Over the years, dividend has become one of the means of earnings for investors. Investors emphasise on the dividend payment history of a company before making their investments. Successful investors always pick stocks with a good history of dividend payment.

Let us have a look at three stocks listed on the ASX - Australia and New Zealand Banking Group Limited, Super Retail Group and Suncorp Group Limited â which have an annual dividend yield of more than 5%.

Australia and New Zealand Banking Group Limited

Australia and New Zealand Banking Group Limited (ASX:ANZ) offers banking services and financial products to both corporates and individuals. The bank has a presence across Asia-Pacific, the United States, and the United Kingdom. Its headquarters is in Melbourne, Australia. ANZ is one of the leading banking groups in Australia and New Zealand.

As per a market update on 2nd August 2019, ANZ has given a notice related to the total percentage of voting shares in ANZ, in respect of which its associated entities have the power to exercise voting or disposal and voting shares underlying derivatives and a net economic exposure, in accordance with the terms of an exemption granted by the Australian Securities and Investments Commission. As per the notice, the total number of âordinary fully paid sharesâ stands at 21,831,948. This number represents 0.77% of the total number of shares.

Wholesale Debt: On 31 July 2019, the bank announced that CNY2.5 billion, 4.75%, Fixed Rate Subordinated Notes are due on 30 January 2025. The issuer of the bond clarified that the interest payment date is 30 January 2020. Moreover, it unveiled the record date as 29 January 2020.

Update on Risk Weight Floors: Through a media release on 29 July 2019, the bank informed that new risk-weight floors would be applicable to the mortgage and farm lending portfolios for Level 2 reporting in New Zealand. This follows a notification by independent statutory authority, Australian Prudential Regulation Authority (APRA). Earlier, the Reserve Bank of New Zealand (RBNZ) had unveiled an increase in risk weights applied by the central bank on these portfolios.

As per the revised risk weight floors, there would be a reduction in ANZâs Level 2 Common Equity Tier 1 capital ratio by a 20-basis point. The new changes would come into effect from 30 September 2019. Meanwhile, ANZâs Level 1 capital ratio would remain unchanged. While the bank has incorporated the higher risk weights for New Zealand into the Level 1 ratio, effective 31 March 2019. The report also indicates that ANZâs Level 2 CET1 capital ratio as on 30th June 2019 stood at 11.8%, which is higher than of APRAâs unquestionably strong requirement of 10.5%.

Issue of Subordinated Notes: Australia and New Zealand Banking Group Limited, on 26 July 2019, announced the issue of âsubordinated notesâ in accordance with its debt issuance programme (Australian Dollar). With a due date of 26 July 2019, the floating rate subordinated notes worth $ 1.75 billion convert into fully paid âordinary sharesâ of the issuer.

Stock Information: On 12 August 2019 (AEST 01:12 PM), the ANZ stock was trading at $ 27.090, up 0.333% from its previous closing price. It has a market capitalisation of $ 76.53 billion and approximately 2.83 billion outstanding shares. ANZ has an annual dividend yield of 5.93%, while its EPS stands at $ 2.191.

Super Retail Group

Super Retail Group (ASX:SUL) is one of the top retailers in Australia and operates in the retailing of auto ancillaries, retailing of sporting equipment & apparel, and other outdoor equipment. The company has several brands in its portfolio like Macpac, BCF, Rebel, and Supercheap Auto. Its headquarters is in Brisbane, Australia, while its network covers more than 670 retail stores. The company employs over 12,000 employees and has an annual turnover of more than $ 2.5 billion.

SUL Brands (Source: Companyâs Website)

MD for BCF brand: The company, on 19 July 2019, made an announcement regarding the appointment of Paul Bradshaw for the post of Managing Director for the brand BCF, the companyâs outdoor business. His tenure would start from 25 November 2019. He would be a part of the Executive Leadership Team of SUL. Prior to SUL, Mr Bradshaw was associated with supermarket chain Coles Group Limited (ASX: COL). He had worked with senior management positions at ASDA (the second largest supermarket retailer in the United Kingdom).

As per the experience is concerned, Mr Paul Bradshaw, who would join the Brisbane office, has deep retail experience with more than 30 years. After working on varied managerial positions at Safeway in the United Kingdom, Mr Paul joined ASDA Stores. At ASDA stores, he worked at the regional offices and headquarters.

Mr. Bradshaw would replace Ethan Orsini, before whom, the post was occupied by Mr Anthony Heraghty. Mr Anthony is now serving as the Chief Executive Officer of Super Retail Group. Moreover, he is the companyâs Managing Director.

Managing Director for Auto segment: SUL, on 11 June 2019, informed about the hiring of Mr Benjamin Ward as Managing Director for the Automobile brand âSupercheap Autoâ, effective from 29 July 2019. Mr Benjamin has experience of more than 25 years into retailing, product-sourcing, merchandise and store management. Mr Benjamin, who would be relocating to Brisbane for the new role, would replace Chris Wilesmith. Mr Chris served Super Retail Group since the year 2006. He would leave SUL in August 2019.

On the experience front, Mr Benjamin has retail experience in senior management roles. He has around 20 years of experience with international supermarket giant ALDI, where he served at the position of Managing Director, Global Business Coordination. His work experience spreads across Australia, the United Kingdom, the United States and Europe.

Stock Information: On 12 August 2019 (AEST 01:33 PM), the SUL stock was trading at $ 8.630, up by 0.818% from its previous closing price. SUL has a market capitalisation of $ 1.69 billion and approximately 197.38 million outstanding shares. It has an annual dividend yield of 5.72% and an EPS of $ 0.647.

Suncorp Group Limited

Incorporated in the year 2010, Suncorp Group Limited (ASX:SUN) is one of the leading insurance companies based out of Australia. The company operates in personal insurance, commercial insurance, general insurance, banking products and life insurance segments across Australia and New Zealand. The companyâs headquarters is located at Brisbane, Australia.

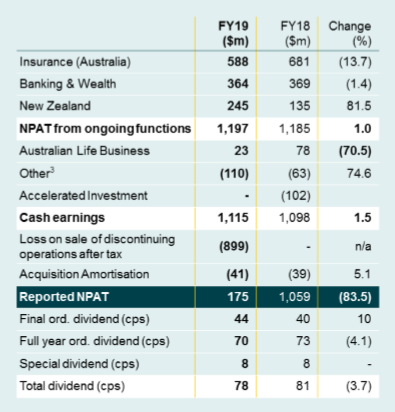

FY19 Highlights: On 7 August 2019, SUN released its financial results for the year ended 30 June 2019, unveiling NPAT of $ 175 million for the reported period, compared with $ 1059 million in FY18. For FY19, Insurance (Australia) and Banking & Wealth reported a 13.7% and 1.4% y-o-y decline in NPAT to $ 588 million and $ 364 million, respectively. While New Zealand operation during FY19 was up by 81.5% to $ 245 million when compared with the same period a year ago. Total dividend for the financial year 2019 stood at 78 cents per share, compared with 81 cents per share in FY18.

FY19 Highlights (Source: Companyâs Report)

$ 506 Million in Capital Return: On 7 August 2019, the company announced that the Board proposed to distribute $ 506 million to ordinary shareholders. It means that each shareholder would get 39 cents per share, if the proposal gets approved. The payment would be made on 24 October 2019. The amount represents the remaining surplus capital from the sale of the companyâs life insurance business in Australia. Earlier on 3 May 2019, the company had distributed a special dividend of 8 cents per share, which was equal to $ 104 million (approx.) The special dividend was paid as the first component of the payment received from the sale proceeds from its life insurance business in Australia.

Stock Information: With a market cap of $ 17.92 billion and approximately 1.3 billion outstanding shares, the SUN stock was trading at a price of $ 13.785 on 12 August 2019 (AEST 02:02 PM), down 0.109% from its previous closing price. SUN has an annual dividend yield of 5.07%, while its EPS stands at $ 0.664.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.