The stocks under discussion in this article are from different, but significant sectors of the Australian market. While Transurban Group (ASX: TCL) is from the industrial sector, Boral Limited (ASX: BLD) is a player operating in the materials sector.

Let us look at the updates and stock performances of these companies:

Transurban Group (ASX: TCL)

Company Profile:

Counted among the worldâs largest toll-road operators, TCL builds and operates roads across the Australian cities of Brisbane, Melbourne and Sydney and has its operational spread in the US and Canada. Besides from being a long-term road designer, it is a technology company, involved in the research and development of innovative tolling and transport technology. As per the Dow Jones Sustainability Index, TCL is the second highest rated entity among transport companies, globally. It is also listed amongst the Top 15 on the Australian Securities Exchange.

Private Placement:

On 27 June 2019, the company announced that the groupâs financing vehicle, Transurban Finance Company Pty Limited, priced a new placement under the Euro Medium Term Note Programme.

The pricing, which was completed on 26 June 2019, is for the private placement of a â¬350 million senior secured 15-year notes, which would mature in July 2034. It is anticipated to settle on 3 July 2019, subject to related and mandatory closing conditions. The placement is regarded as the inaugural Euro private placement of the company.

The proceeds from this placement would be swapped into fixed rate Australian dollars and directed towards the companyâs corporate purposes and funding the operations and developments that are in its pipeline. TCL is hopeful that the placement would open doors towards a fresh and long-term debt investor base.

Dividend Distribution Reinvestment Plan:

On 21 May 2019, the company announced that it would pay a distribution amount of 30 cents per stapled security, for the six months ending on 30 June 2019 (28 cents from Transurban Holding Trust and controlled entities and remaining 2 cents from fully franked dividend from Transurban Holdings Limited and controlled entities).

Post this announcement, the companyâs total distribution for FY19 amounts to 59.0 cents per stapled security (3 cents to be fully franked).

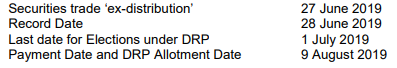

The key dates of this DRP are outlined in the image below:

DRP related dates (Source: Company report)

Investor Day Presentation:

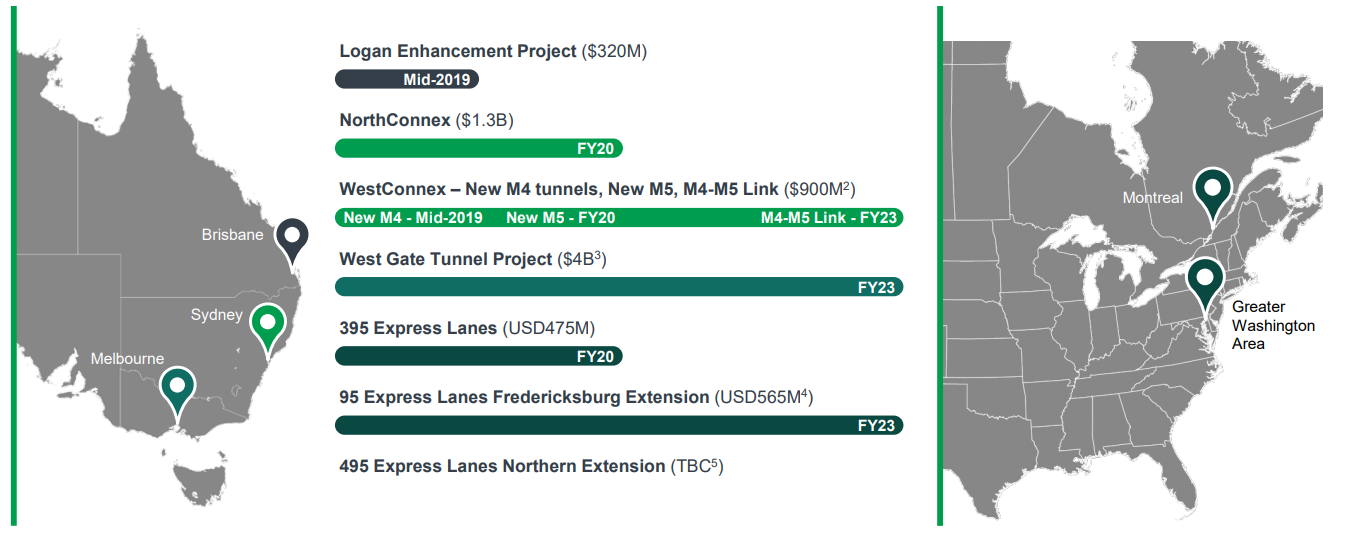

The company conducted its Investor Day on 29 April 2019 and highlighted the projects that it was seeking to accomplish as its near-term priority:

TCLâs committed projects and timeline (Source: Companyâs Investor Presentation)

Besides delivering the above depicted projects, the other two near-term priorities of the company are the maximisation of performance of operations and enhancing its customer and community offerings.

The company is paying attention to the additional development opportunities besides its existing asset base. Some of these opportunities are the Western Harbour Tunnel and Beaches Link in Sydney, GWA opportunities, engagement in Montreal with new Quebec government and USA asset privatisation agenda.

The company would conduct its 2019 Annual General Meeting on 10 October 2019.

Recent Stock Performance:

On 27 June 2019, the companyâs stock traded down by 2.093 per cent relative to its previous trade and valued at A$14.970. With a market cap of A$40.91 billion, the stock has generated returns of 10.40 percent, 16.90 per cent and 28.81 per cent in the last one, three and six months, respectively, and a YTD return of 32.38 per cent.

Boral Limited (ASX: BLD)

Company Profile:

Regarded as Australiaâs largest construction materials and building supplier, BLD was listed on ASX in 2000 and has its registered office in New South Wales. Few of the company products are bricks, asphalt, cement, concrete and aggregates. The company has taken up numerous projects, few of them being the Pacific Highway Upgrade, RAAF Base Amberley, Punchbowl Mosque, Kent Town Revitalisation and Shepparton Law Courts.

New Property Agreement:

On 21 June 2019, the company notified that it has signed up a property development management deed with Mirvac Group (ASX: MGR) related to the 171-hectare Scoresby site in Victoria. As per the agreement, Mirvac would be responsible for the siteâs urban development. The project would be completed in 2035, and the company anticipates receiving almost nearly $66 million of EBITDA through FY2026, and $3 million in FY2019.

Investor Day Presentation:

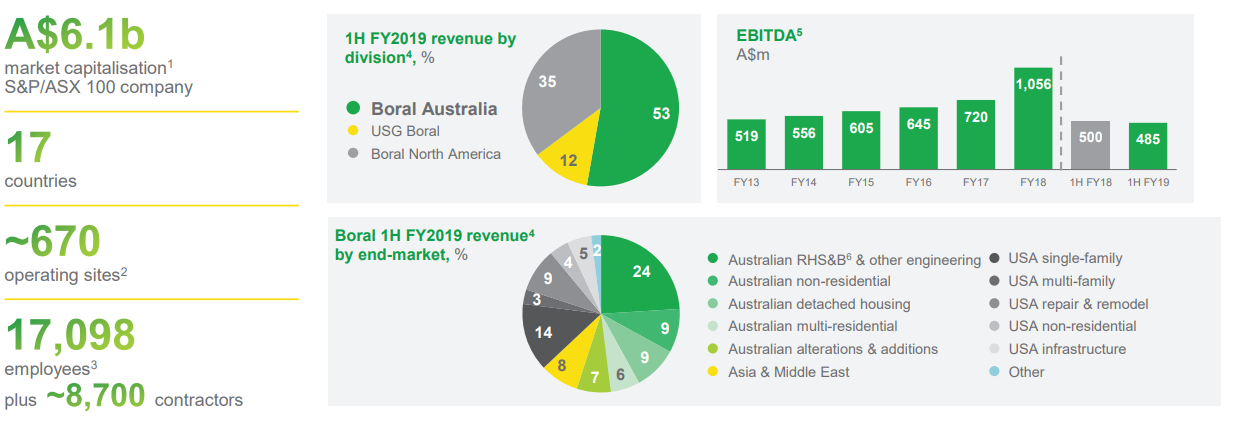

On 31 May 2019, in Sydney, the company conducted its Investor Day. BLDâs EBITDA for 1H FY19 was recorded at A$485 million.

BLD 1H FY19 Results (Source: Companyâs Investor Presentation)

Capex for companyâs Australian business, Boral Australia, in the recent years has depicted quarry and cement investments, which are bound to deliver benefits for the company in the Deer Park Quarry upgrade, Orange Grove Quarry upgrade, Ormeau Quarry upgrade, Berrima alternative fuels and Portside clinker grinding facility Geelong (which is due in 2020). The recent capex includes a downstream network, covering various concrete and asphalt plant projects of the company.

The capex for FY2019 would be on similar lines as that of FY2018, but slightly on the lower end, despite the capital allocation in FY 2020 to complete the Geelong facility.

Zero | one | ten Approach:

The company implements a Zero | one | ten approach to provide the internal drive and focus. It remarks these three to be its pillars of success- Zero harm and enhanced safety excellence, Number One or the market leader and customer excellence and 10 per cent improvement for sustainable growth and continuous improvement.

BLDâs Outlook:

The company expects the Organisational Effectiveness review to lower overheads and deliver modest savings in 4QFY19 through almost 150 fewer positions by 30 June 2019 and approximately $20 million benefit in FY2020. The company is hopeful for a strong June and aims to deliver around $30 million in FY2019.

Recent Stock Performance:

On 27 June 2019, the companyâs stock traded flat at A$5.160. With a market cap of A$6.05 billion, the stock has generated returns of 5.74 percent, 13.66 per cent and 5.74 per cent in the last one, three and six months, respectively, and a YTD return of 6.39 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.