Some call him the world’s greatest investor, others address him as the Oracle of Omaha and a chunk consider him to be one of the most successful investors in the world. This introduction would have created an image in your minds of one of the most efficient billionaires that we have seen- Warren Buffett, an American business tycoon, active investor and philanthropist, who is also the CEO and Chairman of Berkshire Hathaway.

Warren Buffet’s investing strategy is the ultimate guide for new and experienced investors alike and he continues to inspire the world with his tips of the trade.

Warren Buffett’s Investment Life

Born in Omaha in the 1930s (hence often referred to as the Oracle of Omaha), Mr Buffett had developed a keen interest in the investing and business life in his early youth, as early as age 11!

After being involved in the investing sphere in his early life, he went on to mold his investment philosophy around the concept of value investing and attended New York Institute of Finance to focus on his economics background which led to several business partnerships.

Fast forward years, his net worth today is approximately USD 89 billion. Some of his best buys include Coca Cola, Kraft Foods, See’s Candy and Gillette.

Warren Buffett’s Investing Strategies

Investors opine that investing like the Oracle of Omaha is not an art or a science, but an extensive study of human nature and the desire to be on the investing route.

Mr Buffett’s strategies have rather been plain and simple and has interestingly, not changed over the years.

His investments have (usually) centered around the most basic products and services- consumer goods. He taps companies that he foresees being capable of delivering long-term value investment.

He is considered to be a value investor, as he is always on a look-out for businesses that are below their intrinsic worth but have the potential to make money.

Mr Buffett believes in the significance of information. He assesses probable investment avenues’ fundamentals, like the profitability and return on equity before investing in it.

Warren Buffett's Top Tips to Invest

In a message to Berkshire Hathaway’s investors, Mr Buffett stated that he does not make stock recommendations. It is only his personal moves and thoughts that are vigilantly gauged by investors who consider him to be a great investing guide.

Market players learn his principles in the aspiration to replicate his success by selecting the right stock at the right time and place it strategically in their investing portfolios.

So, what are the top tips that one can learn from the greatest investor’s style of investing? Let’s touch base a few-

- Invest in companies that you understand- the sector, the products and business behavior.

- Once you have invested, follow the companies on a fixed period basis so that you do not miss out on any update or development.

- Always be on a look-out for inexpensive stocks that bear the potential to deliver good returns.

- Learn the basics of value investing- select stocks that seem to be trading below their intrinsic value.

- Believe in long-term returns and find businesses that can endure tough market conditions. He is a renowned advocate for companies that have a long history of paying dividends and increasing them over time.

- Buffett advises to be cautious against speculation i.e. retaining a stock in the anticipation of price appreciation.

- Sell stocks at the right time- diligently and strategically. Mr Buffett believes in selling a stock when a company no longer matches the reasons for buying it.

- One should not fall for anything that is trending and not let emotions take a toll over investing decisions. This indicates that an investor needs to understand the dynamic nature of business and be willing to change plans if a rational analysis of business fundamentals hints at it.

- An investor should always keep learning to enable one to make wise decisions based on the knowledge that is gained.

- Mr Buffett believes that the best buying opportunities in the market often occur when other investors are selling.

ASX Stocks That Stole the Show in December 2019

Now that we have an idea about the way good investing decisions can be made and strategic portfolios can be created, let us look at a few stocks which were few of the many good performers on the ASX in December 2019.

oOh!media Limited (ASX: OML)

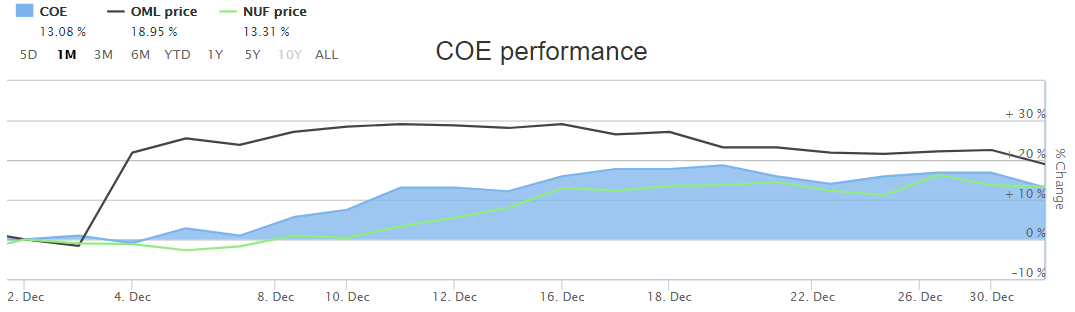

One of Australia's largest Out Of Home media company, OML delivered returns of 18.95 per cent (as on 31 December 2019) in the last one month and has an annual dividend yield of 3.02 per cent. The probable catalyst of this decent stock performance is the Company’s expected earnings for the year ended 31 December 2019.

The FY19 Underlying EBITDA is likely to exceed its earlier forecast and will range between $138 million to $143 million. The improved bookings for last two quarters moved positively over the prior year, causing this upgrade.

The stock settled at $3.760, up 3.3% as on 2 January 2020.

Cooper Energy Limited (ASX: COE)

Finder, developer and making oil and gas commercial, COE came up with an array of announcements, which probably built the stock momentum to deliver return of 13.08 per cent (as on 31 December 2019) in the last month-

- The successful conclusion of the four well appraisal program at the Callawonga oil field, Cooper Basin, South Australia by the PEL 92 Joint Venture;

- Completion of the transaction for acquisition of the Minerva Gas Plant by the participants in the Casino Henry joint venture;

- Commencement of the 4 well appraisal program of the Butlers oil field by the PEL 92 joint venture.

The stock settled at $0.605 as on 2 January 2020.

Nufarm Limited (ASX: NUF)

With manufacturing and marketing operations across Australia, New Zealand, Asia, the Americas and Europe, the NUF stock delivered 13.31 per cent (as on 30 December 2019) in the last month.

In the year, the Company progressed the integration of the European portfolios acquired in 2018 and made significant progress in bringing a large, new value stream online with omega 3 canola. Besides this, the proposed divestment of the South American business was announced.

The stock settled at $6.130, up 5.87% as on 2 January 2020.

The below table depicts the 1-month performance of the three stocks discussed:

(Source: ASX)

With 2020 just in, it will be interesting to watch investors build their sentiments towards the Australian stock market and understand if the Warren Buffett tips drive them towards success.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)