âItâs far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.â This is one of the many pieces of advice that investors have had as a takeaway from the man under discussion in this article. Regardless of any debate, Warren Buffett is rightly tagged as the greatest investor of all times, besides being an American business tycoon, speaker and philanthropist. Interestingly, the legendary investor, also referred to as The Oracle of Omaha, does not give any stock recommendation but is quoted numerous times. Also, his moves are often traced, and they form an inspiration crux for many budding and established investors. Buffett led Berkshire Hathaway is an American MNC conglomerate holding company, and has averaged an annual growth in book value of 19 per cent to its shareholders since 1965. In this article, we would look at a few stock options, that are likely to be based on a Warren style portfolio, if one was to invest in the companies listed on the Australian Securities Exchange, but before that, let us understand a few hand-picked strategies and beliefs of Mr Buffett:

Warren Buffett Beliefs and Trends

In a nutshell, Warren Buffett focuses on the three aspects of stock selection and investing- which could be considered as a tripod stand or could be considered as an individual philosophy. These three philosophies are as depicted below: Mr Buffett has noticeably been keen towards consumer stocks, given the major holdings in Kraft Heinz and Coca Cola. In the recent times, he is seen to have a belief in the S&P 500 index funds, which seems like both a lucrative and profitable option to him and many investors. He believes that most of the investors should ideally buy the stocks and go along for the ride.

Besides, Mr Buffett is highly fond of durable businesses with sustainable moats, like the retail stocks, and believes in budding technology, including the booming e-commerce industry. Likely, for these reasons, he has a major stake in companies like Costco, Apple Inc. and Amazon.com.

Adding on, a Warren Buffett portfolio is likely to constitute financial stocks, which, even though might have struggled in the recent times, bear potential to beat the market over time. Focusing on value and long-term investment approach, along with discipline, enhances the prospects of giving adequate returns across a period of time.

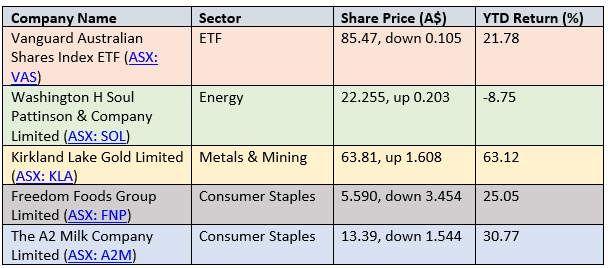

Let us now browse through the 5 stocks, that are listed and trade on the Australian Securities Exchange. They also seem to be gaining traction among investors.

(Please note that the share performance mentioned next to the share price and returns have been noted during the trading session on ASX (as on 17 September 2019, AEST 12:29 PM).

Mr Buffett has noticeably been keen towards consumer stocks, given the major holdings in Kraft Heinz and Coca Cola. In the recent times, he is seen to have a belief in the S&P 500 index funds, which seems like both a lucrative and profitable option to him and many investors. He believes that most of the investors should ideally buy the stocks and go along for the ride.

Besides, Mr Buffett is highly fond of durable businesses with sustainable moats, like the retail stocks, and believes in budding technology, including the booming e-commerce industry. Likely, for these reasons, he has a major stake in companies like Costco, Apple Inc. and Amazon.com.

Adding on, a Warren Buffett portfolio is likely to constitute financial stocks, which, even though might have struggled in the recent times, bear potential to beat the market over time. Focusing on value and long-term investment approach, along with discipline, enhances the prospects of giving adequate returns across a period of time.

Let us now browse through the 5 stocks, that are listed and trade on the Australian Securities Exchange. They also seem to be gaining traction among investors.

(Please note that the share performance mentioned next to the share price and returns have been noted during the trading session on ASX (as on 17 September 2019, AEST 12:29 PM).

Vanguard Australian Shares Index ETF

As mentioned above, the pioneer investor has been advocating index funds since many years. He feels that an S&P 500 index fund suffices every need of an investor, and one need not buy anything more or anything less than that. This would be beneficial, because there are two sets of investors- one who do end up doing the wrong thing, lose some money and give up and the other who repeat the mistakes and end up being underperformers. This is when index funds are a good strategy to be indulged in, along with other stocks. This is also, when blue chips like Vanguard Australian Shares Index ETF, a local version for Australia, comes into the picture. Vanguard had over A$7.9 trillion in assets under management (as on 30 June 2019), and is one of the worldâs largest global investment management companies. On 17 September 2019, the VASâ stock was trading at A$85.530 (at AEST 12: 49 PM), down by 0.035 per cent, with a market capitalisation of A$4.09 billion and approximately 47.84 million outstanding shares.Washington H Soul Pattinson & Company Limited

SOL, the diverse energy portfolio holder of investment, coal mining, pharmaceutical, telecommunications and building materials is tagged as the ASXâs version of Warren Buffettâs Berkshire Hathaway and last year (in September), it reported a 17% increase in its regular profit to a record $331 million, driven by the New Hope Corporation Limited (ASX: NHC) and Brickworks Limitedâs (ASX: BKW) contributions. Moreover, with a P/E ratio of 17.730x, which is above the average of its industry competitors, implies that the market expects SOL to outperform other companies in the industry. On 17 September 2019, the SOL stock quoted A$22.34 (at AEST 12:49 PM), up 0.585 per cent, with a market capitalisation of A$5.32 billion and approximately 239.4 million outstanding shares.Kirkland Lake Gold Limited

The gold miner and explorer KLA features in this list for two reasons- first, because it is from the metals and mining group, which is one of Australiaâs business specialty and secondly, because the stock has delivered a decent YTD return of 63.12 per cent. Mr Buffett is a firm believer in investing in businesses that one understands, and this sector is relatively famous than many others in the Aussie land. Moreover, the company has depicted strong growth in production, net earnings and operating cash flow in Q219, compared to Q218, along with significant improvement in unit costs. Net earnings stood at $104.2 million, up by 69 per cent on pcp and revenue was up by 31 per cent to $281.3 million. The company bears potential to be a safe player for gold enthusiasts, and it quoted A$63.81 (at AEST 12:54 PM), up 1.608 per cent, on 17 September 2019.Freedom Foods Group Limited

One of the first players in the Australian Plant-based beverage market, FNP sources, manufactures, sells, markets and distributes specialty cereal and snacks and plant and dairy beverages. The company is chosen to be in this probable portfolio under discussion, because it hails from the consumer staples section- one of Mr Buffettâs best bets in the world of trade and secondly, because it is likely to gain traction on the back of positive macro trends in healthier lifestyles along with the soaring China-Asia demand for dairy products and plant-based beverages. On 17 September 2019, the FNP stock quoted A$5.560 (at AEST 12:57 PM), down by 3.972 per cent, with a market capitalisation of A$1.58 billion and approximately 272.9 million outstanding shares.The A2 Milk Company Limited

Emphasising on the consumer staples section, as the pioneerâs favourite and a company which is here to go, given the population growth pace, the A2 milk company specialises in infant formula products. It is dual listed on the NZX and ASX and has always been a hot stock, especially after Chinaâs government began planning new roles for the regulation of the baby formula sector, and opened e-commerce doors, with few tagging, the company as a growth machine. Chinaâs government has been planning new roles for the regulation of the baby formula sector. On 17 September 2019, the A2M stock quoted A$13.37 (at AEST 1:00 PM), down 1.691 per cent, with a market capitalisation of A$10.00 billion and approximately 735.17 million outstanding shares.Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.