On 30 September 2019, the benchmark index S&P/ASX 200 closed the day in red, declining by 27.8 points and settling at 6,688.3, while the S&P/ASX 200 Consumer Staples (Sector) closed in green, up 1.1 points, settling at 12,547.3. meanwhile, the S&P/ASX 200 Information Technology (Sector) closed at 1,383.7, down 18.2 points, and S&P/ASX 300 Metals and Mining (Industry) traded at 4,323.8, down 5.4 points.

Below discussed are six companies that are trading under the above-mentioned sectors. Let us have a look at their developments.

Corum Group Limited

Corum Group Limited (ASX:COO) is a technology and software development company operating in two business segments- Corum eCommerce, which develops and manages a financial gateway, and Corum health, which develops and distributes business software for pharmacy industry.

Corum Structure for Growth:

Corum Group Limited in a market update on 27 September 2019 unveiled to have reached agreements for a capital raising of $3,660,000 by way of a fully subscribed placement of 146.4 million new ordinary shares. As part of the capital raising with sophisticated and professional investors, the company announced that Alchemy Healthcare would invest $1.5 million in Corum through related entities of its directors. The placement is subject to shareholder approval, which COO expects to receive during the annual general meeting.

SaaS Technology Tie-up with BAMM:

In another market update on 24 September 2019, COO announced to have reached a deal with significant pharmacy groups management player, BAMM Group Administration Pty Ltd. Under the SaaS technology collaboration agreement, the two parties would focus on developing software solutions, targeted towards multi-store management and in-store retail operations.

Corum has agreed to the issue of 63,642,138 shares to the co-developer in two equal tranches after the satisfactory conclusion of the agreed milestones. Additionally, the company has granted a contractual right to take part in future placements.

Outlook:

The company has the chance to grow in the next few years, which demands the investment in product and operational execution. Corum Group is seeking additional funding to invest in new products and is expecting this process to be completed in the first half of the financial year 2020.

Stock Performance:

The stock of COO closed the dayâs trading at $0.042 on 30 September 2019, down 8.696% from its previous closing price, with a market capitalisation of $11.78 million. The stock has delivered a positive return of 76.92% on a year to date basis.

Lefroy Exploration Limited

Lefroy Exploration Limited (ASX:LEX) is a gold focused exploration company taking a systematic conceptual exploration approach at its flagship Lefroy Gold Project.

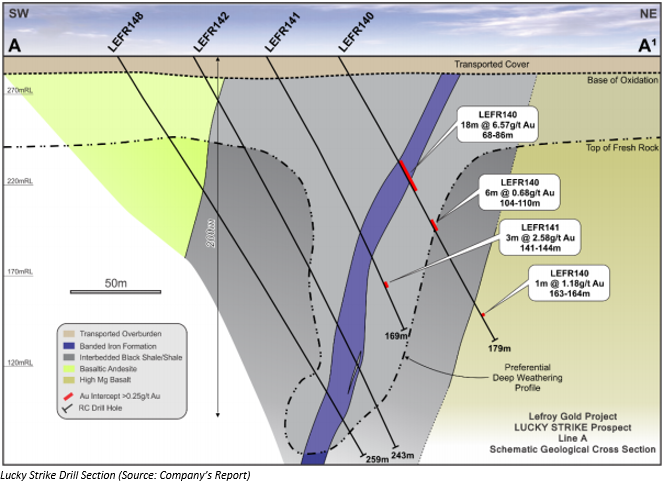

Drilling Delivers Impressive Results at Lucky strike:

At the Lucky Strike trend, a 27-hole reverse circulation drill program led to multiple high-grade gold intersections and extended the deeply oxidised, BIF hosted gold mineralisation by a further 320 metres along strike to the south east. Significant shallow oxide gold intersections included:

- 18m @ 6.57g/t Au from 68m in LEFR140 including 4m @ 21.9g/t Au from 77m

- 12m at @2.97g/t Au from 147m in LEFR146 including 2m @ 8.58g/t Au from 151m

- 22m at 2.49g/t Au from 63m in LEFR152 including 2m @ 15.2g/t from 65m

The company is now planning an additional drilling program (reverse circulation) for the elevation of the trend, with drilling likely to begin in October 2019.

RC Drilling Underway at Zanex:

In a market update in early September 2019, Lefroy Exploration unveiled that South Africa-based gold producer Gold Fields Limited had started a large reverse circulation drilling program at the Zanex prospect. The program is part of a farm-in and JV deal between the South African player and LEX.

Multiple gold intersections by Gold Fields along the strike of the Zanex prospect include:

- 9m @ 2.73g/t Au from 32m to end of hole in KD81399 including 2m @ 8.78g/t Au from 36m

- 8m @ 1.56g/t Au from 36m In KD81377

- 34m @0.44g/t Au from 32m in KD81294

Corporate Performance:

In the financial year 2019, the company reported accelerated gold exploration activity on its tenements including completion of 177 holes for 13,874 metres of drilling at the Lefroy Gold Project, advancement of the Lake Johnston Project and completion of the sale of 100% interest in the tenement package held in the Murchison region of Western Australia.

Stock Performance:

On 30 September 2019, the stock of Lefroy Exploration Limited settled at $0.215, up 7.5% from its previous closing price with a market cap of $19.81 million. The stock has delivered a return of 11.11% on a year to date basis.

Crater Gold Mining Limited

Principal activities of Crater Gold Mining Limited (ASX:CGN) consist of exploitation, evaluation and exploration of world class gold and other metals. On 30 September 2019, the company released its annual report for the year ended 30 June 2019, unveiling a loss of $6,941,949 for the period, compared with $5,739,906 in the year-ago period. In another release, the company updated the market regarding the change of share registry address.

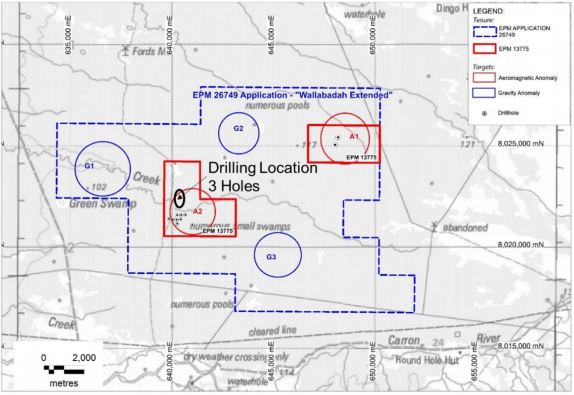

Developments during the June quarter

- High Grade Zone Gold Mine: The company announced the production of 87ozs of gold. The production was from a composite of low-grade and high-grade gold material.

- Grant of EPM 26749 â Wallabadah extended: During the quarter, the grant of EPM 26749 for a term of 5 years effective 11 April 2019 was announced by the company.

Granted EPM Area (Source: Companyâs Report)

Stock Performance:

The stock of Crater Gold Mining Limited closed the dayâs trading at a price of $0.020 on 30 September 2019 with a market cap of $24.55 million. The stock delivered a return of 25% on a year to date basis.

Prospect Resources Limited

Prospect Resources Limited (ASX:PSC) is an explorer and developer of mineral resources. On 27 September 2019, the company released its annual report for the period ended 30 June 2019. During the period, PSC secured mining lease for Arcadia Lithium Project, boosted its ownership in Arcadia to 87%, and secured mining Indaba junior Miner Battlefield.

The company also undertook share placement and exercise of management options in June 2019.

Prospect Resources Dual Listing on Frankfurt Stock Exchange:

The company, on 20 September 2019, announced the dual listing of its shares on the Frankfurt Stock Exchange, which would increase the exposure to European markets and further expand Prospectâs investor reach. The company would trade under the ticker â5E8â.

Prospect signs MoU for Power Supply to Arcadia:

Prospect Resourced Limited announced that a memorandum of understanding has been executed for the supply of power to the Arcadia Lithium Project. The deal was reached with African Continental Minerals (Private) Limited for 5 years which includes minimum supply of 20 megawatts daily power to meet all of the power supply requirements of the project.

Arcadia Location (Source: Companyâs Website)

Arcadia Location (Source: Companyâs Website)

RBZ Approves PSC to Increase Arcadia Ownership to 87%:

Prospectâs acquisition of an additional 17% of the Arcadia Lithium Project from Farvic Consolidated Mines (Pvt) Ltd was approved by the Reserve Bank of Zimbabwe in accordance with the sale and purchase agreement dated 3 October 2018.

Stock Performance:

The stock of Prospect Resources closed at $0.125 on 30 September 2019, up 19.048% from its previous closing price, with a market cap of $24.77 million. The stock has delivered a negative return of 52.27% on a year to date basis.

Australian Whisky Holdings Limited

Australian Whisky Holdings Limited (ASX:AWY) is in the business of further developing investment opportunities in the craft distilling industry, in addition to the management of equity investments in the industry. Recently, the company announced the appointment of Ms Melanie Leydin as the Company Secretary after the resignation of Mr. Gary Stewart. Additionally, AWY unveiled the appointment of Mr Laurent Ly as a Board member.

Brands (Source: Companyâs Website)

Brands (Source: Companyâs Website)

FY19 Performance (as at 30 June 2019):

During the year ended 30 June 2019, the company registered a loss of $4,327,069 compared to a loss of $3,388,235 in the prior year. The net assets of the group increased by $7.1 million from 30 June 2018 to $38 million as at 30 June 2019, partly owing to shares issued, net of issue costs, of $11.4 million, and offset by net loss of $4.3 million.

The company raised an additional capital of $11,946,049 with the issue of nearly 291.37 million ordinary shares in the company and repaid secured loans worth $4,810,000 to Bananacoast Community Credit Union Ltd and Dowd Corporate Finance Pty Ltd. After the repayment of the loans, the security granted for the loans was discharged.

Outlook:

In the future financial years, the likely developments in the companyâs operations and the anticipated outcomes are to be the development of investment opportunities that the company has already identified in the Australian premium whisky industry and the sale of its products in Australia and overseas, coupled with the identification and evaluation of potential new opportunities for the future growth prospects.

Stock Performance:

The stock of Australian Whisky Holdings Limited settled at $0.032 on 30 September 2019 with a market cap of $52.18m. The stock has delivered a negative return of 28.89% on a year to date basis.

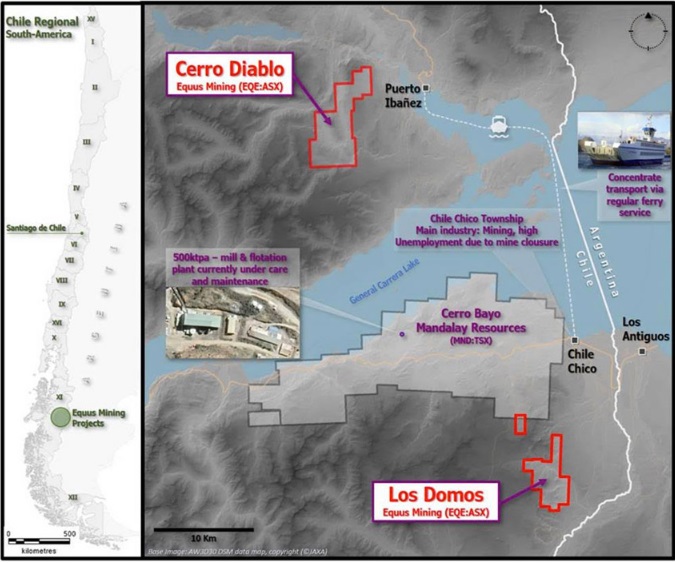

Equus Mining Limited

Equus Mining Limited (ASX:EQE), which is in the business of mineral exploration, released its full year statutory accounts on 27 September 2019 for the period ended 30 June 2019. The company unveiled the year as a transformative period for EQE, during which EQE appointed John Braham as its new Managing Director.

Additionally, the company entered a key agreement with Mandalay Resources for the acquisition of the silver-gold Cerro Bayo Mining Project in Chile, with the deal transitioning Equus Mining from a greenfield explorer to an advanced brownfield explorer with mine infrastructure under option

Cerro Bayo Project Location (Source: Companyâs Website)

Cerro Bayo Project Location (Source: Companyâs Website)

The consolidated loss after income tax attributable to members of the company for the year decreased to $942,751 from a loss of $2,142,214 in FY18.

Stock Performance:

The stock of Equus Mining Limited closed the dayâs trading at $0.015 on 30 September 2019 with a market cap of $18.44 million. On a year to date basis, the stock has delivered a return of 8.94%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.