Mergers & Acquisition

Mergers & Acquisitions are a type of corporate actions undertaken by a company, in order to gain control or merge with another company. Besides, Mergers & Acquisitions are two different actions, that have different meanings and outcomes.

Mergers refer to a situation when the two companies combine and form a new entity. Besides, the companies seek shareholdersâ approval, court approvals, competition commission approvals, among many statutory requirements, that are governed by specific jurisdiction.

Acquisition refers to an action, where a company wishes to purchase the other company. The company which is being acquired is called the target company. At times, the acquisition could be friendly and hostile as well.

Benefits

- Such transactions result in improved economies of scale, and it provides immense opportunities to cut cost while optimising business processes of two companies.

- If the companies are from similar domains, the market share of the business operated by the combined entity would be higher.

- Improved supply chain capabilities allow the combined entities to expand the respective selling & distribution capabilities.

- Labour talent is expanded, resulting in new efficiencies, and larger employee resources.

Drawbacks

- Companies often fund these transactions with freshly raised capital, which could be equity or debt.

- Such transaction incurs substantial costs, which includes pre-transaction costs, as well as post-transaction costs.

Letâs discuss two such companies involved in similar transactions:

Zip Co Limited (ASX: Z1P)

Digital Retail Finance Lender, Zip Co Limited provides point-of-sale credit and digital payments services across retail, home, health and wellness, auto, travel and entertainment sectors.

On 6 September 2019, it was notified that the stock of the company will be part of S&P/ASX 300 Index, starting from 23 September 2019. In addition, the company reported that it would acquire Spotcap ANZ.

Reportedly, Zip Co has reached an agreement to acquire Spotcap Globalâs Australian & New Zealand businesses. The business trades under the name of Spotcap ANZ, and it provides additional capabilities in the small and medium-sized enterprise (SME) credit space.

Meanwhile, Spotcap ANZ is a demonstrated SME credit decisioning platform, which is live since 2015 with over $200 million in credit lines. The acquisition would add to the companyâs recently announced, âbuy now pay laterâ (BNPL) strategy in both countries.

Besides, the transaction allows to access the underlying intellectual property and technical code base (IP), provides substantial opportunities for innovation in Zipâs business-focused digital wallet product offering. In addition, Spotcap Global would licence the IP.

SME Lending Plans (Source: Z1Pâs FY19 Investor Presentation)

As per the release, the technology platform of Spotcap ANZ provides high-level commercial decisioning engine that uses traditional credit, accounting, and bank transactional data to underpin real-time onboarding. Since 2015, the business has lent over $130 million of funds to SMEs with loss rates of less than 3% per annum.

Besides, the acquisition would result in market-leading underwriting capability, along with four years of credit portfolio performance data, and in-depth insights from commercial bank transactional data. These capabilities along with IP licensing, enables the company to revamp its BNPL product in the market.

Further, the key management team of Spotcap ANZ would be retained. More importantly, the company would be paying an amount of $8.825 million through an issue of fresh fully paid ordinary shares in Z1P, which is said to be dependent on an agreed level of net working capital.

It was noted that the transaction is not subject to shareholder approval, and following the satisfaction of certain conditions, the transaction is anticipated to be completed by no later than mid-November 2019.

A few weeks ago, the company had secured a $500 million debt funding, which was originally for $400 million. Besides, the issuance was heavily subscribed, resulting in an upsize of $100 million, and the company had expected to settle the issue on 5 September 2019.

Recently, the company had disclosed full-year results for the period ended 30 June 2019. Revenue from ordinary activities was up 108% to $84.23 million compared to revenue of $40.40 million in the previous year. Besides, the company had narrowed down its losses from the previous year, and the loss for the period stood at $11.13 million against a loss of $22.54 million in the previous year.

According to its final report, the company is now accessible by 1.3 million customers across more than 16k merchants. In FY2019, the company witnessed 80% growth in customer base, while its merchant base increased by 54%.

Besides, it recorded a transaction volume of $1.1 billion, which was up by 108%, and a number of transactions were 4.8 million, up by 154%. Gross profit of the company increased by 257% to $32.5 million from $9.1 million, representing 39% of revenue.

On 9 September 2019, Z1Pâs stock was trading at A$3.965, edging up by 1.928 percent (at AEST 12:22 PM). In the last one-year period, the stock of the company has given a return 283.25%. Besides, the stock has returned +128.82% in the last six months. The market capitalisation of the company is ~A$1.37 billion, with ~352.14 million shares outstanding.

Villa World Limited (ASX: VLW)

Residential Real Estate Developer, Villa World has been amid an acquisition by AVID Property Group Australia Pty Limited.

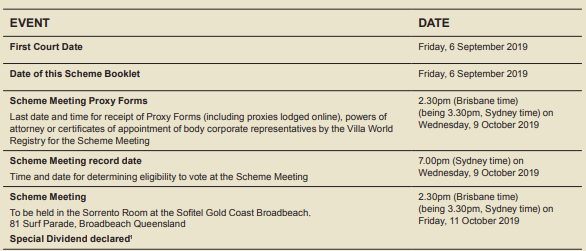

On 6 September 2019, the company registered the Scheme Booklet with ASIC, and publicly released the booklet on the exchange. The Scheme Booklet is related to the proposed acquisition of the company by Avid Property. Accordingly, the Supreme Court of New South Wales had approved the convening a meeting of the companyâs shareholders to vote on the proposed acquisition by Avid.

Indicative Schedule (Source: VLWâs Scheme Booklet)

Reportedly, the scheme meeting has been scheduled for 11 October 2019. The Scheme Booklet includes the Independent Expert Opinion, which came to the conclusion that it was reasonable, fair, and in the best interests of the Villa World shareholders.

Besides, the total consideration for the transaction is of A$2.345 per VLW share, representing a 17.4% to the one-month VWAP of the stock price. The board of the company has an option to declare a special dividend of A$0.31 per share, and if declared, this would result in a revised consideration of A$2.035 per share. If the special dividend is not declared, the consideration will remain the same at A$2.345 per share.

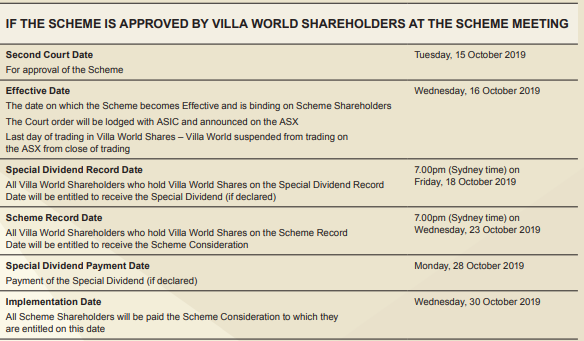

Indicative Schedule (Source: VLWâs Scheme Booklet)

Further, the board of the company intends to declare the special dividend, which would be subject to the Scheme becoming effective. The special dividend would be paid to the shareholders, who will be on records as on the record date. Shareholders of the company may get a franking credit of ~A$0.13 per share, subject to confirmation from the Australian Tax Office (ATO) through a class ruling.

The company also released an amendment to the Villa World Bond Trust Deed. Reportedly, AVID had indicated to the company that it intends to redeem all of the Villa World Bonds on the date of implementation of the Scheme, which was 50 business days later, prior to the amendment.

Besides, the amendment has not altered any amount related to the redemption amount of these bonds. The company has moved the amendment to redeem the bonds on the implementation date.

On 9 September 2019, VLWâs stock was trading at A$2.345, slipping down by 0.213 percent (at AEST 12:34 PM). Over the year-to-date period, the stock has generated return of +33.52%. The market capitalisation of the company is ~A$294.13 million, with ~125.16 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.