Recently, the Australian economy has been a victim of several imbalances that impacted the sales, margins and capital allocations of the business. With the above scenario in place, the investors should now be eyeing the businesses that represent global growth opportunities and are open to the rising demand for software and data.

Benefits of Geographical Expansion: Exposure to multiple geographies as well as currencies help minimise the risk of imbalances while solely operating in Australia. In addition, operation in the foreign markets bring-in opportunities in the form of market growth and diversification. Expanding internationally helps the businesses to diversify their assets and protect their profits against unforeseen events, which in turn, adds value for the investors. Overall, expanding the business globally helps businesses attain both financial and operational growth in the form of increased revenues, new sales, investment opportunities, cost reduction, access to new talent and diversification.

Both software and data form a part of each aspect of the business be it sales, marketing, design or manufacturing. Moreover, businesses capture relevant data and use the information to analyse the details to reach to relevant business decisions and subsequent improvement in the operations. The software helps in management and transmission of the data in a better and efficient manner. The basic benefits lie in the ease of handling data, simplification of tasks, better customer relationships and an advantage over competitors.

Let us now have a look at a few examples of businesses that have incorporated the above two strategies in their operations.

Breville Group Limited (ASX:BRG)

Breville Group Limited (ASX:BRG) designs and develops electrical kitchen appliances. The company recently updated investors about a change in the voting power of Matthews International Capital Management, LLC from 8.17% to 7.16%.

Group Results: During the half year ended 31 December 2018, the company generated group revenues amounting to $440.4 million, up 15.4% on the prior corresponding revenue of $381.8 million. EBITDA for the period amounted to $70.5 million, up 14.6% on pcp. NPAT grew at a rate of 19.7% from $36.3 million in 1H18 to $43.5 million in 1H19.

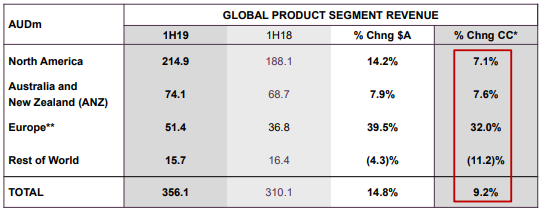

Segment Results: The company witnessed 14.2% growth in Global Product segment revenues from North America despite a tough prior year comparison. Business in Europe also delivered strong growth with a 39.5% increase in revenues as compared to pcp at $51.4 million. Revenues from Australia and New Zealand reported an increase of 7.9%.

Segment Results (Source: Company Presentation)

In the second half of the year, the company is planning the launch of its product Creatista® in Germany and Austria along with the expansion of business to Switzerland and Benelux and the addition of Turkey to its Sage brand.

Outlook: The company expects the EBIT growth rate for FY19 to be slightly above the current market consensus of ~11%.

The stock of the company last traded at a price of $18.170, up 0.832% at market close on 15th July 2019, with a market capitalisation of $2.34 billion.

Collins Foods Limited (ASX:CKF)

Collins Foods Limited (ASX:CKF) operates restaurants in Australia, Europe and Asia. The company recently updated the market on the financial results for FY19.

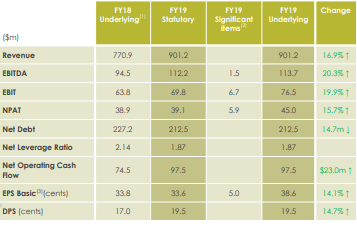

Highlights of FY19: During the year, the company generated revenues amounting to $901.2 million, up 16.9% on pcp revenues of $770.9 million. KFC Australia and KFC Europe reported same store sales growth of 3.7% each. EBITDA for the period stood at $112.2 million, up 25.2% on pcp.

Financial Summary (Source: Company Presentation)

During the first half of the year, the company witnessed 69% growth in statutory net profit as compared to pcp.

International Presence: The company currently operates 37 stores in Europe and has continued to drive sales improvements in Germany and Netherlands with revenues amounting to $123.8 million, up 35.2% on pcp. Sizzler Asia also witnessed growth in both existing restaurant sales and new builds with royalty revenue going up by 12.2%. The company has a total of 77 restaurants in Asia at the end of FY19.

The stock of the company, at market close on 15th July 2019, traded at a price of $8.300, up 1.22%, with a market cap of $955.97 million.

Cochlear Limited (ASX:COH)

Cochlear Limited (ASX: COH) is a global leader in implantable hearing solutions with products, including cochlear implants, bone conduction implants and acoustic implants. The company recently updated that it has received FDA approval for the Nucleus® ProfileTM Plus Series cochlear implant. The commercial availability of the implant will begin in Germany followed by other European countries in the subsequent months, subject to the timing of regulatory approvals.

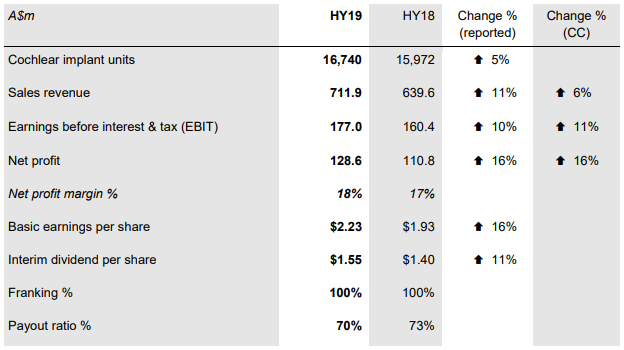

1H FY19 Highlights: During the period ended 31st December 2018, the company reported sales revenue amounting to $711.9 million, up 11% on pcp. Net profit for the period was reported at $128.6 million, up 16% on pcp. The period was marked by strong cash flow generation, which supported a 11% increase in the interim dividend to 1.55 cents per share.

Regional Growth: Sales revenue from Americas reported an increase of 3%. Revenues in the EMEA region grew at a rate of 8% with strong services revenue growth in Western Europe. Sales revenue in the Asia Pacific region reported a rise of 8% with strong unit growth in Japan.

Key Financial Highlights (Source: Company Reports)

FY19 Guidance: The company expects the net profit for FY19 to be in the range of $265 million to $275 million, a rise of between 8% to 12% on FY18.

At market close on 15th July 2019, the stock of the company traded at a price of $220.380, down 0.528%, with a market cap of $12.79 billion.

Altium Limited (ASX:ALU)

Altium Limited (ASX:ALU) is engaged in the development of computer software to design electronic products.

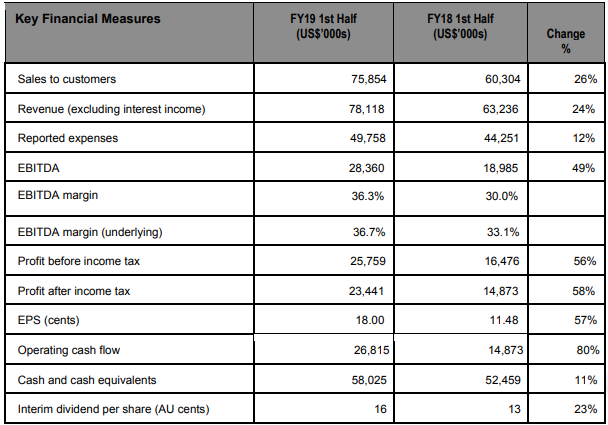

1HFY19 Highlights: During the period, the company generated strong revenue growth of 24% at US$78.1 million. Net profit after tax for the period amounted to US$23.4 million, up 58% on pcp. The EBITDA margin for the period stood at 36.3% as compared to 30% in pcp.

Key Financials (Source: Company Reports)

Business Performance: The companyâs TASKING business revenue in the first half reported an increase of 35%, benefitting from its relationship with European semiconductor manufacturer, Infineon. Octopart business revenue grew at a remarkable rate of 80%. Revenues for Nexus reported a rise of 20% and for the Board and Systems increased by 17%.

Outlook: The companyâs strong margin result portrays its ability to increase profit margins and boost revenue growth while investing for the future. The business is on track to achieve the 2020 targeted revenue of $200 million.

The stock of the company at market close on 15th July 2019 traded at a price of $36.090, down 0.933%, with a market cap of $4.75 billion.

Elmo Software Limited (ASX:ELO)

Elmo Software Limited (ASX: ELO) is a leading provider of cloud HR and payroll software in Australia and New Zealand.

In the March quarter, the company reported strong growth in cash receipts of $9.5 million, up 29% on pcp.

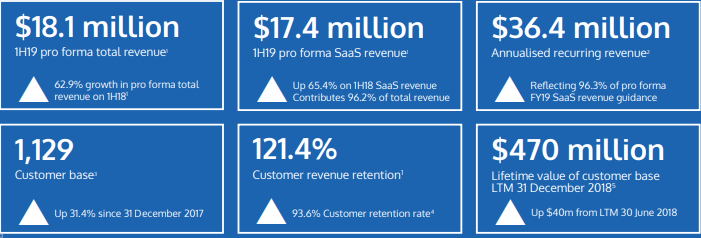

Highlights of 1HFY19: During the six months ended 31st December 2018, the company generated pro forma revenues amounting to $18.1 million, an increase of 62.9% on pcp. SaaS revenues during the period amounted to $17.4 million, up 65.4% on pcp. The company increased its customer base to 1,129 during the period, reporting a rise of 31.4% on pcp.

1HFY19 Key Metrics (Source: Company Presentation)

The period was characterised by accelerated growth strategies and expansion of the integrated product. The recent acquisitions of HROnboard and BoxSuite in January 2019, helped broaden the companyâs suite of modules and increased the market share. FY18 acquisitions also contributed incremental revenues of $4.1 million in the first half.

FY19 Guidance: The company expects FY19 pro forma SaaS revenue to be approximately $40.7 million and total revenues to be approximately $42.4 million.

The stock of the company, at market close on 15th July 2019, traded at a price of $7.160, down 0.279%, with a market capitalisation of $454.01 million.

Technology One Limited (ASX:TNE)

Technology One Limited (ASX: TNE) engages in the development and sale of fully integrated enterprise business software solutions. The company recently updated that it has issued 698,617 fully paid ordinary shares.

Half year Highlights: During the half year ended 31st March 2019, the company reported SaaS fees of $37.5 million, up 42% on pcp. SaaS Annual Contract Value during the period stood at $85.8 million, up 45% on pcp.

Results Summary (Source: Company Presentation)

Outlook: The companyâs SaaS business is growing rapidly with FY19 total ACV expected to grow at a rate of 20% to $213 million. There has been a consistent growth in the SaaS ACV starting from FY15 to FY18, which will now be forwarded to the current financial year.

The stock of the company, at market close on 15th July 2019, traded at a price of $7.950, down 1.852%, with a market capitalisation of $2.57 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.