What is Information Technology?

Information Technology is a study or use of the system (particularly computers and telecommunications) for the purpose of storing, sending information and so forth.

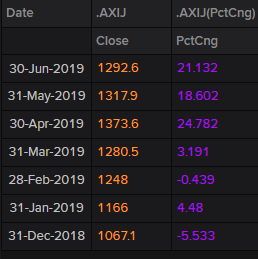

In the previous five days, S&P/ASX 200 Information Technology (Sector) had gone down. By the closure of the market on ASX on 5 June 2019, S&P/ASX 200 Information Technology (Sector) index was up by 2.03% (AEST: 12:12 pm, 5 June 2019. The YTD performance of the index 5 June 2019 was 21.132%.

YTD S&P/ASX 200 Information Technology (Sector) index (Source: Thomson Reuters)

YTD performance (Source: Thomson Reuters)

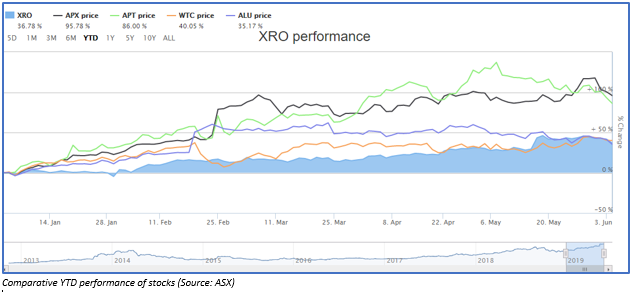

Letâs have a look at the top five Information Technology stock of 2019 by performance

| Stock | YTD Performance | 6 months Performance |

| Appen Limited | 95.78% | 81.20% |

| Afterpay Touch Group Limited | 86% | 63.04% |

| WiseTech Global Limited | 40.05% | 24.41% |

| Xero Limited | 36.78% | 41.19% |

| Altium Limited | 35.17% | 23.88% |

Appen Limited

Appen Limited (ASX: APX) is a company that belongs to the IT sector, and it provides high-quality training data to improve machine learning at scale.

The resource library of the company provides with case studies related to machine learning and artificial intelligence, whitepapers and other downloads which describes the importance of high-quality training data for machine learning.

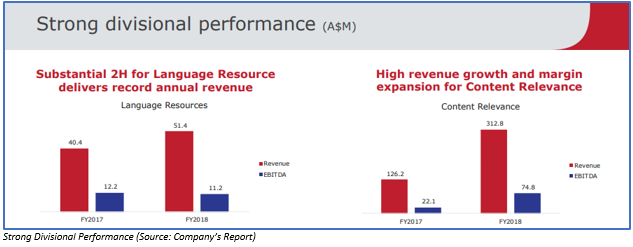

Recently on 31 May 2019, the company released the AGM presentation, where it highlighted the strong growth of the company in FY2018. The company reported an increase in the revenue by 119% to $364.3 million. The underlying EBITDA increased by 153 percent to $71.3 million. The underlying NPAT increased by 148% to $49 million and statutory EBITDA by 192% to $47.1 million. In the presentation, the company highlighted that in Q4 FY2018, it had reported strong performance. Also, the Leapforce integration was completed virtually. All Relevant projects (under Leapforce) are now available on Appen Connect. The Language Resources delivered the best annual revenue till now. The company declared a full year dividend of 8 cps. Also, the company noted an ongoing customer growth with multiple projects, which highlights the importance of data and quality of Appenâs delivery.

Further, the company witnessed a solid divisional performance.

The company is strongly positioned, and it continues to execute in a high growth market. Further, the core business of the company is doing well, and Figure Eight is on track to meet the expectations. The YTD revenue, along with the orders in hand, which includes Figure Eight, is anticipated to deliver ~ $270 million. The company expects its EBITDA to be in a range of $85 million - $90 million.

By the end of the trading session on 5 June 2019, the shares of APX were at A$ 25.590, up by 2.115% as compared to its previous closing price. APX holds a market cap of A$3.03 billion and approximately 120.93 million outstanding shares.

Afterpay Touch Group Limited

Afterpay Touch Group Limited (ASX:APT) is a technology-driven payments company which aims that its global customer base has great buying experience.

Recently on 3 May 2019, APT announced that it had signed a US$300 million receivables funding facility with Citi to help in its US business expansion.

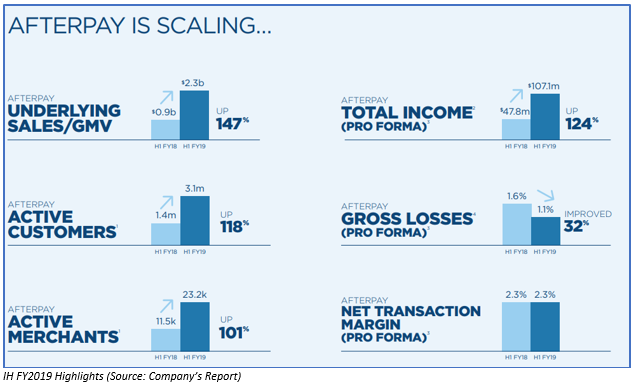

In the 1H FY2019 which ended on 31 December 2018, the company reported an underlying sales of $1.4 billion, up by 147% on pcp. The gross loss (pro forma) for the period was 1.1%, down by 1.6% in pcp. The company has maintained a strong balance sheet to support growth.

By the closure of the trading session on 5 June 2019, the shares of APT were at a price of A$23.90, up by 7.079% as compared to its previous closing price. APT holds a market cap of A$5.33 billion and approximately 238.84 million outstanding shares.

WiseTech Global Limited

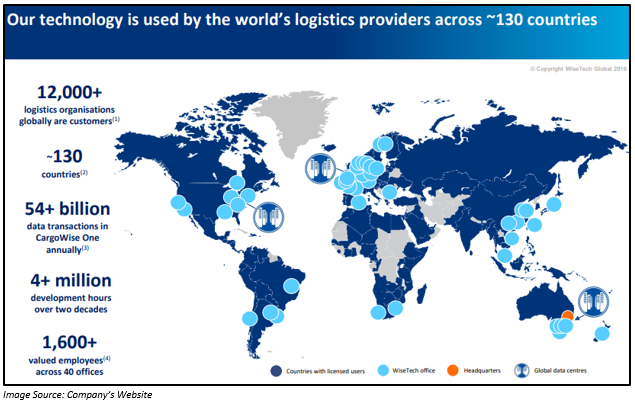

WiseTech Global Limited (ASX: WTC) is another company from the IT sector, which is the leading provider of software to the logistics services industry internationally. Through the software of the company, the logistics service providers could facilitate the movement and storage of goods along with information domestically and globally.

Through its CargoWise One, which is a single-platform software solution of the company which planned for the purpose of increasing productivity as well as improving the integration, automation, along with communication with the supply chain. In the Macquarie Australian Investor Conference, the company highlighted that the logistics industry generates $14 trillion in annual revenues were up to trillions, the companies spent on technology and billions are wasted on sneakerware/people. This industry is drowning in papers, and there is a high error rate ruining margins and visibility. Thus, it is an opportunity for the company as is solving this.

There are more than 12,000 logistics organizations, which are the customers of the company across ~ 130 countries. More than 54 billion data transaction happens through CargoWise One.

In 1H FY2019, the company reported an increase in the total revenue by more than 68% to $156.7 million, EBITDA was above 52% to $48.5 million and NPAT by more than 48% to $23.1 million as compared to its previous corresponding period.

The company is on track to deliver FY2019 revenue of $322 million - $335 million, revenue growth of 45% - 51% and EBITDA growth of 31% - 37%.

By the end of the trading session on 5 June 2019, the shares of WTC closed at A$24.850, up by 4.193% as compared to its previous closing price. APT holds a market cap of A$7.57 billion and approximately 317.31 million outstanding shares.

Xero Limited

Xero Limited (ASX: XRO) is a company from the IT sector that provides online accounting software for small businesses.

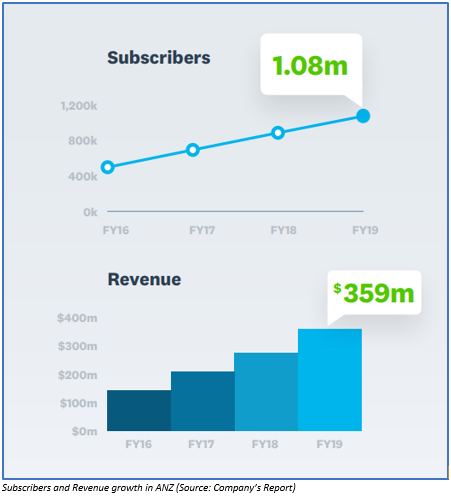

In FY2019, which ended on 31 March 2019, there was an increase in the operating revenue of the company by 36% to $552.8 million. The number of subscribers, which was 1,386,000 in FY2018 increased by 31% to 1,818,000. The free cash flow increased by $35.0 million as compared to the previous financial year. In 2H FY2019, XRO made a net profit of $1.4 million. Around 239,000 international subscribers were added during the period, which exceeds from ANZ for the first time. However, for the complete year, the company made a net loss of $27.143 million.

Outlook:

The company will be focusing on the growth of its global small business platform. Simultaneously, it will be maintaining the preference for reinvesting the fund generated depending on the investment situations as well as the market condition in order to drive the long-term shareholder value.

Further, the balance sheet of XRO witnessed a rise in the net asset because of a significant rise in the total asset. The total shareholdersâ equity for the FY2019 was $353.309m. By the end of the FY2019 on 31 March 2019, XRO had available cash worth $121.527m.

By the end of the trading session on 5 June 2019, the shares of XRO were at A$58.300, up by 1.603% as compared to its previous closing price. XRO holds a market cap of A$8.09 billion and approximately 140.93 million outstanding shares.

Altium Limited

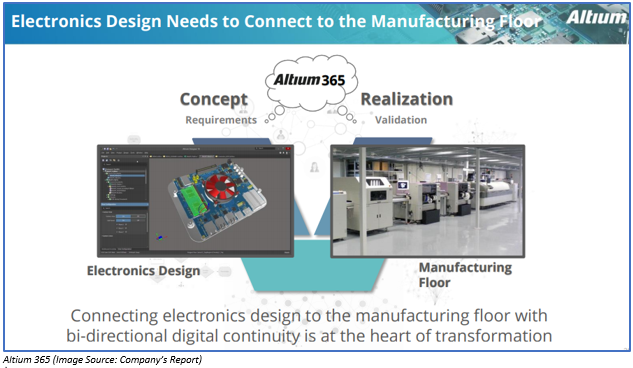

Altium Limited (ASX: ALU) is a company from the Information Technology sector and is engaged in creating tools for designers which would help them to make the most of modern technologies, successfully manage projects, as well as deliver connected, intelligent products.

In more than 30 years, the company had been providing the most widely used PCB design tools and has now developed into one of the leaders in the market. Engineers instead of using obsolete methods affecting the design process use better designing methods of companyâs Altium Designer. This is followed by the activation of new license, each hour, daily.

Recently on 13 May 2019 , Altium Limited announced that it would hold its 2019 AGM on 6 December this year, and it has been granted an extension of the period by the Australian Securities and Investments Commission (ASIC). The purpose behind requesting the postponement of the date, is to help the company in coordinating the schedule of its 2019 Technology Day with its AGM.

Also, the extension will allow the senior executives of the company, as well as the board members based in the US enough time period to arrive in Australia to attend the Technology Day and AGM (both to be held on the same day).

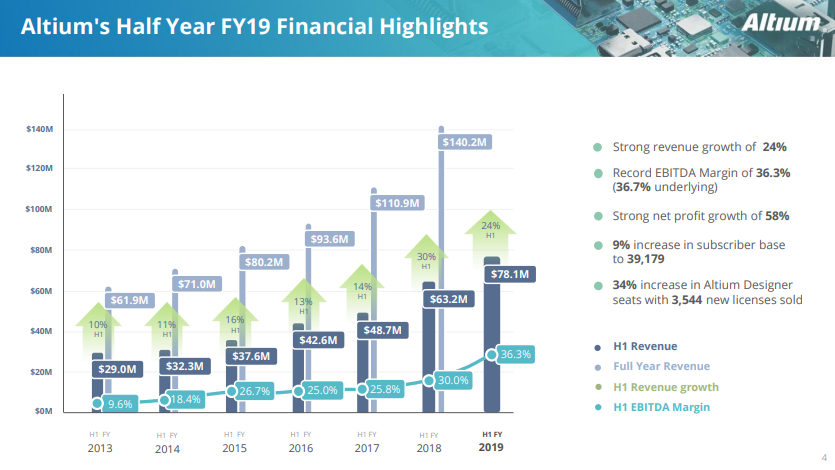

The company in 1H FY2019 reported an exceptional performance with strong revenue growth of 24% to US$78.1 million, EBITDA margin of 36.3% and an increase in the net profit after tax by 58% to US$23.4 million.

ALUâs 1H FY2019 Financial highlights

During the 1H FY2019, China led a strong growth with a 49% increase in the revenue. The revenue from Board and Systems increased by 17% to US$58.4 million, and all the regions made a positive contribution. There was an increase in the subscription pool by 9% to 39,179. The EPS for the period was up by 57% to 18 cps. The company declared an interim dividend of AUD 16 cps.

By the end of the trading session on5 June 2019, the shares of Altium were at A$29.83, up by 2.123% as compared to its previous closing price. ALU has a market cap of A$3.81 billion and ~ 130.51 million outstanding shares.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)