Lefroy Exploration Limited (ASX:LEX) is a metals & mining company based in Perth, WA. Today, LEX announced the scheduled commencement of a step out RC drilling program at Lucky Strike from June 2019. The announcement also covered results from EIS funded diamond holes and an update relating ongoing research project at University of Western Australia.

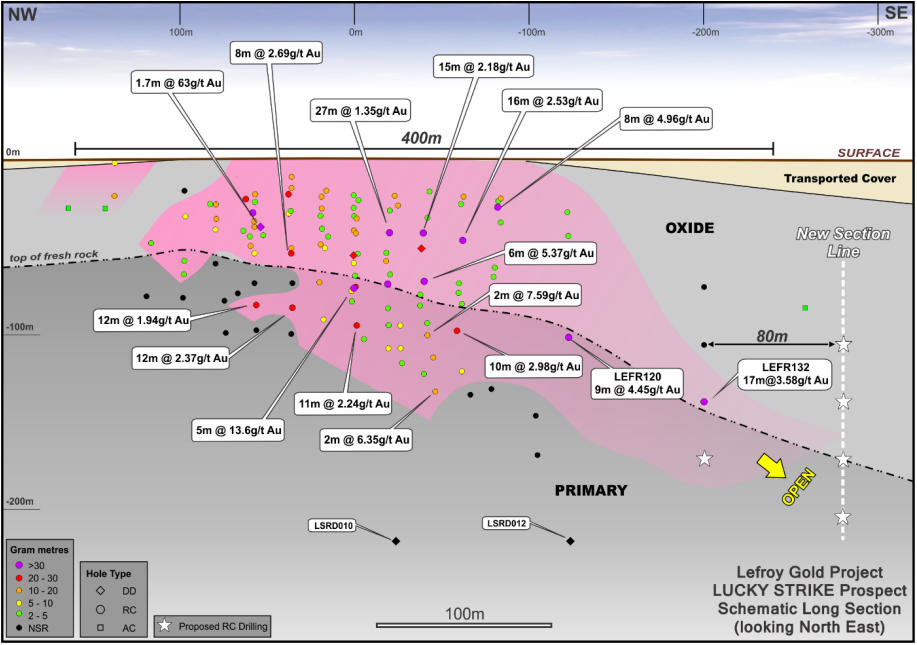

Lucky Strike Schematic Long Section (Source: Companyâs Announcement)

Lucky Strike Schematic Long Section (Source: Companyâs Announcement)

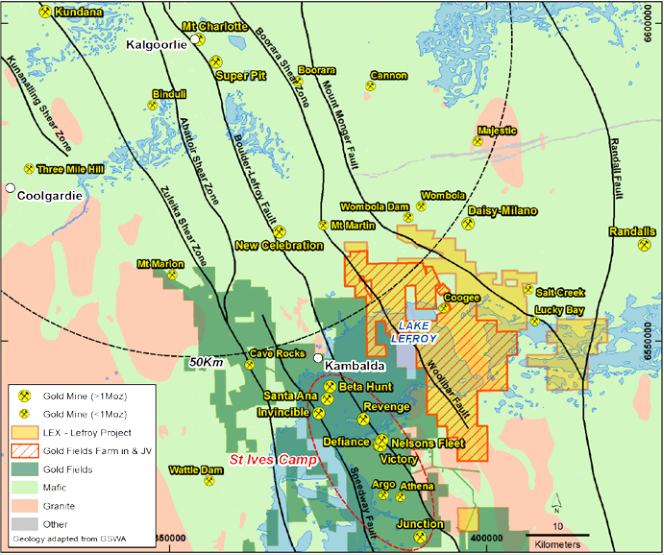

Lucky Strike is within Eastern Lefroy tenement package which is a part of Lefroy Gold Project (LGP) situated 50km south east of Kalgoorlie. Gold mineralisation at Lucky Strike is hosted within multiple north west trending Banded Iron Formation (BIF) units. In May, a dual drilling program was completed with 14 holes comprising ten (10) reverse circulation (RC) drill holes and four (4) RC pre-collared diamond holes at Lucky Strike. This program resulted in standout gold mineralisation which intersected in hole LEFR132 ([email protected]/t Au including 2m at 11.8g/t Au from 132m), as reported.

The intersection is interpreted as 100m down plunge extension of the high-grade mineralisation intersected in hole LEFR120. An intersection in LEFR132 has been reported as one of the strongest gold intercepts at Lucky Strike (+60gram metres) and demonstrates a strengthening of the gold tenor to the south east and down plunge.

After RC drilling, a four-hole diamond drilling program was completed totalling 624 m. Western Australian State Governmentâs Exploration Incentive Scheme (EIS) funded three out of the four holes. Diamond holes were drilled to evaluate the down dip projection of the BIF hosted gold system and holes were designed to penetrate the footwall basalt to provide a wider appreciation of geology along with exploration for new mineralisation. Assay results for diamond drilling do not depict any significant intersections from either the lower BIF unit or the sulphide altered basalt, told Lefroy.

The emphasis of exploration at Lucky Strike remains at the BIF hosted gold mineralisation, next round of drilling focuses on delivering an initial resource which can be developed rapidly. The relationship between strong BIF hosted gold mineralisation and the adjacent sulphide altered basalt is reportedly unclear in LEFR 132. LEX considers the adjacent sulphide altered basalt to be part of larger Lucky Strike system, which may host gold mineralisation in right structural positions along strike or at depth.

LEX has initiated a focused research project to improve geological understanding and assist with ongoing target generation both at Lucky Strike and the district. The research project was commenced with the detailed geological logging of the Lucky Strike diamond drill core, in collaboration with underway at Centre of Exploration Targeting (CET), University of Western Australia (UWA).

Going forward, the company aims to recommence drilling in early June at Lucky Strike while drilling rigs remain secured with the company. This drilling program is designed to evaluate the along strike and down plunge continuity to BIF hosted gold mineralisation in LEFR132. A total of five holes would reportedly be drilled for approximately 1000m, including an 80m step out drill section along strike of LEFR132 comprising four 40m spaced deep RC holes. The company also plans to drill an additional hole to evaluate the down dip projection of the mineralisation in LEFR132.

Location of the Lefroy Gold Project (Source: Companyâs Announcement)

Location of the Lefroy Gold Project (Source: Companyâs Announcement)

LEX last traded at A$0.185 with no trades recorded on 27 May 2019. The 52-week high is A$0.22 and the market capitalisation of the stock stands at approximately A$15.07 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.