A brief look at the technical developments made in communications technology

Humans have come a long way in terms of technological development in every area of life. For transportation, we have developed airways and waterways vehicles and reduced the reliability of road vehicles (to some extent). In the healthcare sector, we now have machines that can operate the patient on its own with the use of artificial intelligence (AI).

In the communications technology, also, humans have made huge leaps and now we live in an era wherein we can talk to someone sitting overseas and can even start a video chat at a fraction of cost as compared to the earlier times. With the advent of mobile phone and mobile internet connectivity an entirely new world has emerged, and the role played by mobile internet or telecommunication technology cannot be highlighted enough.

Letâs dig in more on telecommunication technologyâs evolution and see how it revolutionised the world that we are living in today.

0G

In the initial days, the world had 0G, which is a phone mobile telephony technology using radiotelephones. Mobile radio telephone systems came before the modern cellular mobile telephony technology.

1G

Then came 1G, the actual advent of the revolution. The technology involved using analog signals and multiple cell sites. It had the ability to transfer calls from one location to the next as the user travelled between cells during a conversation.

2G

In 1990, the second generation of the technology came out as 2G. It used digital transmission of signals which used less power and was using the GSM standard. It used fast and advanced phone-to-network signalling and enabled SMS texting.

2.5G (GPRS)

This was a slightly modified version of 2G and used General Packet Radio Service (GPRS) technology. The data rates were faster than 2G.

2.75G (EDGE)

Again, a minutely updated version from 2.5G, using Enhanced Data rates for GSM Evolution (EDGE). It allowed even higher transmission of data and information up to 384kbit/s speed.

3G

This was a major upgrade from 2.75G as 3G introduced high-speed data which transformed the industry as for the first time, media streaming of radio and even television content to 3G handsets became possible.

4G

As of now, 4G is the latest technology available to the user, but the world is working on the 5G as well. 4G introduced internet speed that was ten times the speed that 3G used to provide. The data transfer speed may vary, but a massive speed of 100Mbps are easily noted. 4G technology did away with circuit switching and introduced all-IP network.

5G

5G is the latest revolution in the wireless network business which aims to provide a high level of performance as compared to the previous generations of mobile communications systems. Many companies across the world and in Australia are making headway into the 5G technology. As per Qualcomm study 5G is expected to create over twelve trillion dollars in wealth by 2013.

After years of chasing the latest generation of the mobile phone network, the wait is finally coming to an end. 5G is the next revolution in the mobile network technology, and some few expectations from 5G technology are:

Faster speed networks

5G network speed is estimated to be as fast as multiple Gbps, but the exact speed will vary depending upon the location of the user, the configuration of the network, the smartphone etc. However, the specifications state that the minimum speed one should expect to get is 100Mbps. Thatâs around the top end speed of the 4G network.

Lower Latency

In simple words, latency is the amount of time it takes for the information to get from the phone to the much wider internet and back again to the phone. 5G had a general latency of around 60 milliseconds, and on the other hand, the latency of 5G could drop to as low as one millisecond. The decrease in the latency could prove to be a massive shot in the arm for autonomous cars, as this technology depends on data crunching where an improvement in speed could help developing a robust technology.

More simultaneous connections

With the expanded network ability, the 5G network can add way more devices to a single network work simultaneously. The expanded network connection is more important on the commercial scale, like more cars can be connected to each other for the autonomous car driving or AI based car driving.

Higher bandwidth availability

Bandwidth is the amount of space, available for the users to use on a single network. Less bandwidth makes everyoneâs devices, connected on that network to run slower. The 5G will provide access to higher bandwidth to download, stream and browse even more.

Lower battery consumption

Battery consumption has been an issue since the advent of smartphones. In earlier times the devices were battery hungry, one reason being the usage of older networks which consumed higher power and hence reduced battery life. The 5G technology is expected to consume less battery as compared to the previous generation networks.

Letâs have a look two of the prominent ASX listed companies that are ready to grab the 5G opportunity.

- 1. 5G Networks Limited (ASX: 5GN) is an ASX listed telecommunications company, operating in Australia. The services offered by the company are data connectivity, managed services in the business to business market and cloud-based services.

The company operates and owns Nationwide highspeed MPLS network with points of presence in all major cities of the Australian capital.

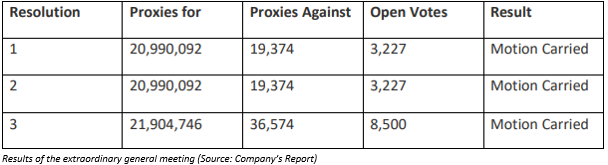

on 4th June 2019, the company announced the results of the extraordinary general meeting and all the resolutions were passed with high votes, including the proxy votes.

In the recent March 2019 quarterly financial performance, the company reported the following;

- The company reported cash receipts of 15.4 million; up 8% from the previous quarter, and YTD cash receipts stood at 11 times greater at $38 million.

- The company successfully launched a nationwide managed data network; future roll-out to meet demand in Australiaâs east-coast growth corridor

- The capital expenditure is guided by infrastructure expansion and product development, both of which are highly aligned to the direct customer demand.

- New and retained annualised contracted revenue depicted ongoing effectiveness of the companyâs sales strategy.

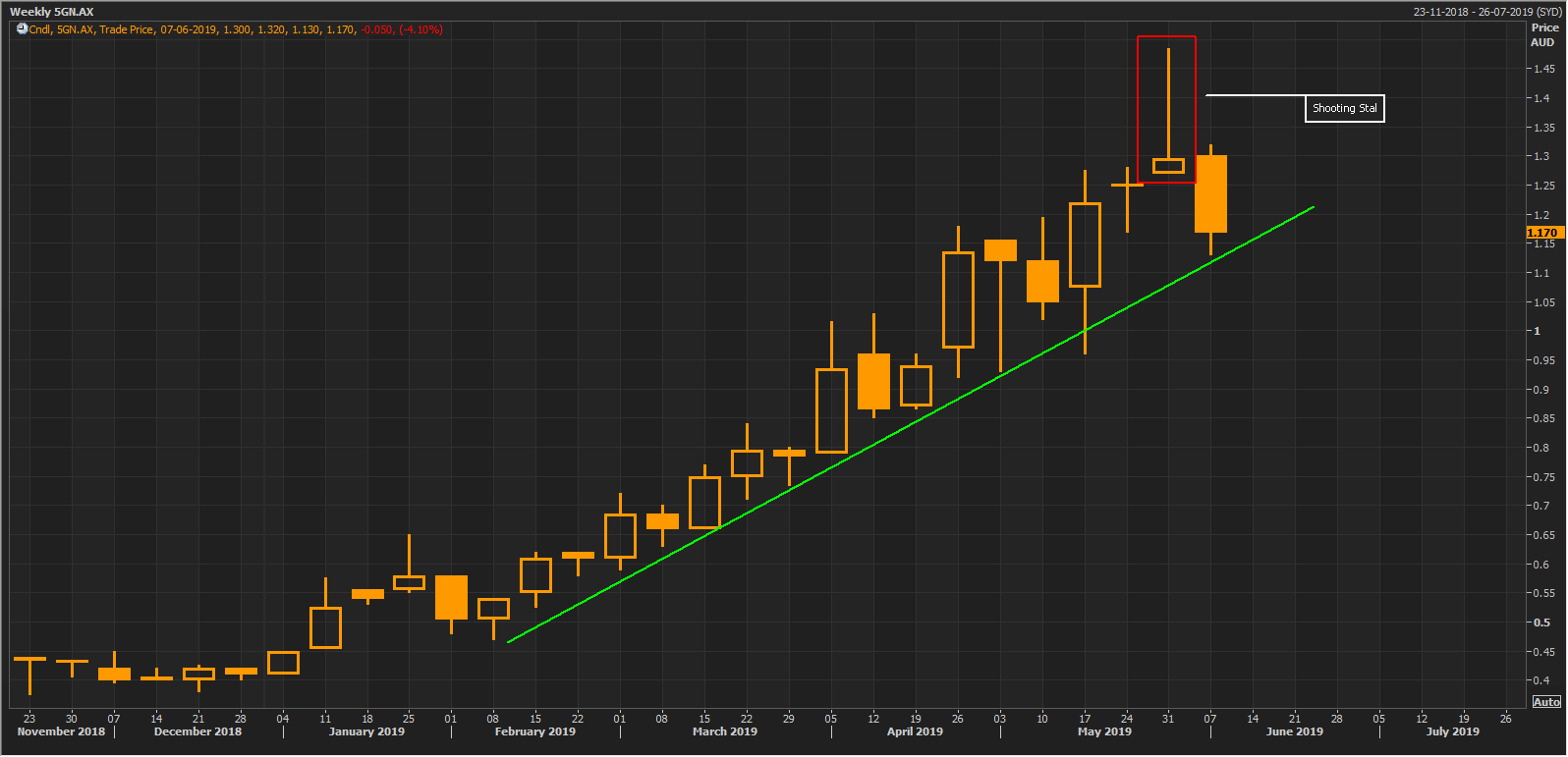

On the technical front, the medium-term trend of the stock is quite positive, and the stock is following its trendline support on its move to the upside. Multiple times the stock has taken support from this trendline in a relatively short span of time, depicting the strong buying zones.

Weekly chart of 5G Networks (Source: Thomson Reuters)

But on a shorter time frame, the stock might take correction as there is a shooting star candlestick pattern formation, which is a bearish reversal pattern. It a single candlestick pattern wherein, on completion, it is expected to reverse the ongoing up trend.

Weekly chart of 5G Networks (Source: Thomson Reuters)

The company has a market capitalisation of A$74.3 million, and the stock had touched a 52-week high and low of A$1.485 and A$0.375, respectively. The stock is trading up by 2.564% (AEST: 1:20 PM), at A$1.2 after making an intraday low of A$1.185, as on 11th June 2019. The last one-year return of the stock is 125.00%, and the YTD return stands at 178.57%.

- Telstra Corporation Limited (ASX: TLS) is an ASX listed established telecommunications company based in Australia and offering a range of services. It is the largest mobile and wi-fi network operator and providing end-to-end technology solutions including voice, cloud-based service, global connectivity, managed network services, satellite solutions, conferencing etc.

The company also noted good performance on its T22 strategy, and it expects to make one-time non-cash impairment and write down of the value of its legacy IT assets by around $500 million. For the FY19, the guidance of its restructuring costs has been increased by $200 million. The company also has plans to simplify its structure and ways of working as a part of this strategy, and a net reduction of around 8,000 employees (over three years) has already been announced.

On the technical grounds, the stock is in a strong uptrend since the start of 2019. Looking at the trend, there has not been any correction during the rally for almost five months, which is quite impressive.

On the weekly chart, the stock is trading above the resistance zone of A$3.6 â A$3.67, and there has been no weakness in the trend as of now. However, the stock is also trading in the overbought zone (173.33) of Commodity Channel Index (CCI) stating the stock has risen quite high in the recent weeks and selling from the top could be expected.

Weekly chart of Telstra Corporation (Source: Thomson Reuters)

However, the selling signal only comes when the CCI falls below 100 and till then, so selling is depicted by the CCI.

The company has a market capitalisation of A$44.24 billion, and the stock had touched a 52-week high and low of A$3.73 and A$2.547, respectively. The stock is trading up by 0.806% and at A$3.750 (AEST: 1:32 PM) after making an intraday high of A$3.770 as on 11th June 2019. The last one-year return of the stock is 36.59%, and the YTD return stands at 35.58%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.