Value trading is an investing strategy wherein investors pick up stocks which are trading below their intrinsic values, with the belief that the stock market is underestimating them regardless of their long-term earnings power. If a stock is believed to offer a long-term value and is available on sale, investors tend to buy and save a lot of money, in a similar manner as it plays out in the commodity markets. This technique doesnât entail following the herd mentality. The rationale lies in taking at second look at the stocks when their prices are down considering that such companies can recover and deliver value in the long run if their fundamentals remain strong and intact. The idea is to own the shares of the company with sound basics and robust financial performance. It is more often than not that the investors trade irrationally based on psychological bias, instead of turning investments into profit they accept a certain loss. This behaviour is so prevalent that it affects the prices of individual stocks, worsening both upward and downward market movements, creating unnecessary oscillations and hence turning a stock into disfavour.

Let us now have a look at Treasury Wine, CSL and Westpac Banking Corporation!

Treasury Wine Estates Limited (ASX: TWE)

Treasury Wine Estates Limited (ASX:TWE) is an international wine Company with a portfolio of luxury, premium and commercial wines. The principal activities of the group include grape growing and sourcing and production, marketing, sales and distribution of wine.

CEO Michael Clarke to retire in fiscal 2021:

TWE announced that Tim Ford will be appointed to the role of Chief Executive Office as Michael Clarke, current CEO intends to retire from role of managing director and CEO in the first quarter of FY21.

Dividend/Distribution â TWE:

The company announced a fully franked dividend of 20 cents per share on TWE - ORDINARY FULLY PAID security which was paid on 4 October 2019 resulting in an annual dividend of 38 cents per share for FY19, up by 19% on the prior corresponding period.

Rising Performance

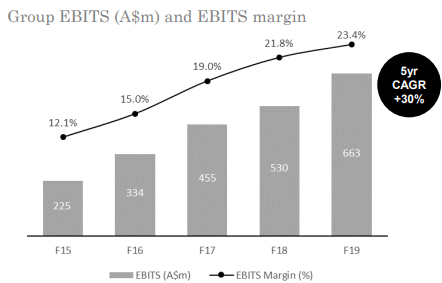

- During the year, the Companyâs EBITS went up by 25% to $662.7 million and EBITS margin reflected a CAGR of 30% in 5 years from FY15 to FY19 rising continuously from 12.1% to 23.4%.

EBITS and EBITS margin (Source: Investors Presentation)

- EPS (before material items and SGARA) of the company rocketed by 16.6% to 60.4 cents per share and Return on Capital Employed improved to 14.9% by 2.3 percentage points compared to the previous corresponding period.

- The revenue of the company went up by 43% in the past 5 years mainly driven by the growth of Luxury and Masstige brands, which went up by 27% representing 69% of total net sales revenue.

Future Prospects

- The company will remain focused on leveraging its organisational, strategic and physical assets across the world to drive continued value growth for its shareholders.

- Focus on preimmunising portfolio, supported by TWEâs non-current inventory of Luxury and Masstige wine, would impact the future operational and financial prospects.

- The company anticipates that the Investments in French production and vineyard assets and Australian Luxury winemaking capacity will support the next phase of the premiumisation journey and is also expecting to launch the new, virtual wine brands that are multi-regionally sourced from new countries-of-origin.

- It is also expected that the company to leverage a new way to the US market driving the greater brand availability, strengthened strategic retail and distributor partnerships and EBITS dollar and margin growth.

- TWE expects to deliver approximately 15% to 20% EBITS growth on a reported basis in FY20 and ongoing EBITS margin and Return on Capital Employed accretion in FY20 and beyond.

Stock Performance:

The stock closed at $17.1 on 23 October 2019 with an annual dividend yield of 2.24%.

CSL Limited (ASX: CSL)

CSL Limited (ASX: CSL) is a healthcare company which is primarily engaged in development, manufacturing and marketing of pharmaceutical and diagnostic products that save lives, protect public health and help people with life threatening medical conditions.

Dividend/Distribution â CSL:

The company announced a dividend of US$1.0 per share on CSL - ORDINARY FULLY PAID which was paid on 11 October 2019.

A strong year for CSL:

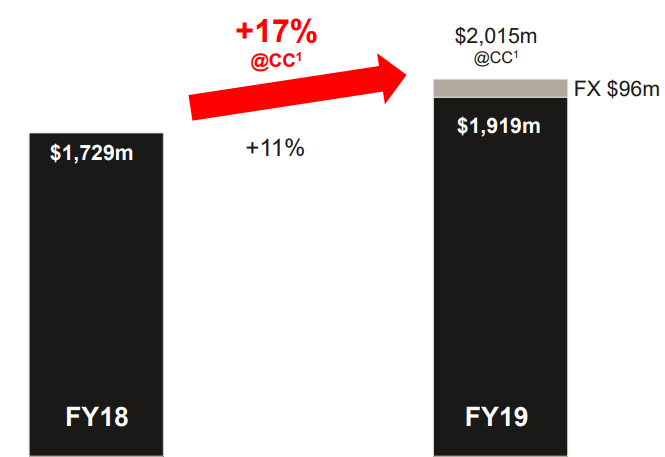

During the FY 2019, the company reported an increase of 11% in revenues reflecting continued strong growth in the core immunoglobulin and albumin therapies, high patient demand for specialty products Haegarda and Kcentra, successful evolution of its Haemophilia portfolio and Seqirus delivering on strategy with strong profit growth. The company also stated an increase of 17% in net profit after tax with research and development expenditure of US$832 million. During the year, net cash inflow from operating activities of the company was US$1,644 million. The company also opened 30 new plasma collection centres in the US and achieved 24 product registrations or new indications for serious diseases in numerous countries.

Financial Highlights (Source: Companyâs Presentation)

Promising futures:

CSLâs global workforce has grown up by 13% to over 25,000 employees in 38 countries. In FY20, the company expects the strong demand for plasma and recombinant products and Slight margin growth from plasma product mix shift. The company also expects that the net profit after tax (NPAT) would range in between ~US$2,050 million to US$2,110 million at constant currency and revenue would go up by approximately 7-10%.

Stock Performance:

The stock of CSL Limited witnessed a price growth of 31.72% in the past 6 months. currently trading at a P/E multiple of 41.510x. The market cap of the stock is $113.81 billion. The stock closed at $250.640 on October 23, 2019.

Westpac Banking Corporation (ASX: WBC)

Westpac Banking Corporation (ASX: WBC) provides financial services like lending, depository and payment services, superannuation and funds management, general finance etc.

APRA Consultation - subsidiary capital investment treatment:

APRA proposed that equity investments in subsidiaries will be risk weighted at 250% with a limit of 10% of Level 1 Common Equity Tier 1. It was also proposed that Equity investments exceeding 10% limit will be fully subtracted from Level 1 CET1 capital in order to determine Level 1 capital ratios.

Westpacâs largest equity investment is in Westpac New Zealand Limited. It has several other banking and insurance subsidiaries where its holding is below 10% in each of them.

Westpac VIEWS over securities in BXB:

Westpac Banking Corporation notified of a dividend/entitlement in respect of Brambles Limited (BXB) to be paid on or about 22 October 2019 for $0.2900 per security with return of capital and special dividend of $0.1200 and $0.1700 respectively.

Digital Highlights:

During the year, online TD renewals were doubled up and feature of Chat bot using IBMâs Watson AI and EasyID significantly improved account opening. It is a leader in Fintech and has expanded Reinventure funds to $150 million, generating real strategic value, insights and opportunities.

Stock Performance:

The price-return of the stock was 6.70% in the past 3 months whereas the annual dividend yield is 6.49%. On the valuation front, it is trading at a P/E multiple of 14.060x with a stock price of $28.910 on 23 October 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.