Online Market â An Overview

In the modern era, the lifestyle of people is changing every day. People feel uncomfortable and time consuming to visit crowded markets for shopping. So, E-commerce is a platform through which costumers promptly purchase goods and services from a vendor over the internet.

Shoppers can get the complete information about the products by just sitting in front of the computer. The online sale and purchase transaction is completely electronic and hassle free, on an E-commerce platform like Amazon.com. Online stores are mostly available 24 hours a day, providing consumers with the flexibility of timings to shop as per their convenience. Since, a variety of goods are available in an online market, the customer is spoilt for choice, and usually ends up receiving the best deal.

By adding preferences over the products, the customer has ample of products available on E-market, and they can buy the products according to their preferences over style, trend and prices of the products. As per the statistics, in 2018 alone, the number of online goods purchased grew by more than 13 per cent, year on year in every state and territory of Australia.

Australian Online Travel Market

A sound economy, with solid demand among its people to see the world are responsible for the healthy travel market in Australia. The online travel bookings industry has surged up rapidly over the past few years. The increase of online purchasing channels has affected the tourism supply chain and enhanced the choices available to customers. People are making use of their mobile phones than ever and the same goes for the usage of internet into their everyday lives too. Therefore, they are becoming more comfortable in booking their tickets online.

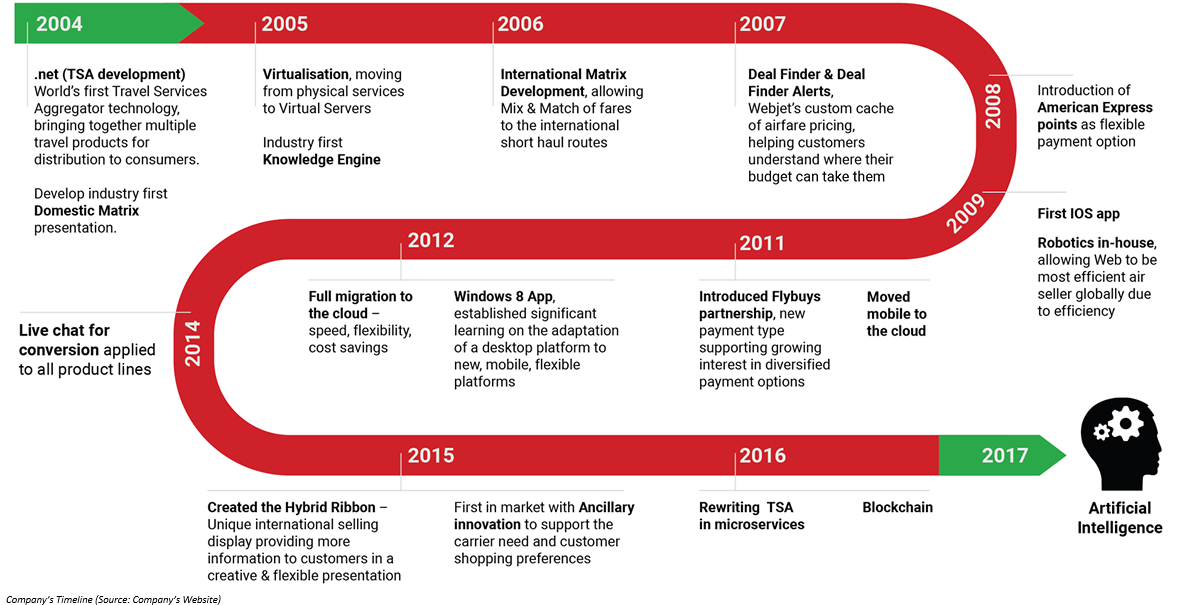

Webjet Limited

Webjet Limited (ASX: WEB) is a leading operator and an online platform for selling travel products, including flights and hotels across Australia and New Zealand region. It provides services to both B2C & B2B clients. The B2C segment of WEB includes Webjet and online republic brands. While, the B2B segment includes Lots of Hotels, and Sunhotels brands.

Recent Updates on Thomas Cook

On 23 September 2019, the company through an ASX release, updated the market on the impact of Thomas Cook entering compulsory liquidation. Thomas cook is the customer of Webjet Limitedâs B2B business WebBeds, and this consequence would affect WEBâs FY 2020 results in various ways. The company is expecting a loss of total transaction value (TTV) from Thomas Cook in FY 2020 period.

As on 23 September 2019, there were unpaid receivables exposure. The impairment of any unpaid receivables would be treated as a one-off expense to the income statement. There would be no material unfavourable influence on WEBâs liquidity, since any write-off would be absorbed by current cash reserves ($211.4 million, as noted on 30 June this year) and undrawn facilities.

However, there would be no effect on beyond three thousand contracts pertaining to hotels that WEB procured from Thomas Cook in August 2016.

On 22 August 2019, in the full year report for the period closed 30 June this year, WEB had signalled that on top of the continuing solid progress, it anticipated WebBeds business to earn a further $27 - $33 million of EBITDA in financial year 2020 period, from an array of drivers like Thomas Cook. The consequence of its collapse is anticipated to slash it down by ~7 million in EBITDA.

On 19 September 2019, the company announced the change in of the directors, Brad Holmanâs interest in WEB. The director acquired 8,000 fully paid ordinary shares, on 13 September 2019 at a consideration of $97,440. Mr Brad Holman now holds 44,008 (direct) and 19,112 (indirect) shares.

On 2 September 2019, the company released a notice of change of interests of substantial holder UBS Group AG and its related bodies corporate on 29 August 2019. UBS Group AG decreased its voting rights from 7.88 per cent to the present 6.64 per cent.

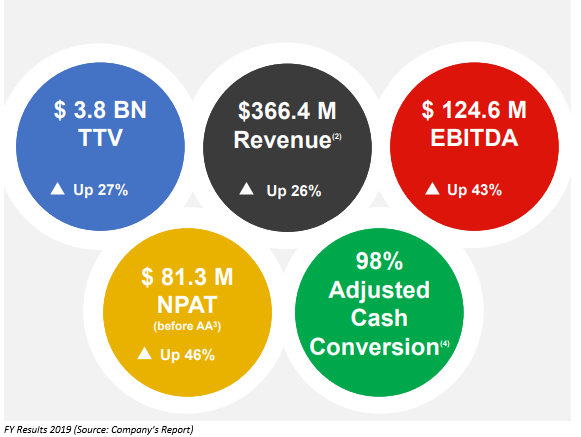

Financial Highlights for FY 2019

On 22 August 2019, WEB announced the financial result for the FY 2019, a few pointerss from the results are as follow:

- The companyâs revenue increased by 26 per cent to $366.4 million compared to the previous year corresponding year (PCP).

- Total transaction value was increased by 27 per cent to $3.8 billion on pcp.

- Earnings before interest tax and amortisation rose by 43 per cent to $124.6 million.

- Net profit after tax increased by 46 per cent to $81.3 million.

- Earnings per share improved by 30 per cent (statutory result) to 47.0 cents.

- CAPEX for FY 19 period grew by 17 per cent to $32.7 million on pcp due to DOTW.

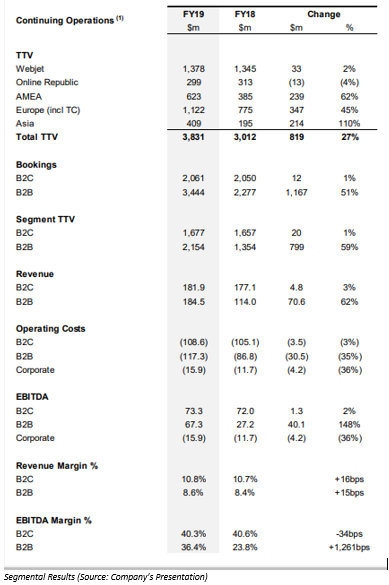

Segmental Results for FY 2019

- The Webjet business topped the TTV segment with $1,378 million.

- Revenue recorded during FY 2019 for B2C segment was recorded at $181.9 million and B2B was noted at $184.5 million.

- EBITDA recorded for FY19 period in the B2C and B2B segments was at $73.3 million and $67.3 million, respectively.

- Number of bookings received in B2B and B2C segments were 3,444 and 2,061, respectively.

Dividend

The company has announced the final dividend of 13.50 cents per share, which is up by 10 per cent from the previous year.

Key FY 19 Initiatives

- The company introduced HSBC Interest-Free, which enables a customer to book now and pay later.

- Became launch partner for the Qantas NDC program and recommitted to Travelport to ensure that it is best placed to obtain real-time content from above 400 carriers worldwide.

- Improvement in the payment options by including POLI and PayPal in the mobile apps.

- Enhancements to automate Change My Booking procedures and user experience enhanced for mobile sites.

- Free selection of seats for the major airlines.

Outlook FY 2020

The company mentioned that it was expecting EBITDA to remain in the range of $27 to $3 million. Destinations of the world (DOTW) five months additional contribution and revenue and cost synergies anticipated to be achieved in full in FY 2020 period. Substantial growth prospects from China, India and Japan offering the potential for further $75-$125 million total transaction value in FY 2020 period.

WEB also stated that it was expecting the IT platform to progress at a lower rate than revenue in the next 2-3 years period. Also, major emphasis was said to be laid on the improvement of the efficiency of the connections.

Moreover, FY 2020 capex was expected to grow by 10-15 per cent over FY 2019 period. The company continued to evaluate and assess options, with regards to the numerous B2B platforms, concentrating on increasing consumer connectivity, while meaningfully decreasing operating cost.

Stock Performance

The stock of WEB was trading at $11.72 on 24 September 2019 (at AEST 3:42 PM), edging up by 5.491 per cent. It has a market cap of $1.51 billion and approx. 135.6 million outstanding shares. The 52-week high and low value of the stock is at $17.190 and $10.180, respectively. The stock has generated a negative return of 23.33 per cent in the last six months period and positive return of 4.91 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.