One of the key criteria which investors consider before investing in the equity market is the dividend history and dividend yield ratio of a stock. Let us have a look at two ASX-listed companies - Ingenia Communities Group and Ridley Corporation Limited, which have provided decent dividend yield to their investors.

Ingenia Communities Group

Based in Sydney, Australia, Ingenia Communities Group (ASX:INA) is a provider of affordable rental land-lease living and holiday accommodation. The group has five segments: Ingenia Lifestyle & Holidays; Fuel, Food & Beverage Services; Ingenia Lifestyle Development; Ingenia Gardens; and Others.

FY19 Results: On 20 August 2019, INA released its full-year results for the period ended 30 June 2019. The company posted a top line of $ 228.7 million, up 21% y-o-y, while its underlying profit grew by 28% on y-o-y to $ 47.2 million. EBIT stood at $ 61.5 million in FY19, representing an increase of 26% when compared with the same period a year ago. Operating cash flow of the company for FY19 was $ 59.3 million, up 26% on FY18, aided by an increase in settlements and rental income. Net Asset Value per security stood at $ 2.65 for the full-year period ended 30 June 2019.

Source: Companyâs Report

Ingenia made 336 new home settlements, which was up 17% from the same period a year ago. These new settlements are forecast to add approximately $ 2.7 million in annual rental income. At the end of June 2019, the company had $ 20.2 million in cash.

Dividend Announcement: The company announced a final dividend of 5.80 cents against each fully paid ordinary/unit stapled security on 20 August 2019, with payment to be made on 26 September 2019. For FY19, the companyâs total dividend distribution stands at 11.2 cents per stapled security, an increase of 4% in FY18.

Guidance for FY20: During the financial year 2020, the company would continue to focus on sales and marketing by rolling out new projects, as well as delivering new rental contracts. It expects to register EBIT growth of 10% - 15% during FY20 and an underlying EPS growth of 5% - 10%. The group would capitalise on opportunities to boost its development pipeline in order to deliver new rental contracts. It would complete the funds management acquisition and deliver performance for investors. INA would implement its JV business plan to seek opportunities for capital-light growth as well as new revenue streams.

$19.6 Million Acquisition Deal: Via a press release dated 19 August 2019, INA announced that it expects to close the acquisition of the funds and asset management business of Eighth Gate Capital Management, which was unveiled on 1 July 2019, on 22 August 2019 for a consideration of $ 19.6 million. The management has concluded that the acquisition would expand INAâs footprints across major key clusters and diversify its revenue base and capital partnerships. The acquisition comprises 759 permanent homes and 844 holiday sites, thereby boosting lifestyle sites under management by over 26%. The acquisition would provide entry to the markets like Victoria and would extend clusters in NSW and South East Queensland. Eighth Gate Capital Management has approximately $ 140 million under its AUM.

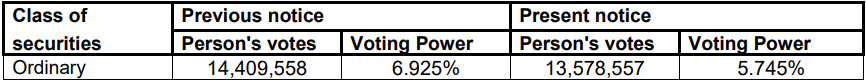

On the same day, INA announced a change in voting shares of substantial holder, IOOF Holdings Limited. The present voting power of IOOF Holdings Limited is 5.745% or 13,578,557 ordinary shares.

Source: Companyâs Report Stock Update: On 21 August 2019 (AEST 01:01 PM), the stock of INA was trading at A$ 3.570. The stock has generated a healthy return of 16.29% and 11.56% in the past three months and six months, respectively. INA has a P/E ratio of 24.97x, a market capitalisation of A$ 843.86 million and approximately 236.37 million outstanding shares. INA has provided an annualised dividend yield of 3.14% to its investors. The 52-week trading range of the stock is at A$ 2.78 to A$ 3.735.

Source: Companyâs Report Stock Update: On 21 August 2019 (AEST 01:01 PM), the stock of INA was trading at A$ 3.570. The stock has generated a healthy return of 16.29% and 11.56% in the past three months and six months, respectively. INA has a P/E ratio of 24.97x, a market capitalisation of A$ 843.86 million and approximately 236.37 million outstanding shares. INA has provided an annualised dividend yield of 3.14% to its investors. The 52-week trading range of the stock is at A$ 2.78 to A$ 3.735.

Ridley Corporation Limited

Ridley Corporation Limited (ASX: RIC) is engaged in the production of high-grade quality of animal nutrition solutions. The company is a provider of complete rations, nutritional blocks, mineral concentrates and supplements.

Appointment of New CEO: On 19 August 2019, Ridley Corporation Limited announced the appointment of Mr. Quinton Hildebran as the companyâs new CEO and Managing Director. Mr Hildebran will replace Interim CEO Mr David Lord and will start his duty from 26 August 2019. As per the experience, Mr Hildebrand served as CEO and Executive Director roles within the sugar industry. His last appointment was at Inghamâs Group Limited as the Chief Commercial Officer.

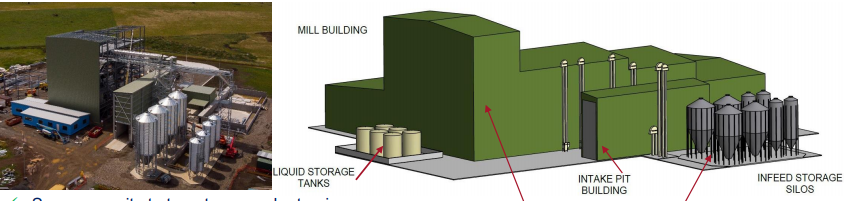

Official Opening of Westbury Facility: On 24 July 2019, RIC unveiled the official opening of a new facility in Westbury, Tasmania, with an initial production capacity of 50,000 tonnes of extruded feeds (including both aquaculture and pet food). According to the company, the plant capacity can be expanded further, depending on the future demand scenario. The new facility would cater to customers based out of mainland Australia and New Zealand due to its location advantage, facilitating consistent and efficient supply chains.

Westbury Extrusion Plant (Source: Companyâs Report)

Westbury Extrusion Plant (Source: Companyâs Report)

The Tasmanian government has provided grant funding assistance of $ 2 million to the company to aid the project. The facility would require 20 full-time permanent employees. Its construction involved the services of approximately 550 contractors and sub-contractors, inclusive of engineering consultants, as well as civil, structural and electrical services.

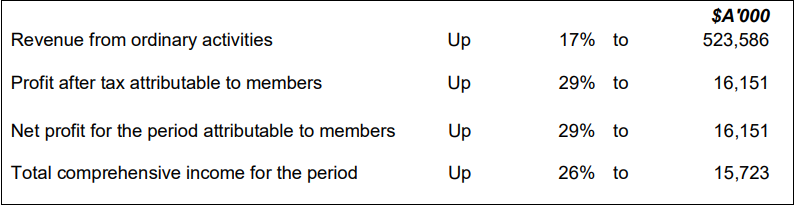

H1 FY19 Highlights: For the six-month period ended 31 December 2018, RIC reported its revenues at $ 523.586 million, up ~17% y-o-y, and a 29% increase in profit after tax to $ 16.15 million. Gross profit for the half year stood at $ 38.79 million. Selling and distribution expenses in H1 FY19 stood at $ 7.77 million vs $ 6.47 million in H1 FY18. General and administrative expenses stood at $ 15.85 million against $ 12.811 million during the previous corresponding half. Cash balance as on 31 December 2018 stood at $ 17.06 million. Earlier, in February 2019, RIC had announced an interim dividend of 1.5 cents against each share held.

Source: Companyâs Report

Source: Companyâs Report

Outlook: Management cited that the long-term outlook of Australian livestock remains bright. However, cyclicality would continue across the industry, and the group is well versed to offer value-added products to the consumers. The company would require delivering a compelling customer value proposition to assist farmers whenever required.

Stock Update: On 21 August 2019 (AEST 01:38 PM), the stock of RIC was trading at A$ 0.995, down 0.5% from its previous close. The stock has generated an annualised dividend yield of 4.25%. The market capitalisation of the company stands at $ 311.26 million. The stock is available at a P/E multiple of 14.71x. In the last three and six months, the stock of RIC has generated a negative return of 25.65% and 28.57%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)