The education sector is believed to be one of those sectors in which the demand for service is predicted to rise further. The application of technology in education has revolutionised the education sector. Businesses are coming up with new and innovative products and services to lure the customers and garner market share.

Moreover, there has been a shift in the way of learning and working across the globe by transition to paperless modules. Increased sustainability goals have trimmed down writing activities on paper, worldwide. The education sector has a slew of evolutions in store.

Some of the ASX-listed education technology companies have pronounced their half-year results for the period ended 31 December 2019.

Let us take a look at a few of these stocks and their performances during the period.

IDP Education Reports Total Revenue of $379 million

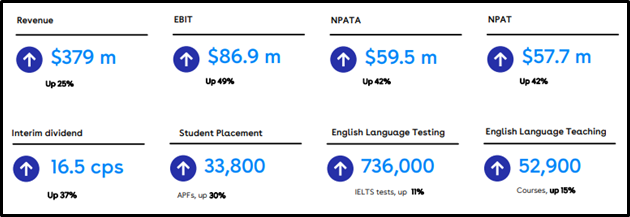

IDP Education Limited (ASX:IEL) recently announced its results for the H1 FY20, for the six months ended 31 December 2019, and reported total revenue of $379 million indicating an increase of 25% compared with the same period in FY19.

Moreover, the company reported strong growth in revenue across all business lines along with margin improvement steering a 42% increase in NPATA relative to the same period in FY 19.

In addition to the above, IEL’s earnings before interest and tax (EBIT) stood at $86.9 million, indicating an increase of 49% compared with the same period in FY19.

The company’s progress further includes the following highlights:

- IDP’s Digital Campus was launched in Chennai, India, enabling rapid product innovation and delivery;

- Opened 37 new computer delivered IELTS centres, touching the total number to 167 centres across the IDP network;

- Adjusted Earnings Per Share of 23.4 cents per share (+41 per cent) and a 16.5 cents per share interim dividend franked at 17 per cent;

- Constant high levels of customer satisfaction with 87% of student placement customers likely or highly likely to recommend IDP;

Source: Company's Report

Acknowledging the belief that the positive results reinforce the company’s commitment to its digital strategy and vision, IDP CEO and Managing Director Andrew Barkla said:

“Our organisation has pivoted to focus deeply on the experience of our customers, which is delivering strong returns across all business lines”

He further added:

“Importantly, our global platform is exceeding our expectations in terms of pipeline growth and

conversion”

IEL witnessed 30 per cent volume growth in its student placement business, which was backed by greater conversions in the sales cycle while the multi-destination markets of the company delivered volume growth of 52%.

Read: ARE THERE ANY HOT STOCKS WITH EXCITING GROWTH IN CANNABIS SPACE?

IEL Surges 28.417%

Post announcement of the results, the IEL stock surged 28.417% intraday and settled at a price of $ 21.420 on 12th February 2020. The stock touched its 52-weeks high price of $22.000 today and has a market capitalisation of $4.24 billion.

The company believes that its strength of IDP’s diverse global business was again reinforced in this period and its markets like India, Canada and the UK delivered stand-out contributions to its overall business performance.

In the English Language Testing front, there was an increase of 11% for the period in IDP’s IELTS volumes and the roll-out of the computer-delivered testing is believed to be well received with strong adoption rates in key markets.

Moreover, an increase of 15% was witnessed in the English Language Teaching business with the strengthening position of the company as a market leader in its Cambodian operations.

The Digital Marketing and Events business line further improved IEL’s B2B offer with accelerated investment in data and insights abilities of the company and delivered an 11% increase in revenue with a shift in contract mix towards longer-term agreements.

The company is focused on extending its digital transformation program and new capabilities to improve the IELTS customer experience and has improved the test day experience through its rapid roll-out of computer-delivered IELTS centres across 47 countries.

Being a service-oriented company, IEL looks forward to further enhancing the customer journey by making it easier to book and prepare for its leading test.

Importantly, the financial performance of the business remains unaffected, and there are no material effects of the coronavirus outbreak on IEL’s financial performance.

Not ignoring the matter completely, the company believes that the situation is constantly evolving with the longer-term structural drivers remaining in place.

Another education technology sector player, Janison Education Group Limited (ASX:JAN) engages in providing Software-as-a-Service to the state and federal government education bodies and large corporates and exam management services for the higher education and the professional certification sectors.

For the six months ended 31 December 2019, JAN reported growth in total operating revenues of 14% reaching $11,395,000 primarily driven by the growth of 19% in recurring revenues and the introduction of Exam Management revenue from LTC Language & Testing Consultants (acquired by Janison in April 2019).

Other highlights from the period include the following:

- Growth of 56% in ARR to $14.3 million as at 31 December 2019 vs. 31 December 2018;

- Increase of 14% in Total Reported Revenue for the six months to 31 December 2019 (1H FY20 vs. 1H FY19);

- Gross Margin increased by 21 percentage points to 46% for 1H FY20 (vs. 24% 1H FY19);

- EBITDA up 16 percentage points to 9% for 1H FY202 (vs. a loss of 7% in 1H FY19);

- Positive Operating Cash Flow of $2.8 million (for the six months to 31 December 2019);

- Zero debt with $4.2 million cash in hand;

The company is of the view that the recurrent revenue growth was driven by new clients such as:

- Roads & Maritime Services NSW (RMS)

- Organisation for Economic Co-operation and Development (OECD)

- UNSW Global

Along with this, the expansion in the existing clients such as Education Services Australia (ESA, for the delivery of NAPLAN Online) and British Council added to the revenue growth.

An important observation is a shift onto the digital assessment platform, causing the reduction in project services revenue and has been replaced with an increase in long-term recurring revenue.

The gross profit, which increased to 46% of total revenue for the six months to December 2019 compared to 24% for the prior corresponding period, was primarily influenced by the following:

- Shift towards a higher sales mix of recurring platform revenue;

- Reduction in the amount of low-margin project services revenue;

The increase in the EBITDA was registered due to higher-margin sales mix and despite increased investment in operating expenses of the business to support its growth in the coming years.

The JAN stock settled in the red zone at $0.430, down by 2.273% intraday on 12 February 2020.

JAN’s business is laying increased emphasis on the international expansion and satisfying the growing global demand for quality, reliable online assessment while the global appetite is only expanding as student numbers continue to rise.

As more and more schools and higher education institutions phase-out pen-and-paper assessments and make a shift to online testing, it is only going to benefit the technology-driven companies like Janison Education Group Limited as well as IDP Education Limited.

.jpg)