Opthea Limited (ASX: OPT) is engaged in the business of developing and commercialising therapies for eye diseases. Today, on 15th May 2019, the company announced that the final patient in the OPTâs Phase 2b trial of OPT-302 for wet AMD (age-related macular degeneration) has completed their last clinical visit.

The management considers the completion of the last visit of the final patient as an important milestone in OPT-302 development. The progress paves the path for OPT to finalise data cleaning activities, with top line results expected to be reported in the upcoming months.

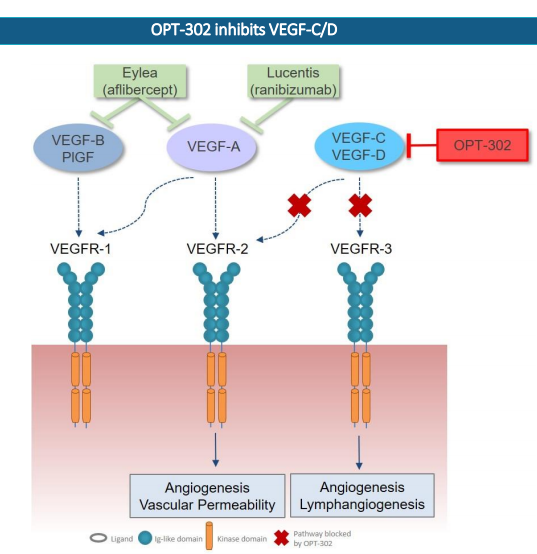

OPT-302 inhibits VEGF-C/D (Source: Companyâs Report)

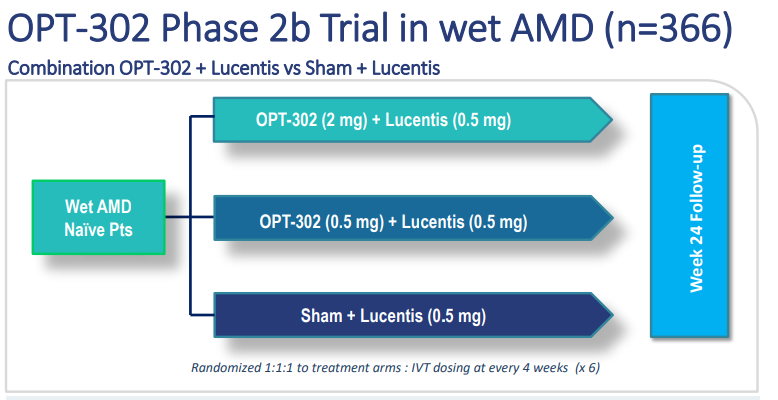

Many patients were enrolled in the OPTâs double-masked Phase 2b trial. These patients were given intravitreal injections of OPT-302 which is a selective VEGF-C/D âtrapâ therapy, administered with the blend of VEGF-A inhibitor ranibizumab (Lucentis®) or ranibizumab alone on a monthly basis for six months. The final clinical visit for the patients was set at week 24, one month after the final dose administration.

OPT-302 Phase 2b Trial in wet AMD (n=366) (Source: Companyâs Report)

Out of 366 patients, 95.1% or 348 patients finished the week 24 visit, therefore meeting the prospectively defined statistical assumptions for the study.

Companyâs Phase 2b trial enrolled patients who have ânot receivedâ prior therapy and is designed to investigate whether a combination of OPT-302 with ranibizumab therapy in a six months dosing duration progresses visual acuity and anatomical parameters, including reductions in retinal thickness, as assessed by a central independent imaging reading centre.

This development brings the company closer to evaluating the potential of OPT-302 combination treatment to improve vision and ocular anatomical outcomes in wet AMD patients receiving standard of care anti-VEGF-A monotherapy. The management is enthusiastic with the progress of this trial, which has completed the recruitment of patient several months ahead of the schedule. The trial has continued to demonstrate a favourable safety profile for OPT-302. The management looks forward to reporting outcomes from the Phase 2b trial, given previously reported encouraging Phase 1/2a study data as well as the scientific rationale for targeted inhibition of VEGF-C/D, two important regulators of aberrant retinal vessel growth and vascular leakage, which are implicated in mediating resistance to selective VEGF-A inhibitors.

What is OPT-302: It is a soluble form of (VEGFR-3) Vascular Endothelial Growth Factor Receptor 3 that blocks the activity of two proteins; VEGF-D and VEGF-C, leading blood vessels to grow and leak. OPT is in the process of developing OPT-302 for use in combination with the inhibitors of VEGF-A (e.g. Lucentis®/EYLEA®).

What is Wet AMD: A disease characterised by the loss of vision of the middle of the visual field. It is a leading cause of loss of eyesight in human beings with an age of more than 50 years. VEGF-A inhibitor with the combination of OPT-302 has the potential to progress patient responses, including visual acuity.

Financial Performance in 1H FY19: The company reported a net loss before tax of $18,918,763 in H1 FY19 as compared to $13,294,524 in H1 FY18. The higher losses in H1 FY19 as compared to the prior year was mainly on account of an increase in R&D (research and development) expenditure, which can be attributed to the expenses incurred in progressing OPTâs ongoing clinical trials with OPT-302 in wet AMD and DME patients.

At the time of writing on 15th May 2019, AEST 02:45 PM, the stock of OPT was trading at a price of $0.680, with a market cap of $169.6 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.