Smiles Inclusive has ambitiously set out to disrupt the industry with its unique business model, focused on the integration of dental practices through its Australia-wide network of a national brand- Totally Smiles.

Listed on Australian Securities Exchange, Smiles Inclusive Limited (ASX: SIL) has integrated 52 practices since its listing in April 2018 with many more in the pipeline. Smiles has built an infrastructure capable of handling future acquisitions and has available funding capacity to acquire a potential $35 million in gross practice revenue.

The heart of the Smiles Business Model is the joint venture with dental practitioners that aligns their growth aspirations to Smilesâ corporate objective of the development of a national brand whilst increasing shareholder value.

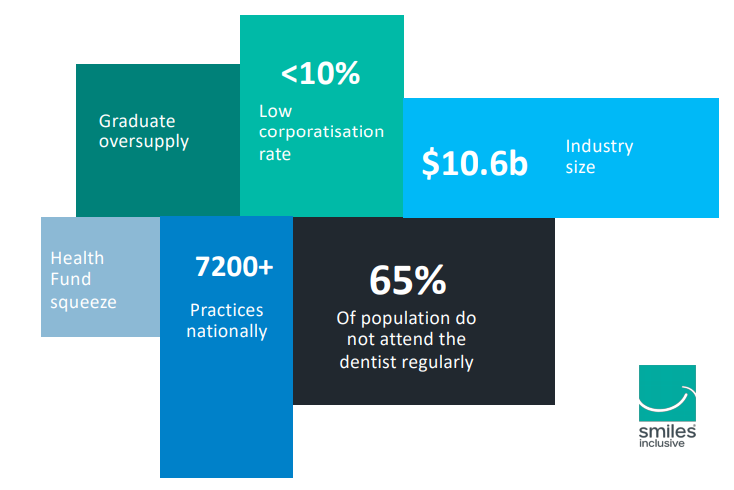

Dental Industry Dynamics (Source: Companyâs 2018 AGM Presentation)

Dental Industry Dynamics (Source: Companyâs 2018 AGM Presentation)

Currently, the company is focused on improving the organisational structure to enhance its financial and operating performance while restoring value for all shareholders.

In the recent extraordinary general meeting, Smiles implemented some crucial management changes on the approval of its majority shareholders. The change saw the exit of Directors Mike Timoney and David Herlihy when other two senior directors, Mr David Usasz and Ms Tracy Penn, were supported by shareholders to remain on the Board.

Mr Timoney and Mr David are insisting for another EGM and shareholders associated with them are demanding identical resolutions for Mr Usasz and Mr Penn. However as per the company, Voting was independently scrutinised by Smilesâ share registry and Mr Timoney and Mr David have been requested to cease their defamatory campaign. The set of events has led to some bit of turbulence which the company is now looking at.

The company is known for providing fully functional dental practices and ancillary services to their partner dental practitioners, allowing them additional time to treat patients and grow their business at a faster pace without getting concerned for practice management.

Broadly, the benefits of companyâs service offering include fully operational dental practices including surgery, reception and waiting rooms; Health fund on-the-spot claims (HICAPS); experienced practice management and administrative staff, dental support and reception staff; head office support; electronic practice management systems for booking services, maintaining patient records and invoicing; and marketing services.

Services offered by âtotally smilesâ (Source- Company Website)

Services offered by âtotally smilesâ (Source- Company Website)

Smiles has increased its patients base through alternative payment channels, which includes Zip Money and Afterpay activated in all practices. The online campaigns have also been the companyâs area of focus to grow its patient base across Australia.

Future Growth Plans:

The company aims to build the foundation of its future growth on practice operations, the optimisation of which will result in achieving cost efficiencies through the scale of network, advanced practice management for clients, and increased purchasing power.

Smiles strives to expand its market share through direct marketing initiatives and increasing its outlays on advanced technology and equipment. The company aims to expand practice revenue by providing an expanded range of services and enhancing the experience for patients. The acquisition of quality dental practices is another thing on companyâs radar for business growth strategies.

On 30 May 2019, SIL settled the dayâs trade at $0.155 with a market capitalisation of $8.98 million. Over the past three months, the stock has witnessed a positive price change of 14.81% with an attractive upside of 19.23% recorded over the past one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.