASX: SXL) is engaged in the development as well as broadcasting of content on free-to-air platforms such as commercial radio, TV and online media throughout Australia. Recently, the company published an investor presentation, communicating about its financial and operational performance for the financial year 2019. Despite a challenging media environment, the company delivered a strong result for the period. SXL outperformed the market in Audio and Television during the reported year.

Operational Performance:

The Audio segment of the company witnessed a rise of 3.4% in underlying EBITDA from $147.7 million to $152.7 million, with a rise of 33.7% in underlying EBITDA margins. The segment reported a rise of 2.4% year-on-year in revenue, primarily backed by substantial growth from national advertisers of 9.2%. The employee costs witnessed a decline on a YoY basis, largely driven by positive outcomes from the Workforce Planning Project. The Television segment reported a decline of 3.2% in revenue. The underlying expenses of the television segment contracted by 4.0%, which is implying the benefits of variable cost base.

Financial Performance:

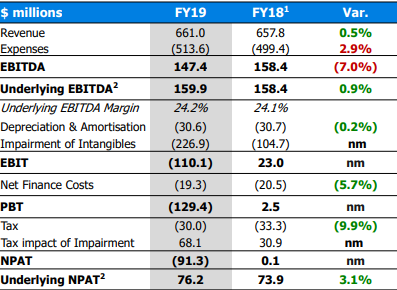

The underlying EBITDA of the group stood at $159.9 million, reflecting a rise of 0.9% on a YoY basis and it posted total group revenue amounting to $661 million, up 0.5% on YoY basis. The underlying net profit after tax of the group stood at $76.2 million for FY19, up 3.1% year-on-year.

SXL Financial Performance (Source: Companyâs Report)

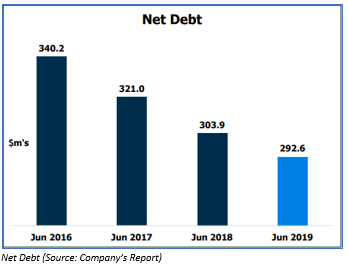

SXL has consistently high operating cash flow with free cash conversion of 91%. The company further decreased its net debt by $11.3 million to $292.6 million. The leverage ratio stood at 1.76x, which lies in the target range of 1.5x to 2.0x. SCA has an interest coverage ratio of 13.0x. It was reported that the balance sheet strength of the company is continuing to improve, enabling the company for flexibility as well as opportunity for future growth. The company has declared a fully franked final dividend of 4.00 cents per share, bringing the full year dividends to 7.75 cents per share.

Outlook:

Under the Audio segment, the company is planning to maximise the value of SCA brands by focusing on growing audience and reach. Moreover, it intends to accelerate the development in âsmart audioâ experiences for audiences. With respect to operational excellence, the company is looking forward to maintaining consistent cash flow generation and supporting strong dividend yield as well as focus on cost discipline and continued investment in systems and workflows.

Stock Performance:

The stock of Southern Cross Media Group Limited closed trading at A$1.185 per share on 26 August 2019, down 0.837% from its previous close. In the last one month and three months, the stock has delivered negative returns of 7.00%. and 5.91%., while its last six-month returns stand at 1.27%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice