Crude oil prices are again slumping in the market with Brent crude futures on the International Commodity Exchange plunging from USD 65.78 (intraday high on 20 January 2019) to the present level of USD 64.89 a barrel (as on 21 January 2020 2:52 PM AEDT), which underpinned a price depreciation of 1.35 per cent.

Crude oil prices were quick to react over the supply concerns in Libya, where militia loyal to the Libya National Army closed the pipeline of southwest oil fields, which in turn, led the National Oil Corporation (or NOC) in Libya to shut down the production at two large-scale.

NOC further anticipated the shutdown to slash 0.8 million barrels of oil production per day from the average capacity of Libya to produce 1.2 million barrels of crude a day. The news slightly supported crude prices; however, oil participants were quick to react over other external factors, which are dictating the direction for oil.

Key Takeaways

- Crude oil prices are again slumping in the market with Brent crude futures on the International Commodity Exchange.

- Crude oil prices were quick to react over the supply concerns in Libya, where militia loyal to the Libya National Army closed the pipeline of southwest oil fields, which in turn, led the National Oil Corporation (or NOC) in Libya to shut down the production at two large-scale.

- NOC further anticipated the shutdown to carb out 0.8 million barrels of oil production per day from the average capacity of Libya to produce 1.2 million barrels of crude a day.

Many price forecasters such as the United States Energy Information Administration (or EIA) had anticipated the oil to move in accordance with the market demand rather than factors of the supply chain amid abundant oil supply from non-OPEC oil-producing countries, which is counterbalancing the supply disturbance in the Middle East and Saudi’s production cut of 1.7 million barrels a day to keep the price healthy.

To Know More, Do Read: EIA Forecasts on the Brent Crude Oil; Crude Oil Prices Likely to be Demand-driven Ahead?

However, at present, the supply seems not to be concerning the energy enthusiasts as compared to the demand, which is currently being estimated by taking inputs from some of the important economic figures.

Economic Figures and Impact

- Manufacturing Activities

The manufacturing activities across the United States and China slowed down for December 2019. The ISM Manufacturing PMI in the United States stood below mean of 50.0 at 47.2 not only for the last month of the year 2019 but for the entire December quarter.

Likewise, the Caixin Manufacturing Index in China declined to stand at 51.5 for December 2019, which marked a fall post three straight gains in the index.

Combined, both the indices reflected weaker manufacturing activities on the global front (as the United States and China are two major economies), which further suggested low demand for oil.

- Declining Inflation

Commodity prices and inflation exhibit positive correlation, i.e., a thriving commodity market usually adds to inflationary pressures.

To Know More, Do Read: Crude Oil As An Economic Indicator and Its Trend Analysis

Both China and the United States indicated early signs of slowdown in inflation, with Consumer Pricing Index (or CPI) y/y in China coming in at 4.5 per cent against pcp in December 2019 as compared to the market consensus of 4.7 per cent.

While the CPI y/y in the United States surged by just 0.2 per cent against pcp in December 2019 as compared to the previous month change of 0.3 per cent (September 2019).

The decline in inflation could also be inferred from the plunge in the value of treasury inflation-protected securities, which is further reducing the yield spread between the same maturity government bonds and inflation-protected bonds across the United States and China.

While the production loss of 0.8 million barrels a day might have raised speculation, the United States surmounting oil generation were given higher weightage by market participants in shaping the oil market, which was a major contributing factor to the current downward pressure on oil prices over various factors.

Key Takeaways

- However, at present, the supply seems not to be concerning the energy enthusiast as compared to the demand, which is currently being estimated by taking inputs from some of the important economic figures.

- Demand is taking a down stroll over the plunge in economic activities, while also taking a hit from slowing inflation across the global front.

- While the production loss of 0.8 million barrels a day might have raised speculation, the United States surmounting oil generation were kept paramount by market participants in shaping the oil market, which provided much of the current downward pressure on oil prices over various factors.

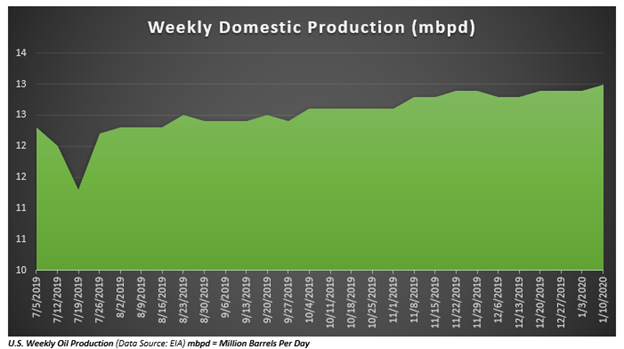

The crude oil production rate in the United States in 2019 averaged between ~ 12.3 million barrels a day now seems to be moving further. For the week ended 10 January 2019, the weekly oil production in the United States surged to 13.0 million barrels per day with a decline in net imports and the increase in export.

The high domestic production exerted pressure on crude oil prices, and the market did not bother much over the Libya production cut mainly due to the surge in production capacity across the United States.

While the US domestic production soared to 13.0 million barrels per day (for the week ended 10 January 2020), the net oil import declined with an increase in exports.

The weekly import decreased by 595 thousand barrels a day (for the week ended 10 January 2020), and oil exports surged by 417 thousand barrels a day (for the week ended 10 January 2020). Such an abundance of production and export coupled with a decline in import suggested ample supply, which in turn, kept the lid on any possible speculative gain by the decline in Libya production.

Key Takeaways

- The U.S. reached an all-time high record production of 13.0 million barrels per day.

- The weekly import decreased by 595 thousand barrels a day (for the week ended 10 January 2020), and oil exports surged by 417 thousand barrels a day (for the week ended 10 January 2020). Such an abundance of production and export coupled with a decline in import suggested ample supply, which in turn, kept the lid on any possible speculative gain by the constraint in Libya supply chain.