Amidst global trade concerns and lower interest rate environment, investors are turning their investments into equity market. With Australiaâs equity market offering decent returns, one sector that has garnered significant investor traction is healthcare sector. The S&P/ASX 200 Health Care Sectoral Index (XHJ) has provided a return of ~27% this year to its investors.

Leading pharmaceutical player, Opthea Limited released promising results from clinical trials and recorded an enormous year-to-date return paving its way to become investorsâ favorite, while another Health Care Player Pro Medicus Limitedâs shares are trading in negative territory after the Founder sell down. In this article, we will have a look at these developments in details.

Opthea Limited (ASX: OPT)

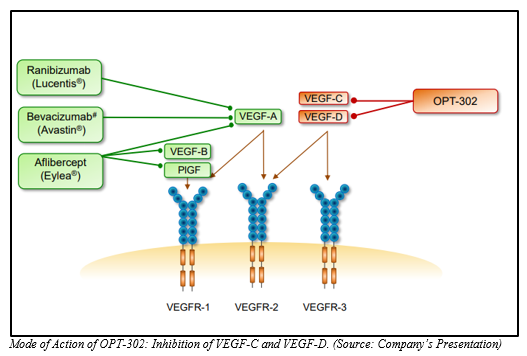

Opthea Limited is a clinical biopharmaceutical company that manufactures ophthalmic drugs with a focus towards improvement in vision in eye disease patients. Optheaâs intellectual property protection revolves around VEGF-C, VEGF-D, and VEGFR-3 (Vascular Endothelial Growth Factors); the intellectual property rights being held with its subsidiary, Vegenics Pty Ltd. Optheaâs developmental program is focused on a novel therapeutic product OPT-302, a VEGF-C/D âtrapâ for retinal diseases.

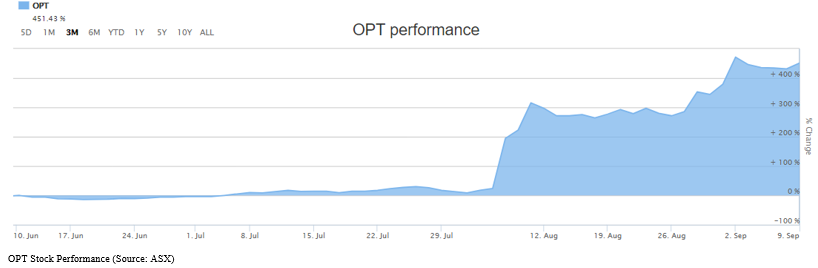

OPT recorded a whopping return of 577.19% on a YTD basis. Of interest, the return during the last three months stands at 451.43%. Further digging into the depth, precisely OPTâs share prices took a vertical jump and reached new heights on 2 August 2019 and increasing progressively thereafter. This could be attributable to the fact that Opthea recently released significant positive outcomes of OPT-302 in wet AMD trial which will revolutionarise the ophthalmic disease treatment, offering a great potential in the market. Is this an indication of Opthea becoming a new market darling?

Latest Announcement

Positive results from OPT-302 Phase 2b Wet AMD Trial presented at EURETINA : For the first time, Opthea presented the outcomes of Phase 2b study data of OPT-302 in Wet AMD, at an international ophthalmology congress, the European Society of Retina Specialists EURETINA Congress held in Paris, France, on 5 September 2019 (CET), by Prof. Tim Jackson, Principal Investigator of the study & Consultant Ophthalmic Surgeon at Kingâs College London.

EURETINA Congress is the largest annual meeting of vitreoretinal and macular experts, attended by clinical ophthalmologists, pharmaceutical professionals, and global investors. Optheaâs CEO & Managing Director, Dr Megan Baldwin is looking forward to sharing the primary as well as the secondary results of this clinical trial with the ophthalmic community and was grateful to the organizers for including the study as a late-breaking presentation in this reputed conference.

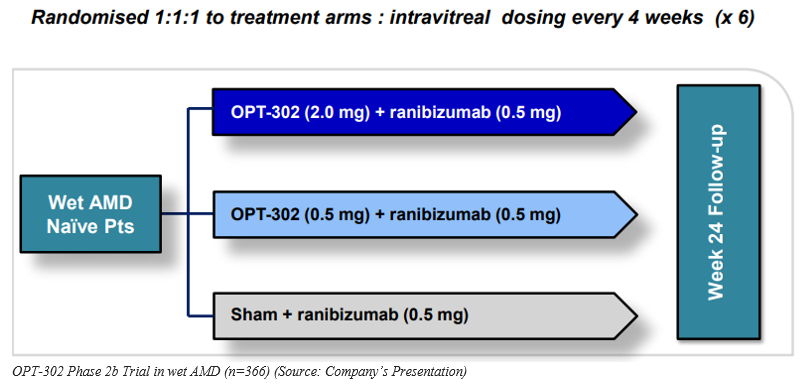

The data presented further supports the primary outcomes of OPT-302 in Wet AMD Phase 2b study in which a statistically significant (p = 0.0107) vision improvement has been demonstrated at 24 weeks in 366 patients dosed with OPT-302 + ranibizumab in contrast to patients administered with only ranibizumab (control) in wet AMD. The tolerability and safety profile of this Intravitreal was found similar to ranibizumab, announced previously on 7 August 2019.

Wet age-related macular degeneration (AMD) is a leading cause of loss of vision in people over 50 years of age.

Phase 2b Study design

Optheaâs Phase 2b clinical trial is a randomized, multicenter, prospective, double-masked, sham-controlled study in which 366 patients with wet AMD were registered. In this treatment regimen, patients were given 2 intravitreal doses of (2mg and 0.5mg) OPT-302 monthly with (0.5mg) ranibizumab for 24 weeks and compared against a control group with (0.5mg) ranibizumab dosed monthly.

Primary Outcomes

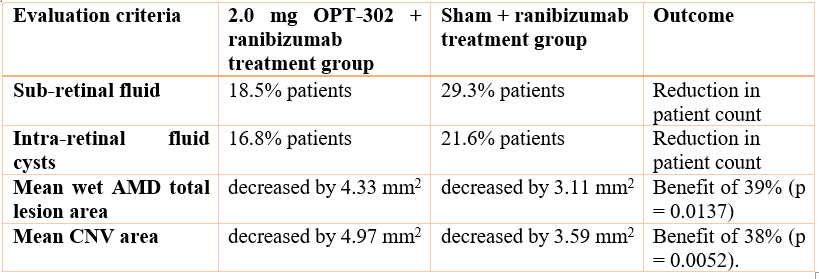

OPT-302 Combination Therapy (OPT-302 with anti VEGF-A) showed superiority in Visual Acuity over Ranibizumab with improved structural changes in retinal lesions, reductions in CST, reduction in retinal fluid as well as reduction in total lesion as well as CNV (choroidal neovascularization) area in comparison to ranibizumab alone.

Overall, this study was found to be well tolerated with no safety concerns recognized.

Stock Performance:

OPTâs shares are trading at $3.530, down by 8.55% on 10 September 2019 (1:18 PM AEST), with the market cap of $964.19 million and nearly 249.79 million outstanding shares.

Pro Medicus Limited (ASX: PME):

Pro Medicus Limited is a group involved in outsourcing healthcare imaging software and services to hospitals, imaging centers, and other health related entities.

PME Founder Sell down

Pro Medicus recently announced that the companyâs founder sold off $ 1,000,000 worth of ordinary shares in the company. The report claims that the sale of shares was made keeping the Boardâs advice in view.

To improve the fluidity in the Companyâs shares, the Board earlier made recommendations to PME founders to consider the sale of up to 3 million shares, announced around one and a half year ago, It was further advised that the timeline for the sale of shares should be within the Companyâs normal trading window, after the financial results announcements in February and August, or after the Annual General Meeting in November.

A further 1 million shares have been sold off by the founders during the current trading window, as advised (1 million shares sold off in 20 March 2018). The Managing Board was also advised about the intentions of the founder to not sell shares in PME any further before the trading period which follows HY results in February 2020.

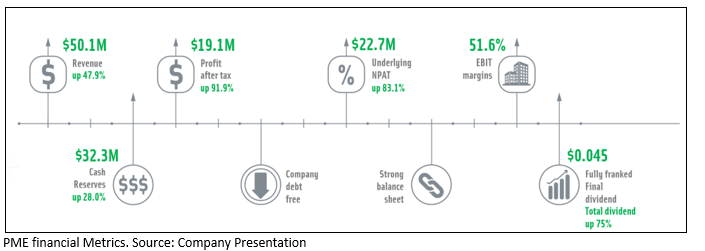

PMEâs FY19 Performance at a glance

Stock Performance:

PME is currently trading at $33.295, down 1.814% on 10th September 2019 (1:18 PM AEST). The stock has recorded an outstanding YTD return of 198.20%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.