Dental care

Oral health refers to conditions and health of teeth, gums, muscles and bone in the mouth, and good oral health represents overall health and wellbeing of a person. Dental diseases may impact a personâs appearance and speech, can result in pain, discomfort, embarrassment and also restrict the participation of a person in social settings. The dental care is also one of the essential parts of the health care system.

Australiaâs dental industry

The dental service industry in Australia is primarily privately funded in comparison with other health care services. The dental services in Australia include orthodontics, general dentistry, prosthodontist and various other complementary services.

In Australia, the expansion of the dental industry is supported by the private health insurance service providers. The patient who has private health cover regularly visits their dentist, and they are keen to undergo expensive dental procedures. In Australia, there are more than 1 million dental prescriptions that were dispensed in each year from 2013 to 2017 as reported by the Australian Institute of Health and Welfare (AIHW).

Here in this article, we are discussing four health care stocks which are key players in the dental industry- ONT, SIL, PSQ, SDI

1300 Smiles limited (ASX:ONT)

An Australian dental and management service company 1300 Smiles limited (ASX:ONT) which owns and operates full-service dental facilities across Australia including Queensland, New South Wales and South Australia. ONT was listed in ASX since early 2005, and Dr Daryl Holmes is the founder of the company. 1300 Smiles provides use of dental services and practice management to self-employed dentists and hence allow the delivery of services to the patients.

According to an ASX update, the company announced about its AGM, which would be held on 25 November 2019 in Townsville, Queensland. The agenda of this meeting would be the discussion of the companyâs financial statements &reports and General Business, including the following resolutions-

- Remuneration Report

- Election of Jason Smith as a director

- Renewal of proportional takeover bid provisions

According to another ASX announcement, the company released a notice concerning its interest in acquiring Maven Dental Group from New Zealand Stock Exchange listed Abano Healthcare Group Limited (NZX: ABA) and ABAâs response.

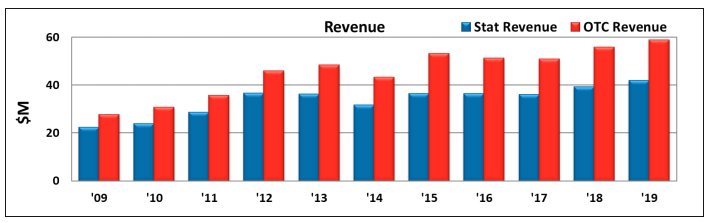

Financial Highlights (year ended 30 June 2019)-

- In the last fiscal year, the company generated a revenue of to $58.9 million, which was up 5.5%.

- The NPAT for FY 2019 increased by 1.8% worth $7.8 million.

- EBITDA of the company was at $13.3 million.

- ONT generated $42.0 million Statutory Revenue, which was up 6.6%.

- Per-share earnings increased to 32.8c.

Stock performance-

The companyâs stock last traded at $6.300 on 12 November 2019 and has a market cap of nearly $149.17 million. The stock has a 52 weeks high price of $6.600. The stockâs outstanding shares were noted at ~23.68 million.

Smiles Inclusive Limited (ASX:SIL)

An Australian headquartered health care company Smiles Inclusive Limited (ASX:SIL) is engaged in operating a network of dental practices in Australia under its national brand named as Totally Smiles. The company provides well-equipped Totally Smiles practices which provide various dental services including general, family and specialist services. The main aim of the company is to become a leading national brand in the Australian region.

Smiles Inclusive released its quarterly cash flow and business update for the first quarter of the financial year 2020 (ended 30 September 2019)-

- The cash inflow from operating activities from first quarter FY2020 was $12.275 million.

- For the quarter, the cash outflow from operating activities was $12.963 million.

- The non-underlying costs were noted at $0.214 million for Q1 FY2020.

- The net cash outflows for Q1 FY2020 were at $1.250 million.

Operating and Financial highlights- (year ended 30 June 2019)

- The company generated a practice revenue (net of direct costs) of $30.4 million.

- There is a statutory loss of $31.0 million after-tax for FY2019.

- The underlying loss after tax was $4.3 million.

- Smile inclusive has a cash balance of $1.6 million.

- The revaluation gain of the company on a joint venture partner contribution liability of $7.1Million.

Stock information-

The companyâs stock was trading flat at $0.040 on 13 November 2019 (AEST 03:53), with a daily volume of ~345,011 and a market cap of nearly $5.33 million. The stock has a 52 weeks high price of $0.504 and a 52 weeks low price of $0.035, with $133.25 million shares outstanding on ASX.

Pacific Smiles Group Limited (ASX: PSQ)

Pacific Smiles Group Limited (ASX:PSQ) is in the business of dental care, and it operates the Pacific Smiles Dental Centres. The company headquartered in Greenhills, and operates in Victoria, Australian Capital Territory, New South Wales and Queensland.

Annual General Meeting (AGM)-

In an ASX update, the company notified that an AGM would be held on 20 November 2019 at Greenhills. The key business highlights of this meeting would be the discussion on Financial Statements and Reports, including the resolutions-

- Non-Binding Resolution to adopt Remuneration Report

- Re-election of Robert Cameron as a Director

- Re-election of Zita Peach as a Director

- Election of Mark Bloom as a Director

- Participation by Executive Director in Long Term Incentive Plan

- Approval of 10% Placement Facility

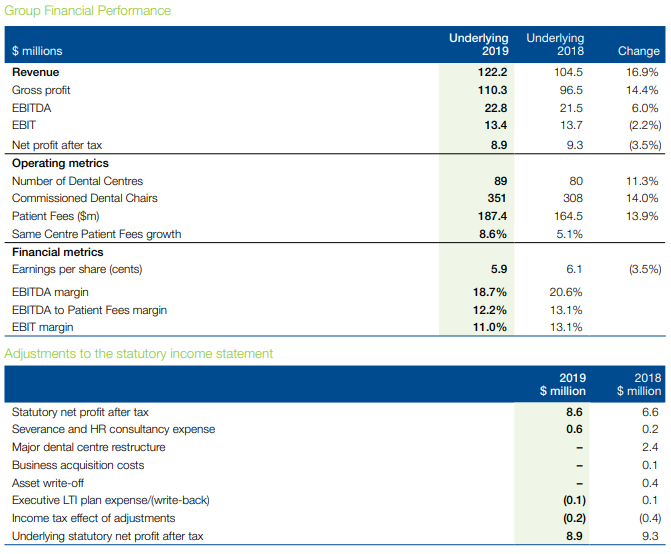

Key Financial Highlights- (year ended 30 June 2019)

- The company generated a revenue of $122.2 million which was up by 16.9% as compared to the last financial year.

- Patient fees generated by the dental centres operated by Pacific Smiles increased 13.9% worth for $187.4 million as compared to pcp.

- Patient fees growth for the same centre increased by 8.6%.

- EBITDA (underlying) of $22.8 million, up 6.0% as compared to the last financial year.

- The total dental centres became 89 after opening of 10 new dental centres in FY2019.

Outlook 2020-

- The company has a strong pipeline and is planning to open 7-10 new dental centres including five sites which are already committed for the financial year 2020.

- The expected EBITDA for FY2020 is to be in between 6-12% up on last financial year.

Stock performance-

The companyâs stock closed the dayâs trading session at $1.770 on 13 November 2019, up by 4.118%, with a daily volume of approximately 3,500 and a market cap of nearly $258.39 million. The stock has a 52 weeks high price of $1.800 and a 52 weeks low price of $1.055. The company has delivered a return of 31.27% on year to date basis and 27.82% in the last six months.

SDI Limited (ASX:SDI)

An Australian based company SDI Limited (ASX:SDI) was listed on the Australian Securities Exchange (ASX) in 1985 and is engaged in manufacturing of specialised dental materials. The company has strong research and development, and its products are distributed worldwide across 100 countries. SDI has its offices and warehouses in the US, Germany and Brazil. All the dental products of the company are manufactured in Victoria, Australia.

According to an ASX announcement, the company generated a notice for its annual general meeting (AGM) which would be on 15 November 2019 at Victoria, Australia.

According to another ASX announcement on 30 September 2019, the company revised its shareholder information which was included in its annual report and attached a correction to the distribution of equitable securities.

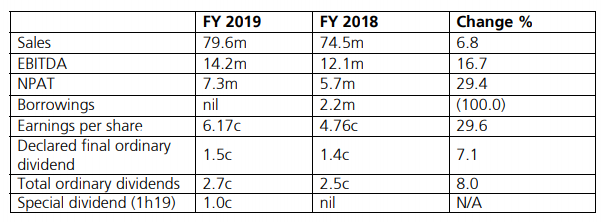

Financial Highlights- (year ended 30 June 2019)

- Net profit after tax up 29.4% to $7.3 million from $5.7 million in FY18.

- Sales growth of 6.8% to $79.7 million ($74.5 million FY18).

- The company generated strong cash in last financial year without any debt.

- EBITDA increased by 16.7% worth $14.2 million, compared to $12.1 million for the last financial year.

- The gross product margins for FY2019 improved to 62.6% as compared to pcp.

Source: Companyâs Report

Stock performance-

The companyâs stock settled the dayâs trading session flat at $0.880 on 13 November 2019, with a daily volume of ~10,970 and a market cap of nearly $104.6 million. The stock has a 52 weeks high price of $0.990 and a 52 weeks low price of $0.568. The company has delivered a return of 36.05% on year to date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.