Stocks of companies with a small market cap are referred as small cap stocks. Though these stocks hold huge growth potential, they are often under-recognised. Let us look at five small caps, listed on ASX along with their recent updates and stock performances:

Pureprofile Limited

About the company: Pureprofile Limited (ASX:PPL) is a communication services sector player that connects brands with consumers across the globe by finding, understanding and engaging them through direct-to-consumer technology platforms. The Pureprofile group is among the top players in the field of data insights, programmatic media, big data, and quantitative research, as well as consumer lead generation.

Response to ASX Query: On 5 September 2019, the company provided response to ASX query related to the price of its securities from a low of $0.009 to a high of $0.021 on that date. For the first question, whether the company was aware of any information that it had not unveiled to the market owing to which the change was observed in the securitiesâ price, PPLâs answer was no. For the other question, whether the company had any other explanation for the price change, PPL again replied a no. The ASX had also asked the company to confirm that it is complying with the Listing Rules and, in particular, Listing Rule 3.1. For this, PPL confirmed that its activities are in compliance with the listing rules. The company also confirmed that all the answers given were approved and given a go ahead under its published continuous disclosure policy or by the authority responsible for responding to ASX on disclosure matters.

Change in Board of Directors: Mr Nic Jones has resigned as Chief Executive Officer and Managing Director and is replaced by Mr Aaryn Nania, who is the co-founder and Head of Fund Management of Lucerne Investment Partners (Lucerne). The company has also announced that Melinda Sheppard, the former Chief Financial Officer of the company, has been promoted to the position of COO.

Changes in Debt Structure: The company has also reached an accord on the revised terms related to its existing loan facilities with Lucerne. The following changes were brought into effect from September 2019 onwards:

- Maturity date: Extended to 1 October 2020.

- Interest rate: Annual interest rate set at 20% on all drawn facilities.

- Repayment Fee on Control Transaction: The âRepayment Feeâ has been removed.

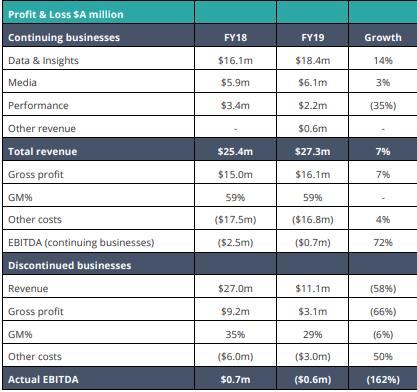

FY19 Results Review: Pureprofile Limited witnessed strong growth in core data and insights business with revenue up by 14% to $18.4 million. Media business had a steady growth with revenues up by 3% to $6.1 million. A supportive existing lender advanced an additional debt of $3 million in February 2019, while further $2.6 million was secured from a new debtor in June 2019. Operating cash flows improved by $1.9 million, predominantly due to improved collection of receipts from customers in H2FY19.

FY2019 Results (Source: Companyâs Report)

Outlook for FY20: The company is expecting to register continued revenue growth in core D&I and Media businesses with a recovery of revenue for the performance UK business. Moreover, PPL has given a FY20 EBITDA guidance of $2.7 million to $3.0 million.

Stock Performance: On 9 September 2019, the stock of PPL traded flat at a price of $0.028, with a market cap of around $3.29 million and approximately 117.53 million outstanding shares. In the previous six months, the stock has given a positive return of 21.74%.

Registry Direct Limited

About the company: Registry Direct Limited (ASX: RD1) caters to Australia-domiciled listed and unlisted companies and trusts. The company offers share and security registry software and services. Unlisted companies can use the software on a self-services basis, thereby typically lowering their registry costs relative to traditional full-service offerings while getting the advantages of an enterprise grade registry system. This self-service capability differentiates the company from the traditional registry service providers in the country.

RD1âs business expansion strategy involves continued focus on attracting and securing new client companies and enterprises early in their lifecycles and disrupting the incumbent service providers by capitalising on its proprietary, cloud-based technology.

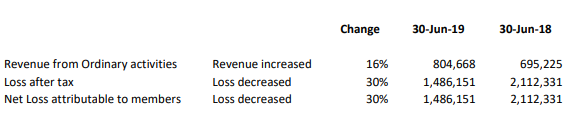

For the year ended 30 June 2019, the company reported an increase of 16% in revenue from ordinary activities to $804,668 and a decrease in loss from $2.11 million in FY18 to $1.49 million in FY2019.

FY19 Highlights (Source: Companyâs Report)

In July 2019, the company made an additional capital raising of $646,00 pursuant to a fully underwritten rights issue, aimed towards funding its core business. The company has not paid or declared any dividend since the start of the year. No recommendation for payment of dividends has been made.

Stock Performance: The stock of RD1 last traded at a price of $0.020 on 5 September 2019, with a market cap of around $3.45 million and approximately 172.37 million outstanding shares. In the previous six months the company has given a negative return of 5.14%.

Pilot Energy Limited

About the company: Pilot Energy Limited (ASX:PGY) is an emerging junior oil and gas explorer. The company focuses on the implementation of a low cost, counter cyclical strategy for the development of a portfolio of high-quality oil and gas exploration assets. The companyâs aggressive new venture program has rapidly led to the acquisition of material working interests in the exploration permits, namely WA-481-P, WA-503-P and EP416/480, which are located offshore and onshore Western Australia. Moreover, the company has a minor working interest in the EP437 permit.

June Quarter Activities Report: WA-481-P (PGY is the operator with a 60% stake)- Interpretation and mapping of the 2D and 3D seismic reprocessing continued during the June quarter, enabling correct quantification of the evaluated resources and independent resource assessment certification. Completion of this work has taken longer than planned.

EP437 Exploration Permit (PGY holds a 13.058% stake)- In the three months to June 2019, preparations for performing drilling activities at the Wye Knot-1 exploration well in EP 437 continued. The operator of the permit, Key Petroleum, has secured access to significant amount of long lead items that could potentially be deployed to an EP 437 work programme of drilling.

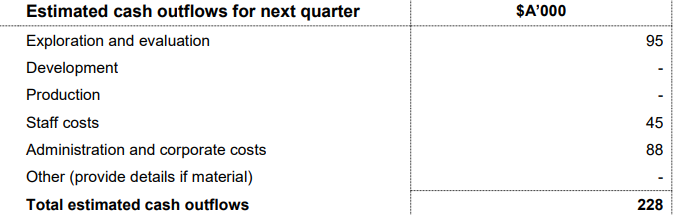

Cash flow: In the reported quarter to 30 June 2019, Pilot Energy reported cash outflows of $201,000 from operating activities and cash inflows of $300,000 from financing activities. The companyâs cash and cash equivalents at end of period stood at $196,000. For the next quarter ending September 2019, the company has estimated total cash outflows of $228,000.

Source: Companyâs Report

Stock Performance: On 9 September 2019, the stock of PGY closed trading at a price of $0.056, down 25.333% from its previous close, with a market cap of around $5.96 million and approximately 79.47 million outstanding shares. In the previous six months, the company has given a positive return of 281%.

archTIS Limited

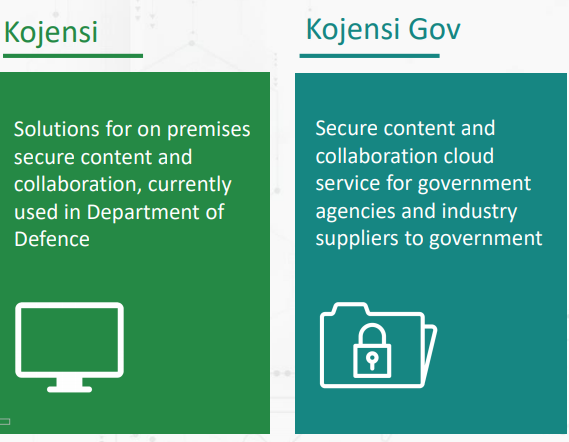

About the company: Established in 2006, archTIS Limited (ASX: AR9) is a cyber security company that focuses on safeguarding sensitive information. The company has developed an industry leading information security platform (Kojensi), which offers a robust platform to start and collaborate on sensitive information.

Source: Companyâs Report

First Customer for Kojensi Gov Platform: On 5 September 2019, the company updated the market that it inked a commercial contract with the Commonwealth Attorney Generalâs Department. Under the contract, the department would purchase its PROTECTED content and collaboration cloud service, Kojensi Gov, which was commercially rolled out in April 2019. Moreover, the department became the first client of the company for the Kojensi Gov platform. The contract is inclusive of an initial term of 12 months. Moreover, it covers two additional annual extensions, with a minimum of 50 users and opportunity to add users monthly.

The company plans to convert its growing pipeline of opportunities and identifying new commercial partners, in order to continue to capitalise on increasing interest and momentum in the offering.

Stock Performance: On 9 September 2019, the stock of AR9 closed the dayâs trading at a price of $0.120, down 14.286% from its previous close, with a market cap of around $17.23 million and approximately 123.1 million outstanding shares. In the previous six months, the company has given a positive return of 40%.

ReNu Energy Limited

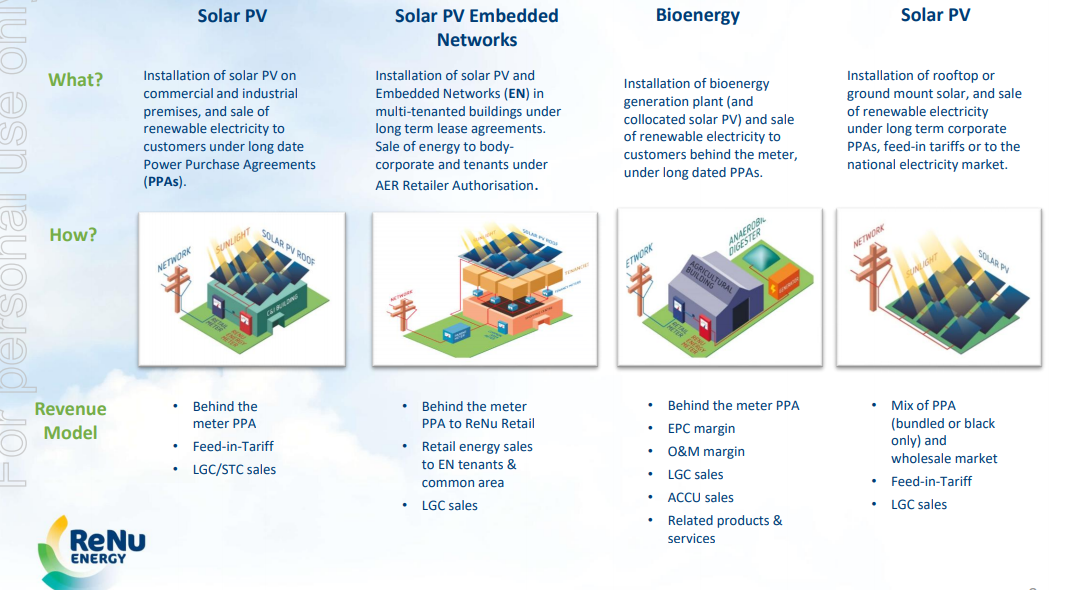

About the company: An independent power producer, ReNu Energy Limited (ASX: RNE) caters to its clients with clean energy products and services. The company is engaged in building, owning, operating and maintaining renewable energy assets. RNE is building a portfolio of projects that will deliver stable returns in the long-term.

The four key businesses are:

- Solar PV Embedded Networks

- Solar PV Power Purchase Agreements (PPAs)

- Biogas PPAs

- Solar PV Grid Connected

Source: Companyâs Report

Solar Operations Sale Completion: ReNu Energy Limited has announced the completion of the sale of its solar operations to CleanPeak Energy Pty Ltd. The transaction involved the sales of the ReNu Energy subsidiaries holding the Embedded Networked Operations, Amaroo Solar PV Facility and the energy retail authorisation.ReNu has received $5.775 million in consideration for the sale. After repayment of the Amaroo loan facility, ReNu Energyâs cash holdings would get a boost of $4.25 million.

Stock Performance: On 9 September 2019, the stock of RNE closed at a price of $0.028, up 3.704% from its previous close, with a market cap of around $3.3 million and approximately 122.07 million outstanding shares. In the previous six months, the company has given a negative return of 67.44 %.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.