We have already explained the concept of forward derivatives, the associated risk and the types of forward derivatives in our previous articles. In this article, we would take you through another interesting topic under derivatives, i.e. Futures.

In the earlier articles on derivatives, we highlighted that futures are just like forward contract but the difference between the two derivatives is that in forward derivatives the contract settles at the end of the agreement while in the futures derivatives the contract is traded on exchange and is settled on a daily basis till the end of the contract.

Let’s understand the futures derivatives in detail-

Futures Derivatives- Futures derivatives is an agreement between a buyer and a seller at a predetermined price and predetermined future date and are traded on the exchange. Futures contracts are the standardised version of the forward contract.

Now let’s look at the similarity and the difference between the two contracts.

- In both the contracts, i.e. forward and futures, the buyer is an investor, let’s say A.

- In case of a forward contract, the seller or the forward seller could be any person, say B. On the other hand, in futures derivatives, the seller or the future seller is the exchange.

- Both contracts have an underlying asset.

- Both have a spot price and strike price.

- In a forward contract, let’s say the underlying asset is a car, then you can enter into a forward contract. On the other hand, in case of the futures contract, if the stock exchange is providing futures on that particular underlying asset (in this case, a car) then only you can enter into a futures contract else not. This is a drawback of the futures derivatives.

- Another difference between the forward and the futures contract is that in case of a forward contract, the parties can enter into a contract with a maturity date as 3 months and 5 days whereas in futures the maturity date is fixed, i.e. 3 months or 5 months, not in between.

- In a forward contract, the buyer can even buy a single asset or more but in case of future, it works in lots. It means that in future you need to buy at a certain quantity of an asset to enter into the contract.

- There are restrictions in futures contract which is not there in a forward contract. In case of a forward contract, if you want to buy shares of a particular company after 10 months, then it is possible whereas, in the futures contract, the buyer can buy shares of the particular company after 1 month, 2 months or 3 months.

- In the case of a futures contract, the person entering into the contract does not have rights to negotiate on the strike price. Either you agree to the contract or leave it. On the other hand, in the forward contract, the participants involved in the contract have the flexibility to negotiate the strike price.

- Futures can even be sold before the maturity date.

Now that we know the limitations of the futures contracts let us look at the advantage of futures-

The advantage of a futures contract will be clearer if you understand the drawback of entering into a forward contract. The major problem with the forward contract is that there is a chance of default risk. However, this problem gets resolved when the buyer enters into a futures contract as an exchange comes in between the two participants. Now let’s see how futures work.

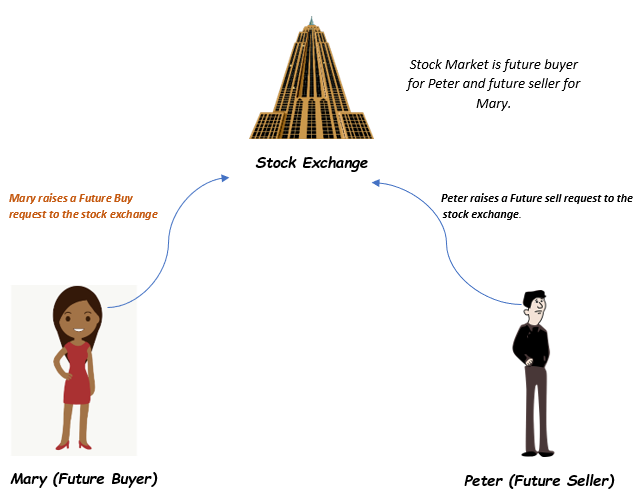

In the above diagram, Mary is the future buyer and Peter is the Future seller. Mary raises a future buy request to the stock exchange against which the stock exchange charges Mary a premium. Similarly, Peter also raises a future sell request to the stock exchange against which he is required to pay a premium. The role of stock exchange here is that it matches the request of Mary with a suitable future seller and facilitate the transaction.

By charging premium from both buyer and seller, the stock exchange helps in eliminating chances of default risk.

Settlement of the future contract

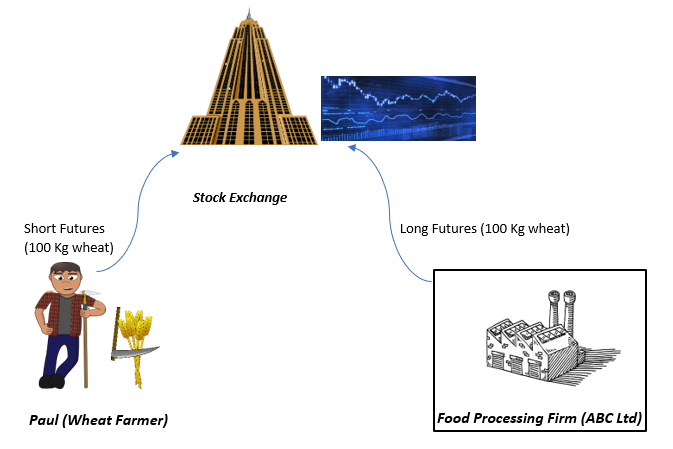

To understand the settlement process, we will again consider the same example which we have used while explaining forward derivatives where a wheat farmer Paul enters into a forward agreement to sell 100 kgs of wheat to a food processing company ABC Ltd. Now, instead of entering into a forward agreement and after understanding the associated risk with the forward contract, Paul decides to enter into a futures contract.

Case 1: Let’s say Paul enters into a three months futures contract. It enters into futures contract on 10 January 2020 which matures on 10 April 2020. The market price of wheat on 10 January 2020 was $2,500 and shorts future at $2,000 predicting that the prices would go down in the future. On the other hand, the food processing company ABC Ltd buys (long) futures at $2,000.

Let’s say on 10 April 2020, the market price of wheat reaches $2,200. Then, in this case, Paul needs to provide ABC Ltd with 100 Kgs wheat and ABC Ltd will pay $2,000 against 100 kgs of wheat. However, this type of trade does not take place in an exchange. The trades are generally cash-settled.

The other way is Paul taking a long position (buy futures at $2,200) and book his loss. It means that he has squared off his position. Now, $200 will be settled from Paul’s margin account at the exchange. On the other hand, ABC Ltd will also have to square off its position. It means that ABC Ltd has to sell its futures before the maturity at the market price $2,200. Thus, books a profit of $200 which would be added to the margin account of ABC Ltd.

Case 2: The market price of wheat on 10 January 2020 was $2,500. Paul shorts futures at $2,000 and ABC Ltd longs futures at $2,000. The market price on 10 April 2020 reaches $1,800. In this case, Paul books a profit of $200 when he squares off his position by buying futures at $1,800 before the maturity of the contract. The profit will be added to Paul’s margin account at exchange. On the other hand, ABC Ltd will bear a loss of $200 when he squares off his position (i.e. short futures at $1,800). $200 will be deducted from ABC Ltd.’s margin account.

An Interested Future Derivative Investor

An investor who is interested in trading in futures needs to have a thorough knowledge about the market. Futures derivatives are highly risky; hence the investor is required to have knowledge before stepping into future derivatives. Lack of complete knowledge might result in huge losses. It’s a zero-sum game, which means that the overall profit of the market is equal to the overall loss. Precisely, if one has made a huge profit then the other participant has made a huge loss.

Whether the person has made a loss or profit depends on the level of knowledge along with his/her risk appetite.

For those investors, who wants to hedge their risk, futures is useful.

After going through derivatives and its types which we have discussed in our previous articles, one would also want to know about the participants.

Participants of the derivatives

Hedgers: Hedgers are people who invest in the financial market to eliminate the risk of price volatility in the market.

Speculators: Speculators could be any sophisticated investors or traders who buy an asset for a smaller time frame and uses his/her strategies to book profit based on price fluctuations.

Arbitrageurs: An arbitrageur is a person who makes an investment to book profit based on market inefficiencies which could be related to price, dividend or regulation.

Margin traders: Margin trading refers to a process of purchasing more underlying asset than their capacity to purchase them.

Australian OTC Derivatives Market:

In Australia, OTC derivatives has an important role during financial stress which includes the global financial crisis. As trading of OTC derivatives does not take place at an exchange, its the details is not usually present at the exchange.

Both financial and non-financial corporations use derivatives to mitigate risk arising from changes in prices and interest rates fluctuations and take a speculative position.

The Australian trade repository keeps a track of each Over The Counter (OTC) derivative that takes place in the Australian market by the closure of every business day. The ‘Australian market’ comprises of any OTC derivative (which could either be centrally cleared or not) which could be signed by an entity in Australia or its subsidiary companies abroad, or by foreign units where the trade is booked or entered into in Australia. It means that the Australian trade repository data takes care of only portion of foreign units' worldwide operations.

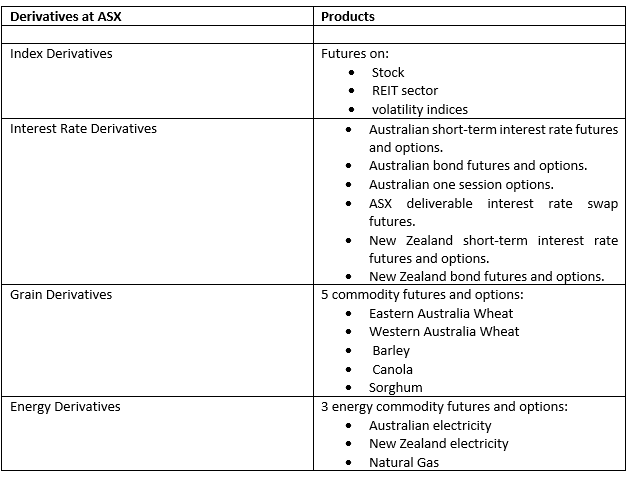

Derivatives at ASX:

Topics that might be of interest:

- Click here to know about Swaps Derivatives

-

Click here to know about Options derivatives

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

TAGS: