Businesses in Australiaâs technology sector have been witnessing continuous improvement in productivity through adoption of new and advanced technologies including robotic, artificial intelligence, remote sensors and autonomous systems. This has helped the companies to improve their output and safety of their offerings, providing better competing capabilities on the world stage. In addition, the adoption of these new technologies has also created well-paying jobs for people of all qualifications, increased benefits to consumers and an improvement in quality of life.

Let us now have a look at the performance of few stocks from the IT sector.

Novonix Limited

Novonix Limited (ASX: NVX) is a supplier of advanced battery materials, equipment and services to the global Lithium-ion Battery market.

Change in Shareholding: The company recently updated that the shareholding of Philip St Baker and Peta St Baker as trustees for the P&P St Baker Family Trust, increased from 7.61% to 11.74%.

Change in Directorâs Interest: One of the Directors, Anthony Bellas recently acquired 1,000,000 options over ordinary shares in the company. Other directors namely, Robert Natter and Gregory Baynton acquired the same number of options over ordinary shares. Philip St Baker, another director in the company, acquired 2,000,000 Options. Andrew Liveris acquired 9,000,000 options over ordinary shares.

Contract with KORE Power: The company through its subsidiary, Novonix Battery Testing Services Inc. has entered into a testing and consulting services agreement with KORE Lithium Technologies, Inc., in relation to the latterâs line of Lithium-ion energy storage products. Both the company will together conduct research and development for improvement of their battery technology. The contract is expected to run for at least one year through several phases of work.

Update on PUREgraphite Operations: The operations of PUREgraphite are being relocated to a larger facility in Chattanooga Tennessee, which involves an initial occupation of 3,700 sqm of the 11,150 sqm of the facility. This will result in greater expansion capability underpinned by a five-year long lease with two renewal options for a further period of 5 years. The relocation is expected to better suit the production with savings in cost and time. The company has made good progress in setting up of the facility and has already installed 75% of the equipment. First commercial production at the facility is expected to begin by the end of August 2019.

Corporate Update: The company recently provided a 5-year interest free loan amounting to $1.5 million to Philip St Baker for the purpose of funding the exercise of 5 million options.

June Quarter Highlights: During the quarter, the company conducted a strategic review of the PUREgraphite business and decided to move the manufacturing to a larger facility. The period saw increased top-level engagements and activations with prospective global customers including leverage of extensive personal networks. The quarter was characterised by strong sales and service performance.

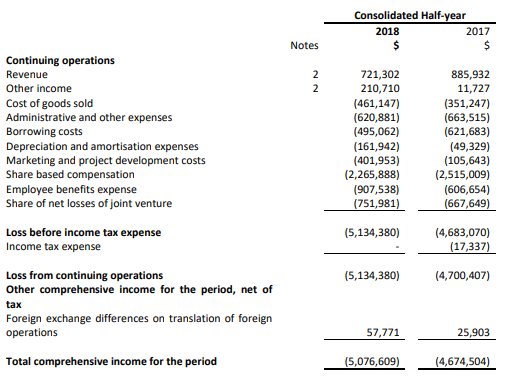

1HFY19 Financial Highlights: During the six months period, the company reported revenue amounting to $721,302, as compared to prior corresponding period revenue of $885,932. Loss from continuing operations for 1HFY19 stood at $5,134,380, in comparison to prior corresponding period loss of $4,700,407. During the period, the company completed manufacturing the first suite of commercial furnaces. The period was also marked by signing of R&D partnership with Dalhousie University. In addition, the company was granted R&D support worth C$487,693 by Government of Canada.

1HFY19 Income Statement (Source: Company Reports)

Stock performance: The stock of the company generated returns of 10.78% and 32.94% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $0.570 on 16 August 2019.

XREF Limited

XREF Limited (ASX: XF1) is primarily engaged in development of human resources technology for automation of candidate reference process for employers.

Issue of Shares: The company released an announcement regarding the issue of shares in relation to acquisition of RapidID. The company has issued a total of 1,583,442 fully paid ordinary shares as consideration to two vendors of Rapid ID Pty Ltd. In addition, the company has also issued 300,000 shares to Ashley Hoey, the Queensland-based founder of RapidID, who has joined the company post acquisition. The shares were issued at an issue price of $0.568 per share.

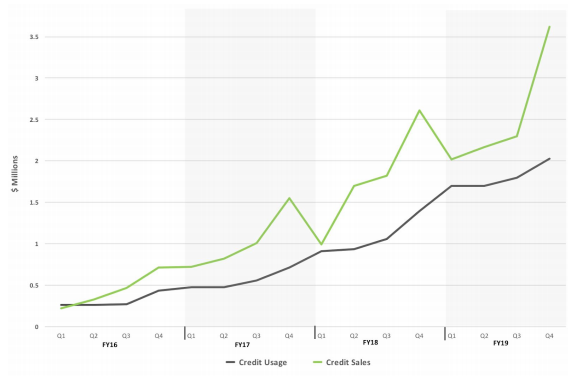

Q4FY19 Update: During the quarter, the company reported record sales amounting to $3.6 million, up 38% on prior corresponding period. Credit usage for the quarter was reported at $2 million, rising 40% in comparison to prior corresponding period. The company continued to grow strong on the international front with overseas offices contributing to 20% of the sales in Q4FY19, as compared to 10% in prior corresponding period.

Trends in Credit Sales & Credit Usage (Source: Company Reports)

The period was also marked by addition of new clients including, Tipico Services, Malta; Melbourne Cricket Club, Australia; Uncommon Schools New York, US; Mantena AS, Norway; The Ritz London, UK; Ministry of Foreign Affairs and Trade, New Zealand and Southampton Football Club, UK.

Insights into Acquisition: During the quarter, the company agreed to acquire Rapid ID Pty Ltd, which offers a disruptive ID verification and fraud prevention platform, which offers flexible and seamless integration through aggregation of leading customer verification technologies. Through the acquisition, Xref will gain access to some of the significant clients of RapidID. Sunsuper, Creditor Watch, Easypay, Experian, Uber and Judobank, are a few clients to name. The acquisition of RapidID seems to be a strategic fit for the business. The integration of RapidID into Xrefâs platform have provided HR professionals with better ways to verify the backgrounds and identity of candidates.

Consideration for Acquiring RapidID: The total consideration to be paid for the acquisition stands at $1.5 million AUD, to be disposed through a combination of cash and Xref shares.

Stock Performance: The stock of the company generated negative returns of 11.46% and 37.50% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $0.445, up 4.706% on 16 August 2019 and has a market capitalisation of $71.17 million.

RXP Services Limited

RXP Services Limited (ASX: RXP) is engaged in providing digital consulting services.

Change in Shareholding: The company recently updated that the shareholding of Bond Street Custodians increased from 5.05% to 6.09%. Regal Funds Management Pty Ltd ceased to be a substantial shareholder of the company, as provided by another update on the exchange.

Appointment of Director: Adrian Fitzpatrick was recently appointed as the Non-Executive Director of the company. His tenure began from 1 July 2019. Adrian holds an extensive experience of 30 years serving senior leadership and management positions.

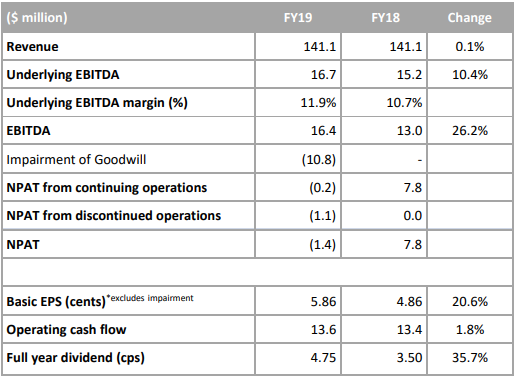

FY19 Key Highlights: Revenue for the period was reported at $141.1 Mn, with digital transformation sales growth driving a higher quality and more resilient revenue base (around 80% of the total revenue). The Earnings Before Interest, Tax, Depreciation & Amortisation (EBITDA) increased by 26.2% to $16.4 million as compared to $13.0 million in FY18, majorly due to higher-margin digital service growth and benefits from organisation realignment. The underlying EBITDA increased by 10.4% to $16.7 million as compared to $15.2 million in FY18, which is in-line with the stated guidance. The non-cash impairment was reported at $10.8 million, which resulted into NPAT of $1.4 million loss. The operating cash flow for the period was reported at $13.6 million. The underlying profit after tax (pre-impairment and bad debt) for FY19 was reported at $10.7 million, reflecting strong growth driven by momentum in digital and operational improvements.

Over the strong balance sheet, the Board of Directors declared final dividend (fully franked) of 2.50 cps plus a special dividend (fully franked) of 0.50 cps, taking the total FY19 dividend to 4.75 cps.

The company has invested in its sales capabilities to enhance its digital services offering to meet the current demand for its solutions. These benefits are being observed via new client acquisitions such as DHHS, VicRoads, Aurora Energy, The Smith Family, Sydney Bridge Climb and H&R Block.

FY19 Key Financial Metrics (Source: Company Presentation)

Cash Flow Position: RXP reported the cash balance of $11.7 million on June 30, 2019, along with net debt of $10.3 million, which highlights its comfortable gearing position and the flexibility required to grow the business. Its operating cash flow represents 95% of EBITDA, reflecting its cashflow conversion strength, and providing the flexibility to reinvest in the business for future growth, pay down debt, and pay dividends.

Outlook: The company is committed to build on its âMaking Happier Humans focusâ, and its Expression, Experience and Enablement capabilities. The above development along with RXPâs investments in digital is expected to drive higher quality revenue and higher margins with double digit earnings growth.

Stock Performance: The stock of the company generated returns of 27.59% and 33.73% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $0.525, down 5.405% on 16 August 2019 and has a market capitalisation of $89.41 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.