The benchmark index S&P/ASX 200 was trading at 6,473.8 on 27 August 2019 (AEST 01:35 PM), up 33.7 points or 0.52% from its previous close. Moreover, the S&P/ASX 200 Communication Services (Sector) was trading upward 3.1 points or 0.24% to 1,298.3.

Let us take a look at recent updates from four stocks from the communication services sector, namely 5G Networks Limited, Spirit Telecom Limited, Prime Media Group Limited and Pacific Star Network Limited.

5G Networks Limited

5G Networks Limited (ASX:5GN), a licenced telecommunications carrier that operates in Australia, released its full-year results for the period ended 30 June 2019, on 26 August 2019.

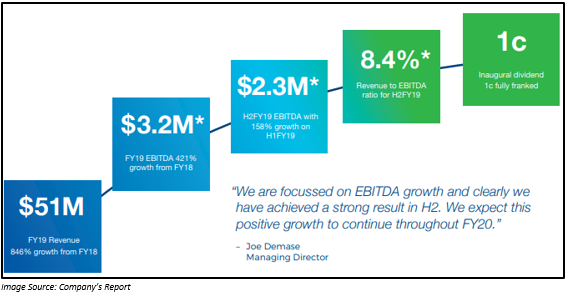

The company reported significant growth during the period with full-year revenue of $51 million, up 846% from the year-ago period. Its EBITDA before acquisition and share option costs stood at $3.2 million, representing a 421% increase as compared to the previous corresponding period. In 2H FY2019, EBITDA was $2.3 million, up 158% from 1H FY2019. The company declared a fully franked dividend of 1 cent per share.

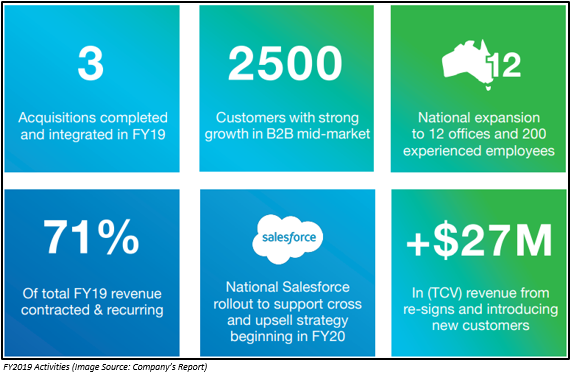

During the period, the company completed three acquisitions, including the acquisition of Anittel and Hostworks from Inabox Group Limited (ASX: IAB), providing the company with one of the most experienced cloud and managed IT providers in Australia. These two entities made a revenue contribution of nearly $43 million on a fully annualised basis. The company also acquired the assets of Melbourne Data Centre, representing a strategic expansion of the 5GN infrastructure footprint and strengthening its existing product portfolio. The company has 2,500 customers with strong growth in the B2B mid-market. The company also expanded to 12 offices and 200 experienced employees on a national level.

FY2020 Plans:

- The company plans new geographical and synergistic acquisitions targeted towards data centres and managed service providers.

- 5GN expects its revenue target to be in the range of $55 million to $65 million and EBITDA to be in between 8% and 12% (which excludes new acquisitions).

- It would also work to optimise the operational efficiencies.

- Focus on continued network expansion and data centre product development.

Plans for FY2021 and Beyond:

- The company would focus on continued acquisition and organic growth, including continued penetration into geographic regions

- It plans to leverage strong customer base with cross and upsell strategy.

- Focus on continued infrastructure expansion

Balance Sheet Highlights:

- The net assets of the company increased from $8.481 million in FY2018 to $16.388 million in FY2019.

- The total shareholdersâ equity for FY2019 was $16.388 million.

- The net cash available with the company by the year-end was $6.660 million.

Stock Information: On 27 August 2019 (AEST 01:47 PM), the stock of 5GN was trading at A$0.970, down by 6.731% as compared to its previous closing price. 5GN has a market cap of A$66.04 million and ~ 63.5 million outstanding shares.

Spirit Telecom Limited

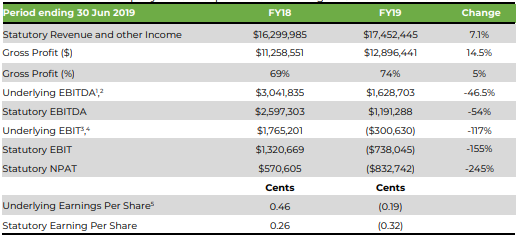

Spirit Telecom Limited (ASX: ST1), a communication services provider, reported a 7.5% year-on-year increase in revenue to $17.4 million in FY19, according to a company presentation released on 27 August 2019. Its gross profit increased to $12.9 million, while underlying EBITDA stood at $1.6 million during FY19.

Source: Companyâs Report

Recently on 29 July 2019, ST1 had announced the completion of acquisition of Phoenix Austec Group, a Melbourne-based managed service provider (MSP).

As per the market release on 24 July 2019, the company had entered into an agreement to acquire 100% of Phoenix Austec in a deal worth $1.6 million. Of the total, 80% of the amount is due for payment in cash, while the remaining 20% of the transaction value is in the form of scrip. The finalisation of the agreement would depend on normal closing conditions. Through this acquisition, anticipated to be earnings accretive, there would be a valuable addition to the expanding portfolio of the company concerning managed IT services.

The company acquired Phoenix, through its existing cash reserves. This 4th acquisition post a long time would enhance the managed services product range of Arinda, which was recently acquired by the company. This product range represents almost 20% of ST1âs overall revenue.

Stock Information: On 27 August 2019 (AEST 01:49 PM), the stock of ST1 was trading at a price of A$0.195, down by 4.878% as compared to its previous closing price. The stock has a market cap of A$69.58 million and ~ 339.42 million outstanding shares.

Prime Media Group Limited

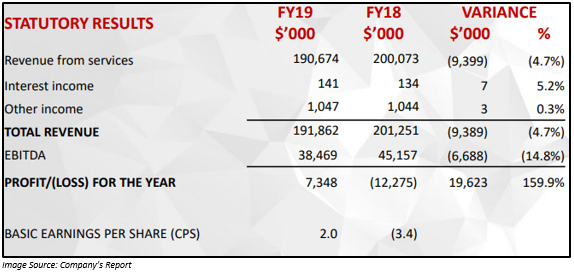

Prime Media Group Limited (ASX:PRT), a regional television broadcaster, on 23 August 2019, announced a correction to the outlook section released on 22 August 2019 as part of the announcement related to full-year results for FY19. The company corrected its forecast for FY20 EBITDA to be in the range of $23.0 million to $25.0 million.

FY2019 Highlights:

- Revenue of the company declined by 4.7% as compared to its previous corresponding period (pcp), reaching $191.8 million, highlighting the absence of significant events during the period as well as difficult trading conditions.

- EBITDA also declined by 14.8% to $38.5 million on pcp.

- Operating cost declined by 5.9% in FY2019, partly due to a reduction in employee costs related to downscaling key management personnel.

- Statutory profit after tax for FY2019 increased by 159.9% year-on-year to $7.3 million.

Outlook:

- The company expects trading conditions to remain a challenge in regional market and continue in FY2020.

- PRT anticipates declines to continue in regional advertising expenses in FY2020.

- Trading conditions are expected to improve in 2H FY2020 in the lead up to the Tokyo Olympics in 2020.

- Core NPAT is expected to be in the range of $8.0 million and $10.0 million.

Stock Information: On 27 August 2019 (AEST 01:50 PM), the stock of PRT was trading at a price of A$0.185. PRT has a market cap of A$67.77 million with ~ 366.33 million outstanding shares and a PE ratio of 10.88x.

Pacific Star Network Limited

On 21 August 2019, Pacific Star Network Limited (ASX: PNW), a media company with interest in broadcasting and publishing, announced that its subsidiary, Bravo Management Pty Ltd had entered into an agreement to acquire the business assets of PNWâs another subsidiary Precision Talent Management Pty Ltd. With the completion of the acquisition, both the business of Bravo and Precision would come together.

With the acquisition, Precision Talent Management Pty Ltd will get aligned with the âWhole of Sportâ offering of the company. It represents more than eighty past and existing players, coaches, cricketers along with other media talent groups from AFL as well as AFLW. The talents from Precision Talent Management Pty Ltd comprise the Jack Riewoldt, Darcy Moore, Gary Ablett Jnr, Dane Swan, Jordan Lewis, Josh Dunkley, Dane Swan, Isaac Smith, Jacob Weitering, John Longmire and David Teague. Talents from Bravo include Shane Crawford, Merv Hughes, Scott Cam, Shaynna Blaze and Jamie Durie among many others.

Precision Talent Management Pty Ltd would be retaining its name. Also, both businesses would carry out their operations as earlier. The consideration for acquiring Precision Talent Management Pty Ltd is not material, and its funding would be done 50% through the existing cash reserves and 50% PNW scrip. The acquisition is planned to complete in September 2019. The company expects that the acquisition would provide an incrementally positive yet immaterial contribution to the earnings in FY2020.

In another market update on 19 July 2019, PNW unveiled that its subsidiary Crocmedia Pty Ltd has signed an agreement to acquire Rapid TV Pty Ltd and Rapid TV Broadcast Pty Ltd (Rapid TV), which is a television broadcast satellite provider. On completion of the agreement, Rapid TV will combine with the Rainmaker division of the company, that offers television production services to broadcasters as well as brands. The funding of the acquisition would be done through existing cash reserves.

Stock Information: The stock of PNW last traded at a price of A$0.290 on 22 August 2019. PNW has a market cap of A$ 58.85 million and ~ 202.94 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.